Jun. 24, 2021 10:03 PM ET

Summary

- PRESENTING

TUTORIAL "TODAY'S TOMORROW TRADER'S EDGE" FOCUS FORECAST PROJECTION

FRAMECHARTS BY MARKETPIVOTPOINTS.COM & DAYTRADINGCHARTS.COM. A

Special Timely Update And Release Provided By The MDPP Precision Pivots

Global Financial Markets Laboratory!

- TODAY

FEATURING WEEKLY PIVOT POINT PROJECTIONS FOR THE S&P500 COMPOSITE

INDEX SPY ETF OR /ES EMINI FUTURES, AND/OR FOR THE DOW30INDUSTRIALS

COMPOSITE INDEX DIA ETF OR /YM EMINI FUTURES.

- INCLUDES

POWERFUL ECHOVECTOR PIVOT POINT INDICATORS AND TREND MOMENTUM

PROJECTIONS: ANNUAL AND KEY SUBSUMPTIVE PIVOT POINT TIME CYCLE LENGTHS

HIGHLIGHTED AND ILLUSTRATED!

- LINKS

TO ADDITIONAL "TODAY'S TOMORROW TRADERS EDGE" FOCUS FORECAST PROJECTION

FRAMECHARTS, FOR ACTIVE ADVANCED TUTORIAL MARKET INTELLIGENCE

PREPARATION & STUDY, AT PRECISIONPIVOTS.NET,

PRECISIONPIVOTPOINTS.COM, POWERDAYTRADERS.COM.

THURSDAY 9:00PM ET USA UPDATE

"TODAY'S TOMORROW TRADER'S EDGE FOCUS FORECAST PROJECTION FRAMECHART" AND PORTABLE EASYGUIDEMAP GRID

S&P500 SPY ETF - DAILY CANDLES - MONTHLY ECHOVECTOR TREND

MOMENTUM AND COORDINATE FORECAST ECHOVECTOR PERSPECTIVES HIGHLIGHTED AND

ILLUSTRATED

Chart_20210624_26

Chart_20210624_25

http://tos.mx/Z8zG00G

http://tos.mx/i2zCWQh

http://tos.mx/Bukew9W

http://tos.mx/cQaZIwM

http://tos.mx/gmsplV0

TO ENLARGE AND FURTHER ZOOM SELECT 'TODAY'S TOMORROW

TRADER'S EDGE FOCUS FORECAST FRAMECHART SNAPSHOTS' FOR INSPECTION, EASY

VIEWING, AND STUDY:*

1. RIGHT CLICK ON THE PROVIDED SNAPSHOT AND 'OPEN IMAGE IN NEW TAB, AND THEN LEFT CLICK ON THE PLUS MAGNIFIER.

2. LEFT CLICK ON THE PROVIDED SNAPSHOT LINK, THEN LEFT CLICK ON

THE SNAPSHOT TO ENLARGE, THEN RIGHT CLICK TO FIND 'OPEN IMAGE IN NEW

TAB' AND LEFT CLICK, THEN LEFT CLICK THE ZOOM MAGNIFIER

*THIS POST MAY INCLUDE POST-MASTERS AND POST-DOCTORAL LEVEL

EDUCATIONAL AND DISSERTATIVE INFORMATION, AND PROFESSORIAL TUTORIAL

CONTEXTING AND REFERENCING, WITHIN THE TECHNICAL FIELDS OF MARKET

BEHAVORAL ECONOMICS, FINANCIAL MARKETS TECHNICAL ANALYSIS, AND ADVANCED

FINANCIAL PHYSICS, DISSEMITATIVELY.

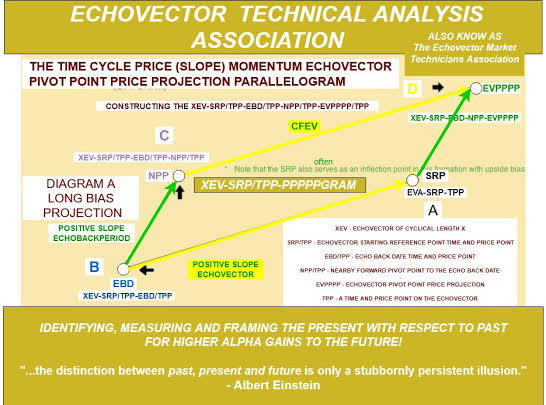

ILLUSTRATING THE POWER OF THE TIME CYCLE PRICE SLOPE MOMENTUM

ECHOVECTOR (X-EV) AND ITS KEY 'CONSTRUCTION DERIVED' COORDINATE FORECAST

ECHOVECTORS (CFEV) WITH THEIR POWERFULLY GENERATED ECHOVECTOR PIVOT

POINT TIME/PRICE PROJECTIONS (EV-PPPP) - WITHIN THE CONTEXTUAL SET OF

KEY ACTIVE TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE

PROJECTION PARALLELOGRAMS IN INTEGRAL AND INTERSECT! ALSO HIGHLIGHTING

KEY ACTIVE COORDINATE FORECAST ECHOVECTOR ECHOBACKDATE (EBD)

TIMEANDPRICEPOINT (TPP) NEARBY-PIVOT-POINTS (NPP)

AND NEARBY-INFLECTION-POINTS (NIP) AND THEIR KEY RADIATING ECHOVECTOR

FAN CLUSTER TRIANGULARIZATIONS - ALSO SYMMETRY TRANSPOSED (SYMTRA'D)

INTO THE CURRENT FORWARD FOCUS INTEREST OPPORTUNITY PERIOD AND THE

ECHOVECTOR SCENARIO SETUP OPPORTUNITY INDICATING ACTIVE ADVANCED

POSITION AND RISK MANAGEMENT PERIOD - AND FURTHER HIGHLIGHTING POTENTIAL

HIGH ALPHA TRANSACTION AND RISK MANAGEMENT POSITION OPPORTUNITY

SIGNALS, AND KEY POTENTIAL HIGH ALPHA PRODUCTION OTAPS-PPS ACTIVE

ADVANCE POSITION AND RISK MANAGEMENT POSITION POLARITY SWITCH SIGNALS

AND THEIR EMPLOYMENT OPPORTUNITY PERIODS.

KEY ACTIVE ECHOVECTOR PARALLELOGRAMS!KEY ACTIVE

ECHOVECTOR PIVOT POINT & INFLECTION POINT TIME/PRICE PROJECTIONS!KEY

ECHOVECTOR ECHOBACKDATE TIMEANDPRICEPOINTS WITHIN ECHOBACKPERIODS!KEY

ECHOVECTOR ECHOBACKPERIOD NEARBY FORWARD PIVOT POINTS!KEY ECHOBACKPERIOD

NEARBY FORWARD PIVOT POINT VECTOR CLUSTERS TRIANGLE MAPPINGS!KEY

ECHOBACKPERIOD VECTOR CLUSTER TRIANGLE MAPINGS SYMMETRY TRANSPOSED TO

FORWARD! FOCUS INTEREST OPPORTUNITY PERIOD KEY GENERATED OTAPS RISK

MANAGEMENT OPPORTUNITY VECTORS

METHODOLOGY NOTES

INTRODUCTION TO ECHOVECTOR ANALYSIS AND ECHOVECTOR PIVOT POINTS

"EchoVector Theory and EchoVector Analysis assert that a securities

prior price patterns may influence its present and future price

patterns. Present and future price patterns may then, in part, be

considered as 'echoing' these prior price patterns to some identifiable

and measurable degree.

EchoVector Analysis is also used to forecast and project potential

price Pivot Points (referred to as PPP's --potential pivot points, or

EVPP's --EchoVector Pivot Points) and active, past and future coordinate

forecast EchoVector support and resistance echovectors (SREV's) for a

security from a starting reference price at a starting reference time,

based on the securities prior price pattern within a given and

significant and definable cyclical time frame.

EchoVector Pivot Points and EchoVector Support and Resistance Vectors

are fundamental components of EchoVector Analysis. EchoVector SREV's

are constructed from key components in the EchoVector Pivot Point

Calculation. EchoVector SREV's are defined and calculated and also

referred to as Coordinate Forecast EchoVectors (CFEV's) to the initial

EchoVector (XEV) calculation and construction, where X designates not

only the time length of the EchoVector XEV, but also the time length of

XEV's CFEVs. The EchoVector Pivot Points are found as the endpoints of

XEV's CFEVs' calculations and the CFEVs' constructions.

The EchoVector Pivot Point Calculation is a fundamentally

different and more advanced calculation than the traditional pivot

point calculation.

The EchoVector Pivot Point Calculation differs from traditional pivot

point calculation by reflecting this given and specified cyclical price

pattern length and reference, and its significance and information,

within the pivot point calculation. This cyclical price pattern and

reference is included in the calculations and constructions of the

EchoVector and its respective coordinate forecast EchoVectors, as well

as in the calculation of the related EchoVector pivot points.

While a traditional pivot point calculation may use simple price

averages of prior price highs, lows and closes indifferent to their

sequence in time to calculate its set of support and resistance levels,

the EchoVector pivot point calculation begins with any starting time and

price point and respective cyclical time frame reference X, and then

identifies the corresponding "Echo-Back-Date-Time-And-Price-Point

(EBD-TPP)" within this cyclical time frame reference coordinate to the

starting reference price and time point A. It then calculates the

EchoVector (XEV) generated by the starting reference time/price point

and the echo-back-date-time-and-price-point, and includes the

pre-determined and pre-defined accompanying constellation of "Coordinate

Forecast EchoVector" origins derived from the prior price pattern

evidenced around the echo-back-date-time-and-price-point (EBD-TPP)

within a certain pre-selected and specified range (time and/or price

version) that occurred within the particular referenced cyclical

time-frame and period X. The projected scope-relative EchoVector Pivot

Points, the EVPPs (OTCPK:PPPS)

that follow Security I's starting point A of EchoVector XEV, of

designated cycle time length X , are then calculated and constructed

using the EBD-TPP and its scope-relative nearby pivot points and

inflection points (NPPs-NFPs), and by the corresponding EchoVector slope

momentum rate indicator shared by both the original EchoVector and its

coordinate forecast echovectors within the fundamental forecast

EchoVector pivot point price parallelogram construction, and by the

support and resistance levels and the slope momentum indicator

determined by XEV and by the included coordinate forecast echovectors

(they also fully utilizing the time-sequence and already occurring

NPP-NFP prices to A's EBD-TPP, and the constellation of CFEV origins

produced).

EchoVector Pivot Point Time And Price Projections

(EV-PPPPs) are therefore advanced and fluid calculations of projected

and coordinate support and resistance levels following the starting

reference price and time point A (SRP-TPP) of the subject focus

EchoVector (X-EV of Cycle Period time length X), levels which are

derived from ascending, descending and/or lateral coordinate support and

resistance forecast EchoVectors (CFEVs) calculated and emanating from

particular range defined echobackperiod times and price points

(NPP-TPPs) related to the price points and time points of proximate

scale and scope and the relative pivoting action that had followed the

focus EchoVector's echo-back-time-point B (EBD-TPP) within, and relative

to, the focus EchoVector's starting time-point and price-point, SRP,

and the EchoVector's given and specified cyclically-based focus interest

time-span X, and the EchoVector's related slope momentum measure

(X-EV's incline). This enables EchoVector Pivot Points to be constructed

from any relevantly identified time cycle period length, or the

aggregation of any set of time cycle period lengths. Intraday, Daily,

Weekly, Monthly, Quarterly, Bi-quarterly, Annual, Congressional Cycle,

Presidential Cycle, Senatorial Cycle, etc., and in accordance with the

economic calendar, earnings calendar, political economic calendar, or

any statistically significant 'calendar' cycle periodicity evident and

recursive in back-data mining.)

Along with EchoVectors, The EchoVector Support and Resistance

Vectors, (referred to as the Coordinate Forecast EchoVectors) as well as

NPP Vectors, are used to generate the EchoVector Pivot Points; all

constructed and determined within the EchoVector Pivot Point Price

Projection Parallelogram."

From "Introduction to EchoVector Analysis And EchoVector Pivot Points" ECHOVECTORVEST MDPP PRECISION PIVOTS

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

TIMELY AND SPECIAL FINANCIAL MARKETS SNAPSHOT IMAGES

MAY ALSO BE PROVIDED TO YOU FROM TODAY'S MARKET PIVOTS REAL-TIME MARKET

BROADCASTS ON MARKETPIVOTSTV! THESE ADDITIONALLY TIMELY ADVANCED

TECHNICAL ANALYSIS IMAGES ARE NOW BEING MADE AVAILABLE TO THE MARKET

ALPHA NEWSLETTERS GROUP AND THE MARKET PIVOTS FORECASTER BY MARKETINVESTORSWEEKLY.COM FOR

THE BENEFIT OF THEIR EXTENDED GLOBAL COMMUNITY READERSHIP AND

MEMBERS,IN ASSOCIATION WITH THE MDPP PRECISION PIVOTS MARKET LABORATORY

AND THE ECHOVECTOR TECHNICAL ANALYSIS ASSOCIATION!

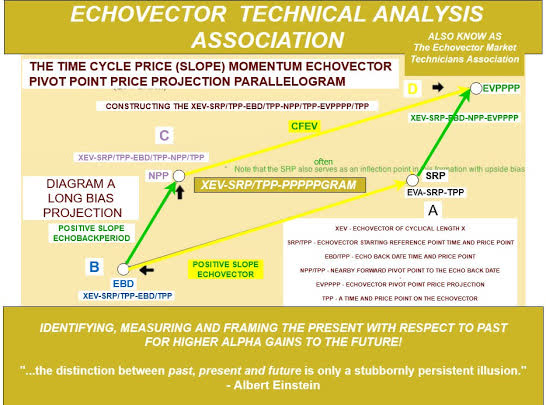

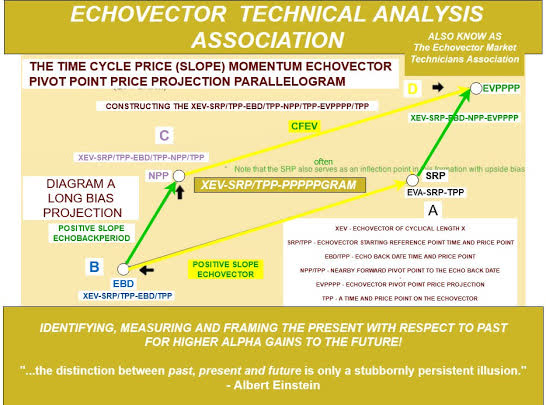

THE TIME CYCLE PRICE (SLOPE) M0MENTUM ECHOVECTOR

AND ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAM: POWERFUL

TECHNICAL ANALYSIS FORECAST PROJECTION TOOLS: ECHOVECTOR XEV OF TIME

CYCLE LENGTH X With SRP-TPP (FAR RIGHT) And EBD-TPP (FAR LEFT), WERE THE

TTPs EQUAL: XEV - ECHOVECTOR OF TIME CYCLE LENGTH XSRP - STARTING

REFERENCE POINT (IN CURRENT FOCUS DAY)TPP - TIMEANDPRICEPOINT (IN

CURRENT FOCUS DAY & EBD)EBD - ECHOBACKDAY (SAME DAY OF WEEK X TIME

CYCLE BACK)EchoVector of cyclical time period length X, with starting

timeandpricepoint SRP-TPP (to the far right) and echobackdate

timeandpricepoint EBD-TPP (to the far left). SRP-TPP is a forward

reflection of EBD-TPP, only located one cyclical time period length 'X'

forward (such as one Quarter forward in a Q-EV). XEV's slope momentum

(change, slopemo) in cyclical time period length X measures the price

difference between EBD-TPP and SRP-TPP over that specific cyclical time

length X period.XEV is the hypotenuse of triangle time length X

(horizontal) and price points P differential (vertical) where the price

point differential is the price difference between the EBD-TPP and the

SRP-TPP.A CFEV (Coordinate Forecast EchoVector) generated from

Echovector XEV runs parallel to XEV and radiates from a scalar NPP

(nearby pivot point, nearby inflection point) ocurring forward from

XEV's EBD-TPP located in the EBP (echobackperiod). At the far right end

of the CFEV is found the EVPPPP (EchoVector pivot point price projection

(s1, s2, s3, r1, r2, r3, etc.) to XEV's SRP-TPP.This full construction

is called the 'Time Cycle Price (Slope) Momentum EchoVector Pivot Point

Price Projection Parallelogram, containing XEV's SRP-TPP, Xev'S EBD-TPP,

the NPP-TPP located forward from the EBD-TPP and serving as XEV's CFEV

origin, and the EVPPPP-TPP found at the far right of the CFEV. The CFEV

is a powerfully indicative EVA Support/Resistance vector! The powerful

TCP(S)MPPPPPgram,

with its identified and defining XEV SRP-TPP, and its EBP

(echobackperiod) identified and constructed CFEV radiating from the

NPP-TPPs to the EVPPPP-TPPs, s1, s2, s3, or r1, r2, r3 etc., is thereby

constructed.XEV/SRP-TPP/EBD-TPP/NPP-TPP/EVPPPP-TPP (S1 Or R1)

THE TIME CYCLE PRICE (SLOPE) M0MENTUM ECHOVECTOR

AND ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAM: POWERFUL

TECHNICAL ANALYSIS FORECAST PROJECTION TOOLS: ECHOVECTOR XEV OF TIME

CYCLE LENGTH X With SRP-TPP (FAR RIGHT) And EBD-TPP (FAR LEFT), WERE THE

TTPs EQUAL: XEV - ECHOVECTOR OF TIME CYCLE LENGTH XSRP - STARTING

REFERENCE POINT (IN CURRENT FOCUS DAY)TPP - TIMEANDPRICEPOINT (IN

CURRENT FOCUS DAY & EBD)EBD - ECHOBACKDAY (SAME DAY OF WEEK X TIME

CYCLE BACK)EchoVector of cyclical time period length X, with starting

timeandpricepoint SRP-TPP (to the far right) and echobackdate

timeandpricepoint EBD-TPP (to the far left). SRP-TPP is a forward

reflection of EBD-TPP, only located one cyclical time period length 'X'

forward (such as one Quarter forward in a Q-EV). XEV's slope momentum

(change, slopemo) in cyclical time period length X measures the price

difference between EBD-TPP and SRP-TPP over that specific cyclical time

length X period.XEV is the hypotenuse of triangle time length X

(horizontal) and price points P differential (vertical) where the price

point differential is the price difference between the EBD-TPP and the

SRP-TPP.A CFEV (Coordinate Forecast EchoVector) generated from

Echovector XEV runs parallel to XEV and radiates from a scalar NPP

(nearby pivot point, nearby inflection point) ocurring forward from

XEV's EBD-TPP located in the EBP (echobackperiod). At the far right end

of the CFEV is found the EVPPPP (EchoVector pivot point price projection

(s1, s2, s3, r1, r2, r3, etc.) to XEV's SRP-TPP.This full construction

is called the 'Time Cycle Price (Slope) Momentum EchoVector Pivot Point

Price Projection Parallelogram, containing XEV's SRP-TPP, Xev'S EBD-TPP,

the NPP-TPP located forward from the EBD-TPP and serving as XEV's CFEV

origin, and the EVPPPP-TPP found at the far right of the CFEV. The CFEV

is a powerfully indicative EVA Support/Resistance vector! The powerful

TCP(S)MPPPPPgram,

with its identified and defining XEV SRP-TPP, and its EBP

(echobackperiod) identified and constructed CFEV radiating from the

NPP-TPPs to the EVPPPP-TPPs, s1, s2, s3, or r1, r2, r3 etc., is thereby

constructed.XEV/SRP-TPP/EBD-TPP/NPP-TPP/EVPPPP-TPP (S1 Or R1)

---------------------------------------------------------------------------------

REAL-TIME MARKET LIVE AUDIO BROADCAST TUTORIAL SHORTHAND

ABBREVIATIONS AND ALGO REFERENCES

---------------------------------------------------------------------------------

P - Price

EV - EchoVector

XEV - EchoVector of time cycle length X (and slope momentum delta p over delta x)

SRP - EchoVector starting reference time/price point. Selected.

WEV - one week lengthed Echovector, Weekly

PCEV - 4 year lengthed EchoVector, Presidential Cycle EchoVector

H - Hourly, M - Monthly, Q - Quarterly, A - Annual, CC - 2 Year Congressional Cycle length

4HEV - 4 Hour length-ed EchoVector

TP - TimePoint, time premium in reference to option RVs

TPP - Time and Price Point along a slope momentum EchoVector

EBP - EchoVector EchoBackPeriod

EBD - EchoVector EchoBackDay

EBDTPP - EchoBackDate TimeAndPricePoint (the far left point along

a slope momentum EchoVector, x length from the SRP. The SRP is the EBD

TPP reflection X cycle length forward)

NPP - nearby forward pivot point from the EchoBackDay TPP

CFEV - EVA Coordinate Forecast Projection EchoVector

PGRAM - EVA time cycle pivot point price projection parallelogram support and resistance channel

EVA - EchoVector Analysis

EVTA - EchoVector Financial Markets Technical Analysis

----------------------ALPHABETICAL----------------------

AMPEX - amplified price extension vector from correlate in ebp

B - broadcast, broadcasting

BB - bounce back

BTV - EVA breakthrough vector, YELLOW SPACED

BT - breakthrough

C - call option

CC - counter-clockwise echovector rotation

CFD, CFW - echovector current focus day, current focus week

CHMK - EVA Checkmark Pattern

CL - closing tradeblock low

CD30M - closing tradeblock end less 30 minutes

CW - clockwise echovector rotation

DC - bounce with no sustaining quality, and setting up lower low.

DBOX - EVA diamond box pattern

DERIV - derivative, option, esoteric, future

DIA - dow30 index etf

DOM - depth of marketDP - price downpressure

D30 - dow jones 30 industrials composite indexE - echo

EQUIL - EVA equilibration/ES - sp500 emini futures

ES0 - esoteric, derivative, option

FCRUM - fulcrum hour/period

FIOP - EVA focus interest opportunity period

FRI - Friday

FSE - Frankfurt SE

GREV - EVA global rotation echovector

H - high (often price high, referring to a candle or TB)

HOR - horizontal, horizontal pivot point vector

HSE - Hong Kong SE

ID - identified, designated,

IDR - intraday reversal

INTD - Intraday

INTERD - interday or interweek or intermonth or interperiod

INTRA - intraday

I/O Box- eva price/time inside/outside forecast projection risk management reference action box, zoomed scalar spot

JAJO - January April July October Quarterly Cycle Phase

KR - key reversal

LB - long bias

LOAD - high volume supply at price level

LSE - London SE

M - minute

MMS - market makers

MOMO - momentum, momentum period, 2nd derivative momentum top

MORN - morning

MTB - MainTradeBlockNL - net short

NPA - not presently available

O - OPEN, OPENING

OBV - on balance volume

OH - opening tradeblock high

OL - opening tradeblock low

OPT - option, options

OOTM - out of the money option

OTAPS - EVA otaps signal vector application (Advanced straddle basket application - Google)

P - put Option

PAR - par, parity

PEB - price equivalency basis

PFP - EVA powerful forecast projection

PNLOP - potential net log opportunity period

PRESS - pressure, intraday press to find intermediate wave price level floor or ceiling

POT - pressure on/off tape

PPROG - programmed, pre-programmed

PRE - before, premium

PV,OPV - pointer vector. Price of option points to value of

underlying at time of expiration. Vector pointing there from underlyings

price at time of option exchange print price quote.

QQQ - nasdaq 100 etfR - resistance

REM - remember

REPO - repositioning, rolling into new or updated position complex

REV - reversal

REX - reduced price extension vector from correlate in ebp

RNR - forecast-ed move underway dramatically

ROT - right on target, echovector rotation

RS - relative price strength

RW - relative price Weakness

RWS - relative weakness inflection points or periods

RV - options rider vehicle basket

S,SUP - support

SIG - signal, significant

SLOPEMO - price vector slope momentum

SP - spaced

SPY - sp500 index etf

S/R - support/resistance

SS - scenario setup

ST - short term

SYMTRA - symmetry transpostiion

T - tickTB - tradeblock

TCPSM - time cycle price (slope) momentum

THO - though

TRAJ - price trajectory of xev, cfev, npp vector, otaps vector, options pointer vector, slopemo vector

TSE - Tokyo Stock Exchange

TT - teeter totter

TUES - TuesdayUP - price up-pressure

UW - upwave

USM - NYSE & CBOE Etc

WKLY - weekly

WWW - EVA Wilbur Winged W Pattern

YEL - yellow

> - then or greater than

THANKING THIS MONTH'S APPRECIATED SPONSOR

POWERTRADESTATONS AND POWERTRADESTATIONSGLOBAL

BE SURE LOOK FOR THE POWERTRADESTATION IMPRIMATUR ON EACH TRADING

COMPUTER LISTING TO MAKE SURE YOU ARE PURCHASING A GENUINE

POWERTRADESTATION!

"We Put Our Traders And Their Success First!"

POWERTRADESTATONS AND POWERTRADESTATIONSGLOBAL

"Experienced traders & trader technicians working

with traders for traders to help enable traders & investors to make

better trades!"

Striving to Provide Both Excellence & Economy In

Proven Extended Market Visibility Supporting Financial Tradestations, To

Help Our Traders Advance!"

Optimizing Intelligence, Performance And Price For Our Traders Globally!

DISCLAIMER: This post is for educational and informational purposes

only. There can be significant risks involved with investing including

loss of principal. There is no guarantee that the goals or the

strategies and examples discussed will be achieved. NO content published

by us on the Site, our Blogs, Newsletters, and any Social Media we

engage in constitutes a recommendation that any particular investment

strategy, security, portfolio of securities, or transaction is suitable

for any specific person. Further understand that none of our bloggers,

information providers, App providers, or their affiliates are advising

you personally concerning the nature, potential, value or suitability of

any particular security, portfolio of securities, transaction,

investment strategy or other matter. Again, this post is for

educational, informational, and entertainment purposes only. BEFORE

MAKING ANY INVESTMENT DECISIONS WE STRONGLY ENCOURAGE YOU TO FIRST

CONSULT WITH YOUR PERSONAL FINANCIAL ADVISER.