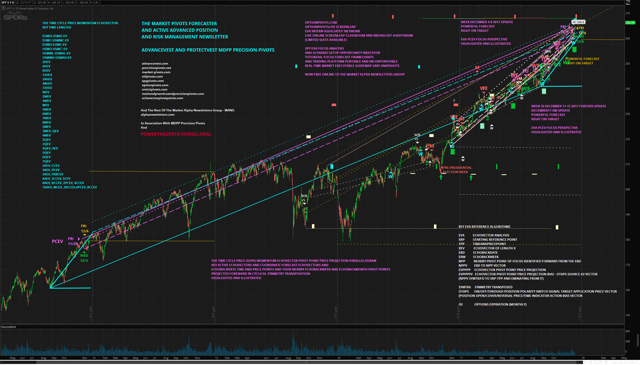

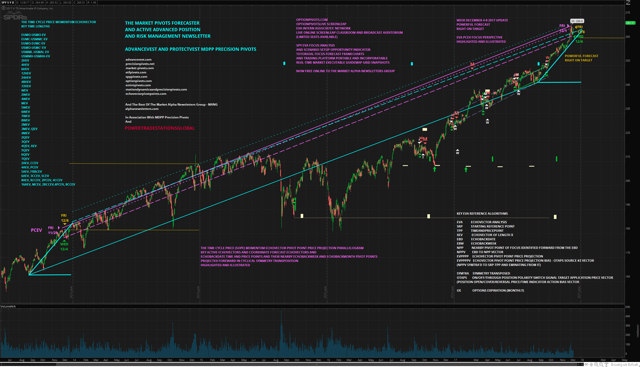

OPTIONPIVOTS.COM: S&P500 SPY ETF: MDPP PRECISION PIVOTS PREMIUM DESK SCENARIO SETUP OPPORTUNITY INDICATOR FOCUS FORECAST FRAMECHARTS: KEY ACTIVE ECHOVECTOR CYCLE UPDATES: 4YR, 2YR, 1YR, 2Q, 1Q, 1M: NOW FREE ONLINE: 12/11/2017 PM UPDATE: MARKET-PIVOTS.COM

Summary

S&P500 (SPY ETF & RELATED PROXY ESOTERICS) UPDATE: WEEK 50 2017 MONDAY DECEMBER 11TH PM EASTERN USA: "YESTERDAY'S TODAY AND TODAY'S TOMORROW": ADDITIONAL US LARGE CAP STOCK COMPOSITE INDEX S&P500 RELATED EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTS.COM LIVE BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS THROUGHOUT THE MARKET WEEK AND MARKET DAY: POWERFUL FORECASTS RIGHT ON TARGET:

THIS WEEK'S OUTLOOK AND PRE-MARKET FORECAST BIAS OPPORTUNITIES IN REVIEW AND A LOOK TO THE WEEK AHEAD: OPTIONPIVOTS LIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATES' NETWORK SCREENLEAP LIVE VIRTUAL AUDITORIUM BROADCAST CLASSROOM TUTORIAL:

THIS WEEK'S DAILY TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR AND FOCUS FORECAST FRAMECHART GUIDEMAP GRIDS WITH TODAY'S SELECTED UPDATES: PREMIUM DESK RELEASES TO THE MARKET ALPHA NEWSLETTERS GROUP NOW FREE ONLINE: SELECT PROXY S&P500 SPY ETF AND/OR /ES EMINI FUTURES AND/OR RELATED WEEKLYS OPTIONS ALSO IN UPDATED ECHOVECTOR ANALYSIS FOCUS: OPTIONPIVOTSLIVE SCREENLEAP BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOT UPDATES HIGHLIGHTED AND ILLUSTRATED WITH REAL-TIME MARKET PRICE ACTION WASHTHROUGH UPDATES:

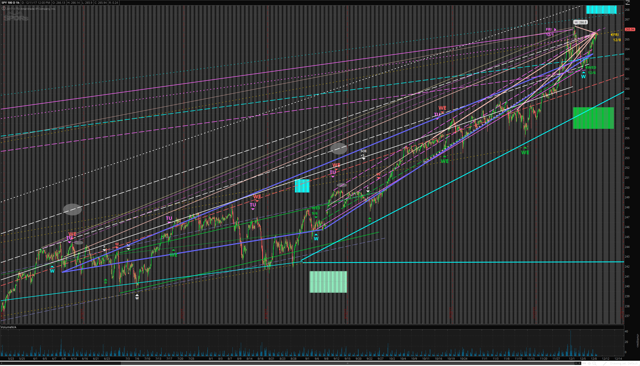

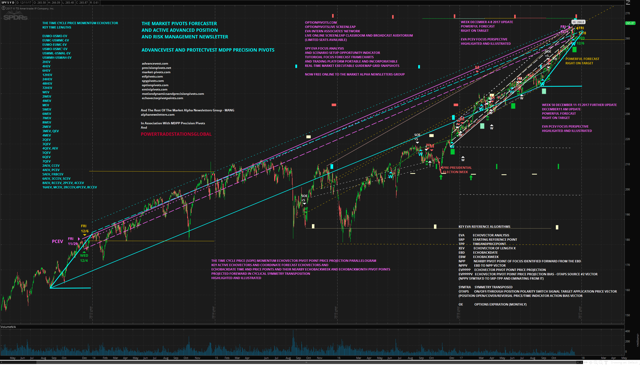

THIS WEEK'S KEY ACTIVE 16-YEAR MATURITY CYCLE ECHOVECTORS & 8-YEAR REGIME CHANGE CYCLE ECHOVECTORS AND 4-YEAR PRESIDENTIAL CYCLE ECHOVECTORS & 2-YEAR CONGRESSIONAL CYCLE ECHOVECTORS & ANNUAL CYCLE ECHOVECTORS & 6-MONTH BI-QUARTERLY CYCLE ECHOVECTORS & 3-MONTH QUARTERLY CYCLE ECHOVECTORS & BI-MONTHLY CYCLE ECHOVECTORS & MONTHLY CYCLE ECHOVECTORS & BI-WEEKLY CYCLE ECHOVECTORS & WEEKLY CYCLE & BI-DAILY CYCLE ECHOVECTORS AND DAILY CYCLE ECHOVECTORS IN ITERATIVE SUBSUMPTION, WITH TIME CYCLE PRICE SLOPE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAMS AND ECHOVECTOR TIME/PRICE PIVOT POINT PROJECTION AND OTAPS-PPS ACTIVE ADVANCE POSITION AND RISK MANAGEMENT POSITION POLARITY SWITCH SIGNAL TARGET VECTORS AND TIME CYCLE PRICE ECHOVECTOR SUPPORT AND RESISTANCE VECTOR PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED:

WITH KEY INTRADAY GLOBAL INTERMARKET ROTATIONAL CYCLE ECHOVECTORS HIGHLIGHTED AND ILLUSTRATED IN ADDITIONAL POSTS AT EITHER OR BOTH:

https://www.mytrade.com/profile/MarketPivots

AND/OR

https://www.mytrade.com/profile/OptionPivots:

THIS WEEK'S UPDATES PROVE VERY TIMELY AND RIGHT ON TARGET: SEE OPTIONPIVOTS.COM EMINIPIVOTS.COM MARKET-PIVOTS.COM ETFPIVOTS.COM SPYPIVOTS.COM DOWPIVOTS.COM QQQPIVOTS.COM STOCK-PIVOTS.COM BONDPIVOTS.COM COMMODITYPIVOTS.COM GOLDPIVOTS.COM ECHOVECTORPIVOTPOINTS.COM ADVANCEVEST.COM PRECISIONPIVOTS.NET ALPHANEWSLETTERS.COM BRIGHTHOUSEPUBLISHING.COM AND ASSOCIATED POWERTRADESTATIONS.COM:

RELATED INSTRUMENTS: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV, TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS, $SPX, $DJIA, $NDX, $RUT:

FOCUS UPDATES WITH KEY ACTIVE MONTHLY, BI-WEEKLY, AND WEEKLY ECHOVECTORS IN ADDITION TO KEY GLOBAL MARKET TIME CYCLE PRICE SLOPE MOMENTUM ROTATIONAL AND RE-CALIBRATION ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS WITH ECHOVECTOR PIVOT POINT HIGHLIGHTS ALSO ILLUSTRATED:

SPY ETF TUTORIAL EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTSLIVE SCREENLEAP TUTORIAL FOCUS FORECAST FRAMECHARTS & SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID AUDITORIUM BROADCAST CLASSROOM RELEASES NOW PORTABLE INTO YOUR OWN LIVE TOS REAL-TIME MARKET WORKSPACE: OPTIONPIVOTS.COM PREMIUM DESK RELEASE UPDATES ALSO NOW FREE ONLINE: ADVANCEVEST AND PROTECTVEST:

"We put our Intern Associate Network Traders, and their Tutorial Market Performance Success, First!"

POWERFUL FORECASTS RIGHT ON TARGET

____________________________________________

FIND ADDITIONAL OPTIONPIVOTS.COM AND MARKET-PIVOTS.COM OPTIONPIVOTSLIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATE NETWORK BROADCAST TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR FRAMECHART AND GUIDEMAP GRID UPDATES

____________________________________________

EVA FRAMECHARTS INTO YOUR OWN TOS WORKSPACE FOR DYNAMIC REAL-TIME USE AND UPDATING

Then proceed to form your three key forecast bias time cycle price momentum echovector pivot point price parallelograms for the each of the key cycle lengths within any one of your various echovector analysis scenario setup opportunity indicator guidemap grid scope perspectives, for their aggregated intersects & combined vector momentum pressure bias point force directions... such as those found in a monthly(mev)/biweekly(2wev)/weekly(wev) echovector cycle lengths highlighting and illustrating echovector analysis scenario setup opportunity indicator focus forecast framechart and guidemap grid (which helps to illustrate roughly a 4/2/1 ratio of echovector cyclical lengths in echovector force bias construction, intersection, aggregation, compilation, and forecast.

MDPP PRECISION PIVOTS

SELECT SPY ETF AND /ES EMINI FUTURES FINANCIAL MARKET YEAR 2017 WITH KEY ACTIVE ECHOVECTOR ANALYSIS MCEV, RCCEV, PCEV, CCEV, 6QEV, AEV, 2QEV, QEV, 2MEV, 5WEV, MEV, 4WEV, 2WEV, WEV, 72HEV, 48HEV, 24HEV, 12HEV, 6HEV, AND MORE, AND THEIR EBD-TPPs, CFEVs, NPPVs, AND EVPPPs INDICATORS (TCPMEVPPPPgrams)

OPTIONPIVOTS.COM SCENARIO SETUP OPPORTUNITY AND ECHOVECTOR ANALYSIS TUTORIAL RELEASE: PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS PREMIUM DESKS RELEASE(S) NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTERS GROUP

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

POWERFUL FORECAST RIGHT ON TARGET: WITH ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHART UPDATES: PREMIUM DESKS RELEASES NOW FREE ONLINE

THE TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTIONS TRADER'S EDGE OTAPS-PPS VECTOR GUIDEMAP -- MDPP PRECISION PIVOTS FORECAST MODEL AND ALERT PARADIGM -- TUTORIAL FOCUS FORECAST FRAMECHART AND GUIDEMAP HIGHLIGHTS AND ILLUSTRATIONS -- WHICH MAY INCLUDE SELECT KEY ACTIVE 8-YEAR REGIME CYCLE ECHOVECTOR (RCCEV), 6-YEAR SENATORIAL CYCLE ECHOVECTOR (SCEV), 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR (PCEV), 2-YEAR CONGRESSIONAL CYCLE ECHOVECTOR (CCEV), ANNUAL CYCLE ECHOVECTOR (NYSE:AEV), BI-QUARTERLY CYCLE ECHOVECTOR (2QEV), QUARTERLY CYCLE ECHOVECTOR (QEV), BI-MONTHLY CYCLE ECHOVECTOR (2MEV), MONTHLY CYCLE ECHOVECTOR (MEV), BI-WEEKLY CYCLE ECHOVECTOR (2WEV), AND WEEKLY CYCLE ECHOVECTOR (WEV), AND COORDINATE FORECAST ECHOVECTORS (CFEVS) WITH NPP OTAPS-PPS SYMMETRY TRANSPOSITION POSITION POLARITY ALERT AND REVERSAL VECTORS HIGHLIGHTED AND ILLUSTRATED

PREMIUM DESK RELEASES NOW FREE ONLINE

__________________________________________________________________________________________

LIMITED SEATS AVAILABLE

ECHOVECTOR ANALYSIS INTERN ASSOCIATES OPTIONPIVOTS.COMSCREENLEAP LIVE NETWORK VIRTUAL AUDITORIUM BROADCAST AND CLASS

S&P500 STOCK COMPOSITE INDEX: SPY ETF AND /ES EMINI FUTURES: TODAY'S TOMORROW IN REVIEW

PREMIUM DESK RELEASES NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTER GROUP

Kevin John Bradford Wilbur, Senior Contributor

President and Founder

Posted Throughout The Day

Can Also Be Viewed At MyTradeOptionPivots and MyTradeMarketPivots.

OPTIONPIVOTS.COM: S&P500 SPY ETF: MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHARTS AND TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE ANALYSIS AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS: HIGHLIGHTS AND ILLUSTRATIONS: NOW FREE ONLINE: MONDAY 12/11/2017 UPDATE: POWERFUL FORECAST RIGHT ON TARGET: NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTER GROUP AND MARKET-PIVOTS.COM

_______________________________________________________

Monday, December 11, 2017 - MANG VERSION SUBMISSION

S&P500 (SPY ETF & RELATED PROXY ESOTERICS) UPDATE: WEEK 50 2017 MONDAY DECEMBER 11TH PM EASTERN USA: "YESTERDAY'S TODAY AND TODAY'S TOMORROW": ADDITIONAL US LARGE CAP STOCK COMPOSITE INDEX S&P500 RELATED EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTS.COM LIVE BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS THROUGHOUT THE MARKET WEEK AND MARKET DAY: POWERFUL FORECASTS RIGHT ON TARGET: THIS WEEK'S OUTLOOK AND PRE-MARKET FORECAST BIAS OPPORTUNITIES IN REVIEW AND A LOOK TO THE WEEK AHEAD: OPTIONPIVOTS LIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATES' NETWORK SCREENLEAP LIVE VIRTUAL AUDITORIUM BROADCAST CLASSROOM TUTORIAL: THIS WEEK'S DAILY TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR AND FOCUS FORECAST FRAMECHART GUIDEMAP GRIDS WITH TODAY'S SELECTED UPDATES: PREMIUM DESK RELEASES TO THE MARKET ALPHA NEWSLETTERS GROUP NOW FREE ONLINE: SELECT PROXY S&P500 SPY ETF AND/OR /ES EMINI FUTURES AND/OR RELATED WEEKLYS OPTIONS ALSO IN UPDATED ECHOVECTOR ANALYSIS FOCUS: OPTIONPIVOTSLIVE SCREENLEAP BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOT UPDATES HIGHLIGHTED AND ILLUSTRATED WITH REAL-TIME MARKET PRICE ACTION WASHTHROUGH UPDATES: THIS WEEK'S KEY ACTIVE 16-YEAR MATURITY CYCLE ECHOVECTORS & 8-YEAR REGIME CHANGE CYCLE ECHOVECTORS AND 4-YEAR PRESIDENTIAL CYCLE ECHOVECTORS & 2-YEAR CONGRESSIONAL CYCLE ECHOVECTORS & ANNUAL CYCLE ECHOVECTORS & 6-MONTH BI-QUARTERLY CYCLE ECHOVECTORS & 3-MONTH QUARTERLY CYCLE ECHOVECTORS & BI-MONTHLY CYCLE ECHOVECTORS & MONTHLY CYCLE ECHOVECTORS & BI-WEEKLY CYCLE ECHOVECTORS & WEEKLY CYCLE & BI-DAILY CYCLE ECHOVECTORS AND DAILY CYCLE ECHOVECTORS IN ITERATIVE SUBSUMPTION, WITH TIME CYCLE PRICE SLOPE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAMS AND ECHOVECTOR TIME/PRICE PIVOT POINT PROJECTION AND OTAPS-PPS ACTIVE ADVANCE POSITION AND RISK MANAGEMENT POSITION POLARITY SWITCH SIGNAL TARGET VECTORS AND TIME CYCLE PRICE ECHOVECTOR SUPPORT AND RESISTANCE VECTOR PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED: WITH KEY INTRADAY GLOBAL INTERMARKET ROTATIONAL CYCLE ECHOVECTORS HIGHLIGHTED AND ILLUSTRATED IN ADDITIONAL POSTS AT EITHER OR BOTH: https://www.mytrade.com/profile/MarketPivots AND/OR https://www.mytrade.com/profile/OptionPivots: THIS WEEK'S UPDATES PROVE VERY TIMELY AND RIGHT ON TARGET: SEE OPTIONPIVOTS.COM EMINIPIVOTS.COM MARKET-PIVOTS.COM ETFPIVOTS.COM SPYPIVOTS.COM DOWPIVOTS.COM QQQPIVOTS.COM STOCK-PIVOTS.COM BONDPIVOTS.COM COMMODITYPIVOTS.COM GOLDPIVOTS.COM ECHOVECTORPIVOTPOINTS.COM ADVANCEVEST.COM PRECISIONPIVOTS.NET ALPHANEWSLETTERS.COM BRIGHTHOUSEPUBLISHING.COM AND ASSOCIATED POWERTRADESTATIONS.COM: RELATED INSTRUMENTS: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV, TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS, $SPX, $DJIA, $NDX, $RUT: FOCUS UPDATES WITH KEY ACTIVE MONTHLY, BI-WEEKLY, AND WEEKLY ECHOVECTORS IN ADDITION TO KEY GLOBAL MARKET TIME CYCLE PRICE SLOPE MOMENTUM ROTATIONAL AND RE-CALIBRATION ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS WITH ECHOVECTOR PIVOT POINT HIGHLIGHTS ALSO ILLUSTRATED: SPY ETF TUTORIAL EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTSLIVE SCREENLEAP TUTORIAL FOCUS FORECAST FRAMECHARTS & SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID AUDITORIUM BROADCAST CLASSROOM RELEASES NOW PORTABLE INTO YOUR OWN LIVE TOS REAL-TIME MARKET WORKSPACE: OPTIONPIVOTS.COM PREMIUM DESK RELEASE UPDATES ALSO NOW FREE ONLINE: ADVANCEVEST AND PROTECTVEST: "We put our Intern Associate Network Traders, and their Tutorial Market Performance Success, First!"

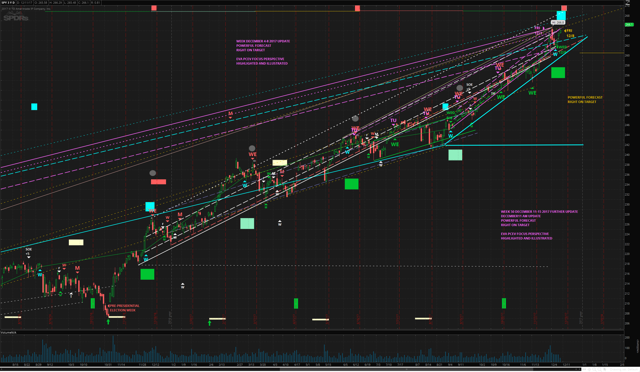

OPTIONPIVOTS.COM: S&P500 SPY ETF: MDPP PRECISION PIVOTS PREMIUM DESK SCENARIO SETUP OPPORTUNITY INDICATOR FOCUS FORECAST FRAMECHARTS: KEY ACTIVE PRESIDENTIAL CYCLE ECHOVECTOR UPDATE: NOW FREE ONLINE: 12/11/2017 PM EASTERN USA UPDATES: MARKET-PIVOTS.COM

Summary

S&P500 (SPY ETF & RELATED PROXY ESOTERICS) UPDATE: WEEK 50 2017 MONDAY DECEMBER 11TH PM EASTERN USA: "YESTERDAY'S TODAY AND TODAY'S TOMORROW": ADDITIONAL US LARGE CAP STOCK COMPOSITE INDEX S&P500 RELATED EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTS.COM LIVE BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS THROUGHOUT THE MARKET WEEK AND MARKET DAY: POWERFUL FORECASTS RIGHT ON TARGET:

THIS WEEK'S OUTLOOK AND PRE-MARKET FORECAST BIAS OPPORTUNITIES IN REVIEW AND A LOOK TO THE WEEK AHEAD: OPTIONPIVOTS LIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATES' NETWORK SCREENLEAP LIVE VIRTUAL AUDITORIUM BROADCAST CLASSROOM TUTORIAL:

THIS WEEK'S DAILY TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR AND FOCUS FORECAST FRAMECHART GUIDEMAP GRIDS WITH TODAY'S SELECTED UPDATES: PREMIUM DESK RELEASES TO THE MARKET ALPHA NEWSLETTERS GROUP NOW FREE ONLINE: SELECT PROXY S&P500 SPY ETF AND/OR /ES EMINI FUTURES AND/OR RELATED WEEKLYS OPTIONS ALSO IN UPDATED ECHOVECTOR ANALYSIS FOCUS: OPTIONPIVOTSLIVE SCREENLEAP BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOT UPDATES HIGHLIGHTED AND ILLUSTRATED WITH REAL-TIME MARKET PRICE ACTION WASHTHROUGH UPDATES:

THIS WEEK'S KEY ACTIVE 16-YEAR MATURITY CYCLE ECHOVECTORS & 8-YEAR REGIME CHANGE CYCLE ECHOVECTORS AND 4-YEAR PRESIDENTIAL CYCLE ECHOVECTORS & 2-YEAR CONGRESSIONAL CYCLE ECHOVECTORS & ANNUAL CYCLE ECHOVECTORS & 6-MONTH BI-QUARTERLY CYCLE ECHOVECTORS & 3-MONTH QUARTERLY CYCLE ECHOVECTORS & BI-MONTHLY CYCLE ECHOVECTORS & MONTHLY CYCLE ECHOVECTORS & BI-WEEKLY CYCLE ECHOVECTORS & WEEKLY CYCLE & BI-DAILY CYCLE ECHOVECTORS AND DAILY CYCLE ECHOVECTORS IN ITERATIVE SUBSUMPTION, WITH TIME CYCLE PRICE SLOPE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAMS AND ECHOVECTOR TIME/PRICE PIVOT POINT PROJECTION AND OTAPS-PPS ACTIVE ADVANCE POSITION AND RISK MANAGEMENT POSITION POLARITY SWITCH SIGNAL TARGET VECTORS AND TIME CYCLE PRICE ECHOVECTOR SUPPORT AND RESISTANCE VECTOR PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED:

WITH KEY INTRADAY GLOBAL INTERMARKET ROTATIONAL CYCLE ECHOVECTORS HIGHLIGHTED AND ILLUSTRATED IN ADDITIONAL POSTS AT EITHER OR BOTH:

https://www.mytrade.com/profile/MarketPivots

AND/OR

https://www.mytrade.com/profile/OptionPivots:

THIS WEEK'S UPDATES PROVE VERY TIMELY AND RIGHT ON TARGET: SEE OPTIONPIVOTS.COM EMINIPIVOTS.COM MARKET-PIVOTS.COM ETFPIVOTS.COM SPYPIVOTS.COM DOWPIVOTS.COM QQQPIVOTS.COM STOCK-PIVOTS.COM BONDPIVOTS.COM COMMODITYPIVOTS.COM GOLDPIVOTS.COM ECHOVECTORPIVOTPOINTS.COM ADVANCEVEST.COM PRECISIONPIVOTS.NET ALPHANEWSLETTERS.COM BRIGHTHOUSEPUBLISHING.COM AND ASSOCIATED POWERTRADESTATIONS.COM:

RELATED INSTRUMENTS: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV, TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS, $SPX, $DJIA, $NDX, $RUT:

FOCUS UPDATES WITH KEY ACTIVE MONTHLY, BI-WEEKLY, AND WEEKLY ECHOVECTORS IN ADDITION TO KEY GLOBAL MARKET TIME CYCLE PRICE SLOPE MOMENTUM ROTATIONAL AND RE-CALIBRATION ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS WITH ECHOVECTOR PIVOT POINT HIGHLIGHTS ALSO ILLUSTRATED:

SPY ETF TUTORIAL EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTSLIVE SCREENLEAP TUTORIAL FOCUS FORECAST FRAMECHARTS & SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID AUDITORIUM BROADCAST CLASSROOM RELEASES NOW PORTABLE INTO YOUR OWN LIVE TOS REAL-TIME MARKET WORKSPACE: OPTIONPIVOTS.COM PREMIUM DESK RELEASE UPDATES ALSO NOW FREE ONLINE: ADVANCEVEST AND PROTECTVEST:

"We put our Intern Associate Network Traders, and their Tutorial Market Performance Success, First!"

POWERFUL FORECASTS RIGHT ON TARGET

____________________________________________

FIND ADDITIONAL OPTIONPIVOTS.COM AND MARKET-PIVOTS.COM OPTIONPIVOTSLIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATE NETWORK BROADCAST TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR FRAMECHART AND GUIDEMAP GRID UPDATES

____________________________________________

EVA FRAMECHARTS INTO YOUR OWN TOS WORKSPACE FOR DYNAMIC REAL-TIME USE AND UPDATING

Then proceed to form your three key forecast bias time cycle price momentum echovector pivot point price parallelograms for the each of the key cycle lengths within any one of your various echovector analysis scenario setup opportunity indicator guidemap grid scope perspectives, for their aggregated intersects & combined vector momentum pressure bias point force directions... such as those found in a monthly(mev)/biweekly(2wev)/weekly(wev) echovector cycle lengths highlighting and illustrating echovector analysis scenario setup opportunity indicator focus forecast framechart and guidemap grid (which helps to illustrate roughly a 4/2/1 ratio of echovector cyclical lengths in echovector force bias construction, intersection, aggregation, compilation, and forecast.

MDPP PRECISION PIVOTS

SELECT SPY ETF AND /ES EMINI FUTURES FINANCIAL MARKET YEAR 2017 WITH KEY ACTIVE ECHOVECTOR ANALYSIS MCEV, RCCEV, PCEV, CCEV, 6QEV, AEV, 2QEV, QEV, 2MEV, 5WEV, MEV, 4WEV, 2WEV, WEV, 72HEV, 48HEV, 24HEV, 12HEV, 6HEV, AND MORE, AND THEIR EBD-TPPs, CFEVs, NPPVs, AND EVPPPs INDICATORS (TCPMEVPPPPgrams)

OPTIONPIVOTS.COM SCENARIO SETUP OPPORTUNITY AND ECHOVECTOR ANALYSIS TUTORIAL RELEASE: PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS PREMIUM DESKS RELEASE(S) NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTERS GROUP

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

POWERFUL FORECAST RIGHT ON TARGET: WITH ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHART UPDATES: PREMIUM DESKS RELEASES NOW FREE ONLINE

THE TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTIONS TRADER'S EDGE OTAPS-PPS VECTOR GUIDEMAP -- MDPP PRECISION PIVOTS FORECAST MODEL AND ALERT PARADIGM -- TUTORIAL FOCUS FORECAST FRAMECHART AND GUIDEMAP HIGHLIGHTS AND ILLUSTRATIONS -- WHICH MAY INCLUDE SELECT KEY ACTIVE 8-YEAR REGIME CYCLE ECHOVECTOR (RCCEV), 6-YEAR SENATORIAL CYCLE ECHOVECTOR (SCEV), 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR (PCEV), 2-YEAR CONGRESSIONAL CYCLE ECHOVECTOR (CCEV), ANNUAL CYCLE ECHOVECTOR (AEV), BI-QUARTERLY CYCLE ECHOVECTOR (2QEV), QUARTERLY CYCLE ECHOVECTOR (QEV), BI-MONTHLY CYCLE ECHOVECTOR (2MEV), MONTHLY CYCLE ECHOVECTOR (MEV), BI-WEEKLY CYCLE ECHOVECTOR (2WEV), AND WEEKLY CYCLE ECHOVECTOR (WEV), AND COORDINATE FORECAST ECHOVECTORS (CFEVS) WITH NPP OTAPS-PPS SYMMETRY TRANSPOSITION POSITION POLARITY ALERT AND REVERSAL VECTORS HIGHLIGHTED AND ILLUSTRATED

PREMIUM DESK RELEASES NOW FREE ONLINE

__________________________________________________________________________________________

WEEK 50 2017, MONAY DECEMBER 11TH:

SEE ECHOVECTOR ANALYSIS SCENARIO SETUP OPPORTUNITY INDICATOR BIAS OUTLOOKS FOR TODAY

OPTIONPIVOTS.COM: S&P500 SPY ETF: MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHARTS AND TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE ANALYSIS AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS: HIGHLIGHTS AND ILLUSTRATIONS: NOW FREE ONLINE: MONDAY 12/11/2017 UPDATE: POWERFUL FORECAST RIGHT ON TARGET: NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTER GROUP AND MARKET-PIVOTS.COM

_______________________________________________________

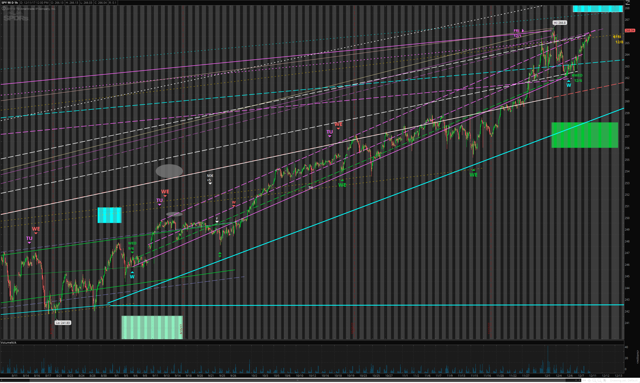

OPTIONPIVOTS.COM: S&P500 SPY ETF: MDPP PRECISION PIVOTS PREMIUM DESK SCENARIO SETUP OPPORTUNITY INDICATOR FOCUS FORECAST FRAMECHARTS: KEY ACTIVE PRESIDENTIAL CYCLE ECHOVECTOR UPDATE: NOW FREE ONLINE: 12/8/2017 UPDATE: MARKET-PIVOTS.COM

Summary

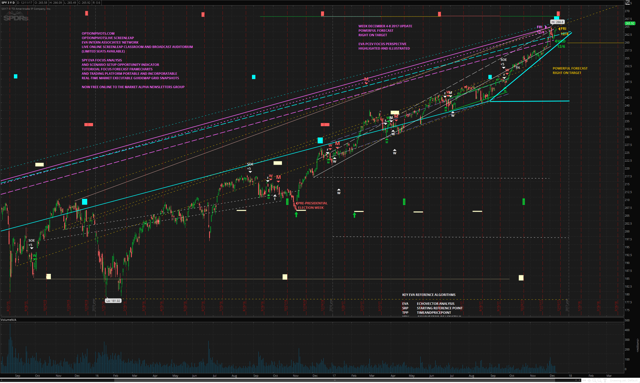

S&P500 (SPY ETF & RELATED PROXY ESOTERICS) UPDATE: WEEK 49 2017 FRIDAY DECEMBER 8TH: "YESTERDAY'S TODAY AND TODAY'S TOMORROW": ADDITIONAL US LARGE CAP STOCK COMPOSITE INDEX S&P500 RELATED EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTS.COM LIVE BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS THROUGHOUT THE MARKET WEEK AND MARKET DAY: POWERFUL FORECASTS RIGHT ON TARGET:

THIS WEEK'S OUTLOOK AND PRE-MARKET FORECAST BIAS OPPORTUNITIES IN REVIEW AND A LOOK TO THE WEEK AHEAD: OPTIONPIVOTS LIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATES' NETWORK SCREENLEAP LIVE VIRTUAL AUDITORIUM BROADCAST CLASSROOM TUTORIAL:

THIS WEEK'S DAILY TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR AND FOCUS FORECAST FRAMECHART GUIDEMAP GRIDS WITH TODAY'S SELECTED UPDATES: PREMIUM DESK RELEASES TO THE MARKET ALPHA NEWSLETTERS GROUP NOW FREE ONLINE: SELECT PROXY S&P500 SPY ETF AND/OR /ES EMINI FUTURES AND/OR RELATED WEEKLYS OPTIONS ALSO IN UPDATED ECHOVECTOR ANALYSIS FOCUS: OPTIONPIVOTSLIVE SCREENLEAP BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOT UPDATES HIGHLIGHTED AND ILLUSTRATED WITH REAL-TIME MARKET PRICE ACTION WASHTHROUGH UPDATES:

THIS WEEK'S KEY ACTIVE 16-YEAR MATURITY CYCLE ECHOVECTORS & 8-YEAR REGIME CHANGE CYCLE ECHOVECTORS AND 4-YEAR PRESIDENTIAL CYCLE ECHOVECTORS & 2-YEAR CONGRESSIONAL CYCLE ECHOVECTORS & ANNUAL CYCLE ECHOVECTORS & 6-MONTH BI-QUARTERLY CYCLE ECHOVECTORS & 3-MONTH QUARTERLY CYCLE ECHOVECTORS & BI-MONTHLY CYCLE ECHOVECTORS & MONTHLY CYCLE ECHOVECTORS & BI-WEEKLY CYCLE ECHOVECTORS & WEEKLY CYCLE & BI-DAILY CYCLE ECHOVECTORS AND DAILY CYCLE ECHOVECTORS IN ITERATIVE SUBSUMPTION, WITH TIME CYCLE PRICE SLOPE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAMS AND ECHOVECTOR TIME/PRICE PIVOT POINT PROJECTION AND OTAPS-PPS ACTIVE ADVANCE POSITION AND RISK MANAGEMENT POSITION POLARITY SWITCH SIGNAL TARGET VECTORS AND TIME CYCLE PRICE ECHOVECTOR SUPPORT AND RESISTANCE VECTOR PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED:

WITH KEY INTRADAY GLOBAL INTERMARKET ROTATIONAL CYCLE ECHOVECTORS HIGHLIGHTED AND ILLUSTRATED IN ADDITIONAL POSTS AT EITHER OR BOTH:

https://www.mytrade.com/profile/MarketPivots

AND/OR

https://www.mytrade.com/profile/OptionPivots:

THIS WEEK'S UPDATES PROVE VERY TIMELY AND RIGHT ON TARGET: SEE OPTIONPIVOTS.COM EMINIPIVOTS.COM MARKET-PIVOTS.COM ETFPIVOTS.COM SPYPIVOTS.COM DOWPIVOTS.COM QQQPIVOTS.COM STOCK-PIVOTS.COM BONDPIVOTS.COM COMMODITYPIVOTS.COM GOLDPIVOTS.COM ECHOVECTORPIVOTPOINTS.COM ADVANCEVEST.COM PRECISIONPIVOTS.NET ALPHANEWSLETTERS.COM BRIGHTHOUSEPUBLISHING.COM AND ASSOCIATED POWERTRADESTATIONS.COM:

RELATED INSTRUMENTS: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV, TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS, $SPX, $DJIA, $NDX, $RUT:

FOCUS UPDATES WITH KEY ACTIVE MONTHLY, BI-WEEKLY, AND WEEKLY ECHOVECTORS IN ADDITION TO KEY GLOBAL MARKET TIME CYCLE PRICE SLOPE MOMENTUM ROTATIONAL AND RE-CALIBRATION ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS WITH ECHOVECTOR PIVOT POINT HIGHLIGHTS ALSO ILLUSTRATED:

SPY ETF TUTORIAL EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTSLIVE SCREENLEAP TUTORIAL FOCUS FORECAST FRAMECHARTS & SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID AUDITORIUM BROADCAST CLASSROOM RELEASES NOW PORTABLE INTO YOUR OWN LIVE TOS REAL-TIME MARKET WORKSPACE: OPTIONPIVOTS.COM PREMIUM DESK RELEASE UPDATES ALSO NOW FREE ONLINE: ADVANCEVEST AND PROTECTVEST:

"We put our Intern Associate Network Traders, and their Tutorial Market Performance Success, First!"

POWERFUL FORECASTS RIGHT ON TARGET

____________________________________________

FIND ADDITIONAL OPTIONPIVOTS.COM AND MARKET-PIVOTS.COM OPTIONPIVOTSLIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATE NETWORK BROADCAST TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR FRAMECHART AND GUIDEMAP GRID UPDATES

____________________________________________

EVA FRAMECHARTS INTO YOUR OWN TOS WORKSPACE FOR DYNAMIC REAL-TIME USE AND UPDATING

Then proceed to form your three key forecast bias time cycle price momentum echovector pivot point price parallelograms for the each of the key cycle lengths within any one of your various echovector analysis scenario setup opportunity indicator guidemap grid scope perspectives, for their aggregated intersects & combined vector momentum pressure bias point force directions... such as those found in a monthly(mev)/biweekly(2wev)/weekly(wev) echovector cycle lengths highlighting and illustrating echovector analysis scenario setup opportunity indicator focus forecast framechart and guidemap grid (which helps to illustrate roughly a 4/2/1 ratio of echovector cyclical lengths in echovector force bias construction, intersection, aggregation, compilation, and forecast.

MDPP PRECISION PIVOTS

SELECT SPY ETF AND /ES EMINI FUTURES FINANCIAL MARKET YEAR 2017 WITH KEY ACTIVE ECHOVECTOR ANALYSIS MCEV, RCCEV, PCEV, CCEV, 6QEV, AEV, 2QEV, QEV, 2MEV, 5WEV, MEV, 4WEV, 2WEV, WEV, 72HEV, 48HEV, 24HEV, 12HEV, 6HEV, AND MORE, AND THEIR EBD-TPPs, CFEVs, NPPVs, AND EVPPPs INDICATORS (TCPMEVPPPPgrams)

OPTIONPIVOTS.COM SCENARIO SETUP OPPORTUNITY AND ECHOVECTOR ANALYSIS TUTORIAL RELEASE: PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS PREMIUM DESKS RELEASE(S) NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTERS GROUP

"Positioning for change, staying ahead of the curve, we're keeping watch for you!"

POWERFUL FORECAST RIGHT ON TARGET: WITH ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHART UPDATES: PREMIUM DESKS RELEASES NOW FREE ONLINE

THE TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTIONS TRADER'S EDGE OTAPS-PPS VECTOR GUIDEMAP -- MDPP PRECISION PIVOTS FORECAST MODEL AND ALERT PARADIGM -- TUTORIAL FOCUS FORECAST FRAMECHART AND GUIDEMAP HIGHLIGHTS AND ILLUSTRATIONS -- WHICH MAY INCLUDE SELECT KEY ACTIVE 8-YEAR REGIME CYCLE ECHOVECTOR (RCCEV), 6-YEAR SENATORIAL CYCLE ECHOVECTOR (SCEV), 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR (PCEV), 2-YEAR CONGRESSIONAL CYCLE ECHOVECTOR (CCEV), ANNUAL CYCLE ECHOVECTOR (AEV), BI-QUARTERLY CYCLE ECHOVECTOR (2QEV), QUARTERLY CYCLE ECHOVECTOR (QEV), BI-MONTHLY CYCLE ECHOVECTOR (2MEV), MONTHLY CYCLE ECHOVECTOR (MEV), BI-WEEKLY CYCLE ECHOVECTOR (2WEV), AND WEEKLY CYCLE ECHOVECTOR (WEV), AND COORDINATE FORECAST ECHOVECTORS (CFEVS) WITH NPP OTAPS-PPS SYMMETRY TRANSPOSITION POSITION POLARITY ALERT AND REVERSAL VECTORS HIGHLIGHTED AND ILLUSTRATED

PREMIUM DESK RELEASES NOW FREE ONLINE

__________________________________________________________________________________________

WEEK 49 2017, FRIDAY DECEMBER 8TH:

SEE ECHOVECTOR ANALYSIS SCENARIO SETUP OPPORTUNITY INDICATOR BIAS OUTLOOKS FOR TODAY

OPTIONPIVOTS.COM: S&P500 SPY ETF: MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHARTS AND TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE ANALYSIS AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS: HIGHLIGHTS AND ILLUSTRATIONS: NOW FREE ONLINE: THURSDAY 12/8/2017 UPDATE: POWERFUL FORECAST RIGHT ON TARGET: NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTER GROUP AND MARKET-PIVOTS.COM

_______________________________________________________

----------------------------------------------------------------------------------------------------------------------------------------------

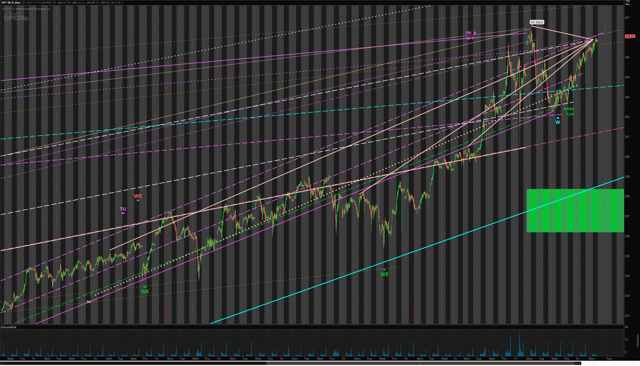

Thursday, October 19, 2017

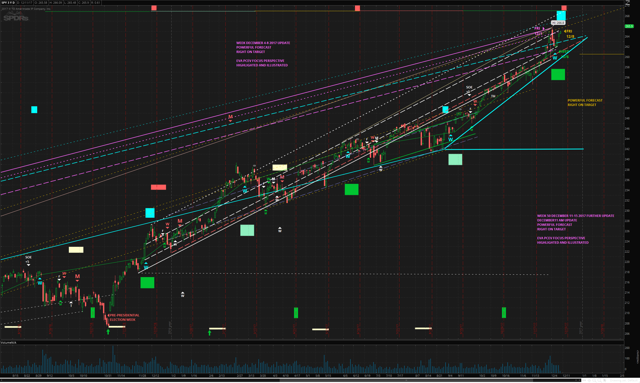

S&P500 (SPY ETF & RELATED PROXY ESOTERICS) UPDATE: WEEK 42 2017 THURSDAY OCTOBER 19TH: "YESTERDAY'S TODAY AND TODAY'S TOMORROW": ADDITIONAL US LARGE CAP STOCK COMPOSITE INDEX S&P500 RELATED EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTS.COM LIVE BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS THROUGHOUT THE MARKET WEEK AND MARKET DAY: POWERFUL FORECASTS RIGHT ON TARGET: THIS WEEK'S OUTLOOK AND PRE-MARKET FORECAST BIAS OPPORTUNITIES IN REVIEW AND A LOOK TO THE WEEK AHEAD: OPTIONPIVOTS LIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATES' NETWORK SCREENLEAP LIVE VIRTUAL AUDITORIUM BROADCAST CLASSROOM TUTORIAL: THIS WEEK'S DAILY TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR AND FOCUS FORECAST FRAMECHART GUIDEMAP GRIDS WITH TODAY'S SELECTED UPDATES: PREMIUM DESK RELEASES TO THE MARKET ALPHA NEWSLETTERS GROUP NOW FREE ONLINE: SELECT PROXY S&P500 SPY ETF AND/OR /ES EMINI FUTURES AND/OR RELATED WEEKLYS OPTIONS ALSO IN UPDATED ECHOVECTOR ANALYSIS FOCUS: OPTIONPIVOTSLIVE SCREENLEAP BROADCAST CLASSROOM TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOT UPDATES HIGHLIGHTED AND ILLUSTRATED WITH REAL-TIME MARKET PRICE ACTION WASHTHROUGH UPDATES: THIS WEEK'S KEY ACTIVE 16-YEAR MATURITY CYCLE ECHOVECTORS & 8-YEAR REGIME CHANGE CYCLE ECHOVECTORS AND 4-YEAR PRESIDENTIAL CYCLE ECHOVECTORS & 2-YEAR CONGRESSIONAL CYCLE ECHOVECTORS & ANNUAL CYCLE ECHOVECTORS & 6-MONTH BI-QUARTERLY CYCLE ECHOVECTORS & 3-MONTH QUARTERLY CYCLE ECHOVECTORS & BI-MONTHLY CYCLE ECHOVECTORS & MONTHLY CYCLE ECHOVECTORS & BI-WEEKLY CYCLE ECHOVECTORS & WEEKLY CYCLE & BI-DAILY CYCLE ECHOVECTORS AND DAILY CYCLE ECHOVECTORS IN ITERATIVE SUBSUMPTION, WITH TIME CYCLE PRICE SLOPE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAMS AND ECHOVECTOR TIME/PRICE PIVOT POINT PROJECTION AND OTAPS-PPS ACTIVE ADVANCE POSITION AND RISK MANAGEMENT POSITION POLARITY SWITCH SIGNAL TARGET VECTORS AND TIME CYCLE PRICE ECHOVECTOR SUPPORT AND RESISTANCE VECTOR PERSPECTIVES HIGHLIGHTED AND ILLUSTRATED: WITH KEY INTRADAY GLOBAL INTERMARKET ROTATIONAL CYCLE ECHOVECTORS HIGHLIGHTED AND ILLUSTRATED IN ADDITIONAL POSTS AT EITHER OR BOTH https://www.mytrade.com/profile/MarketPivots AND/OR https://www.mytrade.com/profile/OptionPivots: THIS WEEK'S UPDATES PROVE VERY TIMELY AND RIGHT ON TARGET: SEE OPTIONPIVOTS.COM EMINIPIVOTS.COM MARKET-PIVOTS.COM ETFPIVOTS.COM SPYPIVOTS.COM DOWPIVOTS.COM QQQPIVOTS.COM STOCK-PIVOTS.COM BONDPIVOTS.COM COMMODITYPIVOTS.COM GOLDPIVOTS.COM ECHOVECTORPIVOTPOINTS.COM ADVANCEVEST.COM PRECISIONPIVOTS.NET ALPHANEWSLETTERS.COM BRIGHTHOUSEPUBLISHING.COM AND ASSOCIATED POWERTRADESTATIONS.COM: RELATED INSTRUMENTS: QQQ, PSQ, QLD, QID, IWM, RWM, UWM, UKK, TWM, DIA, DOG, DDM, DXD, TLT, TLH, IEF, UUP, UDN, GLD, GTU, DGZ, UGL, DZZ, GLL, IAU, SGOL, SLV, DBS, AGQ, ZSL, CU, PALL, PPLT, VXX, UVXY, XIV, TVIX, XLI, TNA, SPXU, IVV, TQQQ, SQQQ, SPLV, SPY, SSO, SDS, $SPX, $DJIA, $NDX, $RUT: FOCUS UPDATES WITH KEY ACTIVE MONTHLY, BI-WEEKLY, AND WEEKLY ECHOVECTORS IN ADDITION TO KEY GLOBAL MARKET TIME CYCLE PRICE SLOPE MOMENTUM ROTATIONAL AND RE-CALIBRATION ECHOVECTORS AND COORDINATE FORECAST ECHOVECTORS WITH ECHOVECTOR PIVOT POINT HIGHLIGHTS ALSO ILLUSTRATED: SPY ETF TUTORIAL EVA INTERN ASSOCIATES' NETWORK OPTIONPIVOTSLIVE SCREENLEAP TUTORIAL FOCUS FORECAST FRAMECHARTS & SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID AUDITORIUM BROADCAST CLASSROOM RELEASES NOW PORTABLE INTO YOUR OWN LIVE TOS REAL-TIME MARKET WORKSPACE: OPTIONPIVOTS.COM PREMIUM DESK RELEASE UPDATES ALSO NOW FREE ONLINE: ADVANCEVEST AND PROTECTVEST: "We put our Intern Associate Network Traders, and their Tutorial Market Performance Success, First!"

POWERFUL FORECASTS RIGHT ON TARGET

___________________________________________________

FIND ADDITIONAL OPTIONPIVOTS.COM AND MARKET-PIVOTS.COM OPTIONPIVOTSLIVE ECHOVECTOR ANALYSIS INTERN ASSOCIATE NETWORK BROADCAST TUTORIAL SCENARIO SETUP OPPORTUNITY INDICATOR FRAMECHART AND GUIDEMAP GRID UPDATES

TO PORT DIRECTLY INTO YOUR TOS WORKSPACE AT:

AND

LEARN HOW TO PORT ADVANCEVEST AND PROTECTVEST MDPP PRECISION PIVOTS TUTORIAL ECHOVECTOR ANALYSIS FRAMECHARTS AND GUIDEMAP ILLUSTRATION GRIDS SAFELY AND SECURELY INTO YOUR OWN TOS WORKS SPACE FOR LIVE, DYNAMIC VIEWING AND USER AMENDMENT AND UPDATING AT THE FOLLOWING LINK: http://kb.simplertrading.com/workspacetos/

_____________________________________________________________

DIRECTIONS TO SAFELY, SECURELY, AND EASILY, PORT

EVA FRAMECHARTS INTO YOUR OWN TOS WORKSPACE FOR DYNAMIC REAL-TIME USE AND UPDATING

1. Sign into your free MyTrade TOS Account.

2. Control C copy the URL of the FrameChart from the following OptionPivots and Market-Pivots sites that you want to port into your TOS Workspace

3. Sign into your TOS account.

4. In upper right corner click on "Setup."

5. Then click on "Open shared item."

6. Use Control V to paste the selected URL into "Shared item URL" block.

7. Click on "Preview."

8. Click on "Open."

9. Add and subtract your own updated topological notations, overlays, analysis, and key time cycle echovector support and resistance vectors on your now ported, live, and dynamic MDPP Precision Pivots Forecast Model and Alert Paradigm Tutorial EVA Focus Forecast Time Cycle Price Momentum EchoVector FrameChart Illustration, and Scenario Setup Opportunity Indicator and OTAPS-PPS Active Advanced Position Polarity and Risk Management Signal GuideMap Grid!

YOU CAN ALSO FIND MDPP EVA FRAMECHART GRIDS PRE-PREPARED FOR YOU TO ADD YOUR OWN UPDATED TIME CYCLE PRICE MOMENTUM ECHOVECTORS AT THE SAME LINKS

YOU CAN ALSO UPDATE YOUR ECHOVECTORS ON ANY FRESHLY PORTED EVA FRAMECHART IN TOS

SIMPLY CLICK IN THE UPPER RIGHT CORNER ON "Drawings," then by moving your cursor on "Remove Drawings" click on "Tendlines," Then click on "Yes."

______________________________________________________________

HOW TO CONSTRUCT ECHOVECTORS AND ECHOVECTOR PIVOT POINT PRICE PROJECTIONS FROM "THE ECHOVECTOR ANALYSIS INTERN ASSOCIATES TECHNICAL GUIDEBOOK" - -

CONSTRUCTING THE ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAM AND COORDINATE FORECAST ECHOVECTOR PIVOT POINT PROJECTION SUPPORT AND RESISTANCE VECTORS FOR ANY SELECTED CYCLICAL LENGTH X, OR GROUP OF CYCLICAL LENGTHS X, Y, Z, ETC., FROM YOUR ELECTED ECHOVECTOR STARTING REFERENCE TIME/PRICE POINT SRP - EVA 101

"Fundamental EVA Time Cycle EchoVector Support and Resistance Vectors for any selected time cycle length are easy to generate yourself.

Just pick your financial instruments starting reference point's day, time, and price (srp-tpp) & your cyclical length, x, then find your corresponding ecobackdate time&pricepoint (ebd-tpp) one cyclical length of time back from your starting reference point (such as Friday's 4PM closing price).

The time cycle price slope momentum echovector (x-ev) is the line between them (also the triangulated hypotenuse within the echovector pivot point price projection parallelogram under construction).

Identify a nearby forward pivot point (npp) of interest that rests in your focus instrument's price path forward in time from its now identified ebd-tpp, and "duplicate & drag" your echovector, of time cycle length x, to "left-side start" there at your identified forward focus nearby pivot (or inflection) point.

This is the coordinate forecast echovector (CFEV) within the EVA parallelogram.

The EV pivot point time/price projection (evpppp) occurs at the end of the right side of the cfev, completing the EV forecast bias parallelogram's 4 key points (the xev-srp-tpp, the xev-ebd-tpp, the identified xev-ebd-tpp-npp, and the xev-evpppp-tpp). The parallelogram's 4 sides (the echovector, the coordinate forecast echovector, the echobackdate timeandpricepoint's forward focus nearby pivot point price extension vector, and the starting reference point's forward forecast bias price extension vector are each essential parts of the time cycle price momentum echovector pivot point price projection parallelogram's construction. Remember that the echovector is "symmetry transposed" (duplicated and dragged) to start at the npp to form the coordinate forecast echovector, and that the the echobackdate timeandpricepoint's forward focus nearby pivot point price extension vector is "symmetry transposed" (duplicated and dragged) to start at the srp to form the forward forecast bias price extension vector (whether up or down). And the at the ends of both (and either) the cfev and the ffbpev is found the evpppp-tpp.

Then proceed to form your three key forecast bias time cycle price momentum echovector pivot point price parallelograms for the each of the key cycle lengths within any one of your various echovector analysis scenario setup opportunity indicator guidemap grid scope perspectives, for their aggregated intersects & combined vector momentum pressure bias point force directions... such as those found in a monthly(mev)/biweekly(2wev)/weekly(wev) echovector cycle lengths highlighting and illustrating echovector analysis scenario setup opportunity indicator focus forecast framechart and guidemap grid (which helps to illustrate roughly a 4/2/1 ratio of echovector cyclical lengths in echovector force bias construction, intersection, aggregation, compilation, and forecast.

These 3 parallelograms can yield (generate & illustrate) powerful intersecting echovector cyclical price pressure bias pivot point projections (under the criterion of identified cyclical continuance).

Also consider looking at the annual/biquarterly/quarterly cycle lengths EVA SSOI guidemap grid, the congressional/annual/biquartelycycle lengths EVA SSOI guidemap grid, the presidential/congressional/annual cycle lengths EVA SSOI guidemap grid, the biweekly/weekly/midweek cycle lengths EVA SSOI guidemap grid, the weekly/halfweek/daily cycle lengths EVA SSOI guidemap grid, and the 12hour/6hour/3hour and 4h/2h/1h and 2h/1h/halfhour, intraday cycle lengths EVA SSOI guidemap grids, etc.

And don't forget the regime change/presidential/congressional cycle lengths EVA SSOI guidemap grid too.

Note: Where you find multiple key Economic Calendar, and Earnings Calendar, and Federal Reserve Announcement Calendar, Futures Expiration Calendar, and Options Expiration Calendar, in cyclical intersect and phase aggregation, this can indicate powerful pivot points and ensuing and opportunistic directional composite price pressures and extensions!"

FOR THURSDAY 19 OCTOBER 2017

WEEK 42 UPDATE

SPY ETF AND /ES EMINI FUTURES AND RELATED OPTIONS TIME CYCLEPRICE MOMENTUM ECHOVECTOR TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOT UPDATES: POWERFUL FORECAST RIGHT ON TARGET

EVA FRAMECHARTS INTO YOUR OWN TOS WORKSPACE FOR DYNAMIC REAL-TIME USE AND UPDATING

Then proceed to form your three key forecast bias time cycle price momentum echovector pivot point price parallelograms for the each of the key cycle lengths within any one of your various echovector analysis scenario setup opportunity indicator guidemap grid scope perspectives, for their aggregated intersects & combined vector momentum pressure bias point force directions... such as those found in a monthly(mev)/biweekly(2wev)/weekly(wev) echovector cycle lengths highlighting and illustrating echovector analysis scenario setup opportunity indicator focus forecast framechart and guidemap grid (which helps to illustrate roughly a 4/2/1 ratio of echovector cyclical lengths in echovector force bias construction, intersection, aggregation, compilation, and forecast.

WITH KEY ECHOBACKPERIODS AND ECHOBACKDATES AND TIMEANDPRICEPOINTS HIGHLIGHTED AND ILLUSTRATED

FOR FULLER STUDY PANORAMA AND PERSPECTIVE OF EACH "YESTERDAY'S TODAY AND TODAY'S TOMORROW" EVA ANALYSIS FOCUS FORECAST FRAMECHART SNAPSHOTS, WIDEN YOUR FRAMECHART BY DRAGGING IT OPEN FURTHER ACROSS MULTIPLE MONITORS.

ALSO CLICK TO OPEN "YESTERDAY'S TODAY AND TODAY'S TOMORROW" EVA ANALYSIS FOCUS FORECAST FRAMECHART SNAPSHOTS IN NEW TAB TO FURTHER ENLARGE.

POWERFUL FORECAST RIGHT ON TARGET!

S&P500: SPY ETF AND RELATED ESOTERIC DERIVATIVES

ALSO CLICK TO OPEN "YESTERDAY'S TODAY AND TODAY'S TOMORROW" EVA ANALYSIS FOCUS FORECAST FRAMECHART SNAPSHOTS IN NEW TAB TO FURTHER ENLARGE.

POWERFUL FORECAST RIGHT ON TARGET!

S&P500: SPY ETF AND RELATED ESOTERIC DERIVATIVES

THURSDAY 9/29/2017

ADDITIONAL US LARGE CAP STOCK COMPOSITE INDEX S&P500 RELATED EVA INTERN ASSOCIATES' NETWORK TUTORIAL FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOT RELEASES ISSUED THROUGH THE MARKET DAY TODAY: POWERFUL FORECASTS RIGHT ON TARGET

Premium Desk Releases Now Free Online To The Market Alpha Newsletters Group

POWERFUL FORECAST RIGHT ON TARGET

SEE PRIOR PREMIUM DESK RELEASE POSTS FOR STUDY, REFERENCE, AND REVIEW

SEE PRIOR PREMIUM DESK RELEASE POSTS FOR STUDY, REFERENCE, AND REVIEW

_____________________________________________________________________________________________________

PROTECTVEST AND ADVANCEVEST

MDPP PRECISION PIVOTS

S&P500 US LARGE CAP STOCK COMPOSITE INDEX

PROTECTVEST AND ADVANCEVEST

MDPP PRECISION PIVOTS

S&P500 US LARGE CAP STOCK COMPOSITE INDEX

SELECT SPY ETF AND /ES EMINI FUTURES FINANCIAL MARKET YEAR 2017 WITH KEY ACTIVE ECHOVECTOR ANALYSIS MCEV, RCCEV, PCEV, CCEV, 6QEV, AEV, 2QEV, QEV, 2MEV, 5WEV, MEV, 4WEV, 2WEV, WEV, 72HEV, 48HEV, 24HEV, 12HEV, 6HEV, AND MORE, AND THEIR EBD-TPPs, CFEVs, NPPVs, AND EVPPPs INDICATORS (TCPMEVPPPPgrams): OPTIONPIVOTS.COM SCENARIO SETUP OPPORTUNITY AND ECHOVECTOR ANALYSIS TUTORIAL RELEASE: PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS PREMIUM DESKS RELEASE(S) NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTERS GROUP "Positioning for change, staying ahead of the curve, we're keeping watch for you!": POWERFUL FORECAST RIGHT ON TARGET: WITH ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHART UPDATES: PREMIUM DESKS RELEASES NOW FREE ONLINE

THE TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE PROJECTIONS TRADER'S EDGE OTAPS-PPS VECTOR GUIDEMAP -- MDPP PRECISION PIVOTS FORECAST MODEL AND ALERT PARADIGM -- TUTORIAL FOCUS FORECAST FRAMECHART AND GUIDEMAP HIGHLIGHTS AND ILLUSTRATIONS -- WHICH MAY INCLUDE SELECT KEY ACTIVE 8-YEAR REGIME CYCLE ECHOVECTOR (RCCEV), 6-YEAR SENATORIAL CYCLE ECHOVECTOR (SCEV), 4-YEAR PRESIDENTIAL CYCLE ECHOVECTOR (PCEV), 2-YEAR CONGRESSIONAL CYCLE ECHOVECTOR (CCEV), ANNUAL CYCLE ECHOVECTOR (AEV), BI-QUARTERLY CYCLE ECHOVECTOR (2QEV), QUARTERLY CYCLE ECHOVECTOR (QEV), BI-MONTHLY CYCLE ECHOVECTOR (2MEV), MONTHLY CYCLE ECHOVECTOR (MEV), BI-WEEKLY CYCLE ECHOVECTOR (2WEV), AND WEEKLY CYCLE ECHOVECTOR (WEV), AND COORDINATE FORECAST ECHOVECTORS (CFEVS) WITH NPP OTAPS-PPS SYMMETRY TRANSPOSITION POSITION POLARITY ALERT AND REVERSAL VECTORS HIGHLIGHTED AND ILLUSTRATED

PREMIUM DESK RELEASES NOW FREE ONLINE

TO THE MARKET ALPHA NEWSLETTERS GROUP:

ALPHANEWLSETTERS.COM & BRIGHTHOUSEPUBLISHING.COM

SEE PRIOR PREMIUM DESK RELEASE POSTS FOR STUDY, REFERENCE, AND REVIEW

___________________________________________________________________________________________________

ADDENDUM

WEEK 42 2017, THURSDAY OCTOBER 19TH:

SEE ECHOVECTOR ANALYSIS SCENARIO SETUP OPPORTUNITY INDICATOR BIAS OUTLOOKS FOR TODAY

OPTIONPIVOTS.COM: S&P500 SPY ETF: MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHARTS AND TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE ANALYSIS AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS: HIGHLIGHTS AND ILLUSTRATIONS: NOW FREE ONLINE: THURSDAY 10/19/2017 UPDATE: POWERFUL FORECAST RIGHT ON TARGET: NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTER GROUP AND MARKET-PIVOTS.COM

BEFORE MAKING ANY INVESTMENT DECISIONS WE STRONGLY ENCOURAGE YOU TO FIRST CONSULT WITH YOUR PERSONAL FINANCIAL ADVISER.

ADDITIONAL NEWSLETTER SPONSOR

POWERTRADESTATIONS AND POWERTRADESTATIONSglobal ARE PROUD SPONSOR OF

THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER -- FREE ONLINE VERSION

PUBLISHED BY THE MARKET ALPHA NEWSLETTERS GROUP AND BRIGHTHOUSE PUBLISHING

PROVIDING RESEARCH, ANALYSIS, FORECASTS, TUTORIALS, ILLUSTRATIONS, STRATEGIES, AND COMMENTARY BY MDPP PRECISION PIVOTS,

AND THE MOTION DYNAMICS AND PRECISION PIVOTS FORECAST MODEL AND ALERT PARADIGM

"Positioning for change, Staying ahead of the curve, we're keeping watch for you!" - MDPP PRECISION PIVOTS

POWERTRADESTATIONS AND POWERTRADESTATIONSglobal ARE PROUD SPONSOR OF

THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER -- FREE ONLINE VERSION

PUBLISHED BY THE MARKET ALPHA NEWSLETTERS GROUP AND BRIGHTHOUSE PUBLISHING

PROVIDING RESEARCH, ANALYSIS, FORECASTS, TUTORIALS, ILLUSTRATIONS, STRATEGIES, AND COMMENTARY BY MDPP PRECISION PIVOTS,

AND THE MOTION DYNAMICS AND PRECISION PIVOTS FORECAST MODEL AND ALERT PARADIGM

"Positioning for change, Staying ahead of the curve, we're keeping watch for you!" - MDPP PRECISION PIVOTS

SEE PRIOR PREMIUM DESK RELEASE POSTS FOR STUDY, REFERENCE, AND REVIEW