HOURLY PIVOT POINT INDICATORS, DAILY PIVOT POINT INDICATORS,

WEEKLY

PIVOT POINT INDICATORS, BI-WEEKLY PIVOT POINT INDICATORS, MONTHLY PIVOT

POINT INDICATORS, QUARTERLY PIVOT POINT INDICATORS, BI-QUARTERLY PIVOT

POINT INDICATORS, ANNUAL PIVOT POINT INDICATORS, CONGRESSIONAL CYCLE

PIVOT POINT INDICATORS, PRESIDENTIAL CYCLE PIVOT POINT INDICATORS

S&P500 SPY ETF AND /ES EMINI FUTURES - INSIDE THE QUARTERLY TIME CYCLE PIVOT POINT INDICATORS

1:00PM EDST UPDATE

https://tos.mx/gyCtVkd

https://tos.mx/faSOULS

https://tos.mx/KSQmSW7

https://tos.mx/3cpcDy5

https://tos.mx/Hc15fHt

2QEV EBP

https://tos.mx/i1zR3h6

QEV EBP

https://tos.mx/hXrSKgS

AEV EBP

https://tos.mx/M1nBLw3

CFP

https://tos.mx/cM0PJZI

CFD

https://tos.mx/M6fc5x3

FPRV SPY Wed P452

https://tos.mx/b6DyXZv

3:55PM ET USA UPDATE

https://tos.mx/bnrvpzI

WEDNESDAY MORNING PRE-MARKET, 9/1/21 8:15AM ET USA UPDATE

https://tos.mx/QsCWTQ6

8:15AM

https://tos.mx/PNWhJ0e

http://tos.mx/Jc0t9t1

KEY INTRADAY PIVOT POINT PROJECTION CONSTRUCTION SESSION SSOI FRAMECHARTS

2:45PM UPDATE POST SSOI FIOP COMPLETION FRAMES SHOWING SETUP 2ON 4H3V 12 OCLOCK HOUR (12:30 KEY HORIZONTAL INFLECTION POINT), WITH KEY TCEV CCW ROTATION AND 2ND HALF OF BB RALLY EXTENSION (IN CCW ROTATION TO LONG SLOPEMO TRAJ), WITH POST 1PM COMPLETION TARGET OFF MORNING OPENING RALLY HIGH... WITH ENSUING FORECAST SELLOFF AND FPRV FORWARD FRAMING ALSO INCLUDED IN KEY GREEN REFLECTION TRAJECTORY VECTOR CFEV FORWARD SQUARING INDICATORS.

https://tos.mx/Bpog7l3 fcrv Wc542 rider vehicle indicator framing...on fiop ssoi framing for afternoon selldown after late morning bounceback rally...

3:03PM

https://tos.mx/tgPZ2uR

3:17PM

https://tos.mx/0uM24yb

https://tos.mx/BUmjnEi fprv Wp454 rider vehicle indicator framing for ensuing 1pm+ hour target selloff affter bb c452 high target met.. .

3:20PM

https://tos.mx/3t329W0

3:23PM

https://tos.mx/Bn3wN6i

TO ENLARGE AND FURTHER ZOOM 'TODAY'S TOMORROW TRADER'S EDGE PIVOT POINT INDICATOR FOCUS FORECAST FRAMECHART SNAPSHOTS

(1) RIGHT CLICK ON THE PROVIDED SNAPSHOT AND 'OPEN IMAGE IN NEW TAB, AND THEN LEFT CLICK ON THE PLUS MAGNIFIER, OR

(2) LEFT CLICK ON THE PROVIDED SNAPSHOT LINK, THEN LEFT CLICK ON THE SNAPSHOT TO ENLARGE, THEN RIGHT CLICK TO FIND 'OPEN IMAGE IN NEW TAB' AND LEFT CLICK, THEN LEFT CLICK THE ZOOM MAGNIFIER

echovectorvest.blogspot.com market-pivots.com marketpivotpoints.com marketpivots.net

*THIS POST MAY INCLUDE POST MASTERS AND POST DOCTORAL LEVEL EDUCATIONAL AND DISSERTATIVE INFORMATION, AND PROFESSORIAL TUTORIAL CONTEXTING AND REFERENCING, WITHIN THE TECHNICAL FIELDS OF MARKET BEHAVIORAL ECONOMICS, FINANCIAL MARKET PIVOTS TECHNICAL ANALYSIS, AND ADVANCED FINANCIAL PHYSICS, DISSEMITATIVELY.

___________________________________________________________________________________

PIVOT POINT CALCULATION AND CONSTRUCTION SESSION

ILLUSTRATING

THE TIME CYCLE PIVOT POINT INDICATORS AND THEIR KEY SREV CFEV 'S AND R'

SUPPORT/RESISTANCE PIVOT POINT PRICE PROJECTION VECTORS

S&P500 SPY ETF PIVOT POINTS INDICATOR - ANNUAL AND SUBSUMPTIVE TIME CYCLE PIVOT POINTS IMPLICATIONS AND THEIR ASSOCIATED ECHOBACKPERIODS AND COORDINATE FORECAST SUPPORT AND RESISTANCE VECTORS (CFEVs, SREVs) HIGHLIGHTED AND ILLUSTRATED - DAILY CANDLES

PRESENTED BY THE PRECISION PIVOTS GLOBAL FINANCIAL MARKETS LABORATORY!

================================================

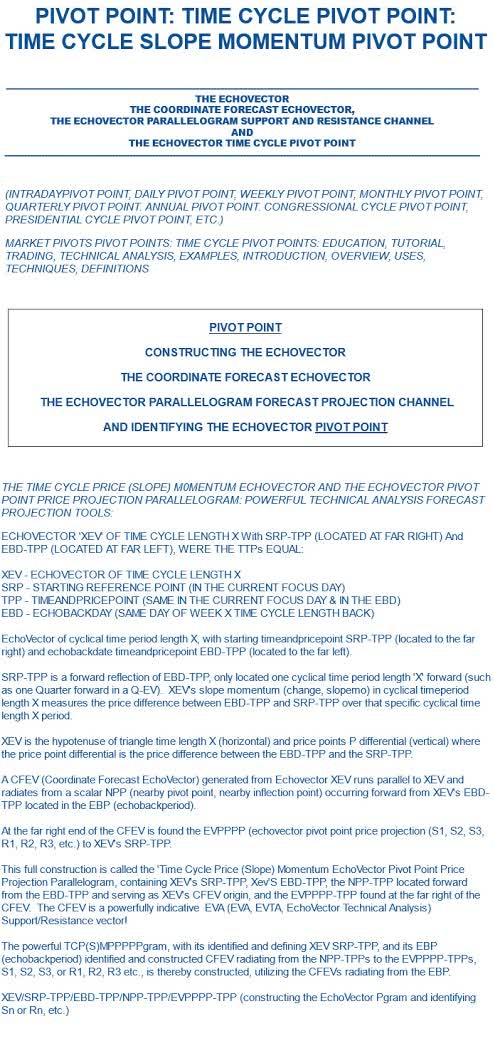

THE TIME CYCLE PRICE (SLOPE) MOMENTUM ECHOVECTOR AND ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAM:

POWERFUL TECHNICAL ANALYSIS FORECAST PROJECTION TOOLS:

ECHOVECTOR XEV OF TIME CYCLE LENGTH X With SRP-TPP (LOCATED ON FAR RIGHT) And EBD-TPP (LOCATED ON FAR FAR LEFT).

XEV - ECHOVECTOR OF TIME CYCLE LENGTH X

SRP - STARTING REFERENCE POINT (IN CURRENT FOCUS DAY)

TPP - TIMEANDPRICEPOINT (IN CURRENT FOCUS DAY & EBD)

EBD - ECHOBACKDATE (SAME DAY OF WEEK, X TIME CYCLE LENGTH BACK)

EchoVector of cyclical time period length X, with starting timeandpricepoint SRP-TPP (to the far right) and echobackdate timeandpricepoint EBD-TPP (to the far left).

SRP-TPP is a forward reflection of EBD-TPP, only located one cyclical time period length 'X' forward (such as one Quarter forward in a Q-EV). XEV's slope momentum (change, slopemo) in cyclical time period length X measures the price difference between EBD-TPP and SRP-TPP over that specific cyclical time length X period.

XEV is the hypotenuse of triangle time length X (horizontal) and price points P differential (vertical) where the price point differential is the price difference between the EBD-TPP and the SRP-TPP.

A CFEV (Coordinate Forecast EchoVector) generated from EchoVector XEV runs parallel to XEV and radiates from a scalar NPP (nearby pivot point, nearby inflection point) occurring forward from XEV's EBD-TPP located in the EBP (echobackperiod).

At the far right end of the CFEV is found the EVPPPP (EchoVector Pivot Point Price Projection (S1, S2, S3, S4, R1, R2, R3, R4, etc.) to XEV's SRP-TPP.

This full construction is called the 'Time Cycle Price (Slope) Momentum EchoVector Pivot Point Price Projection Parallelogram, containing XEV's SRP-TPP, Xev'S EBD-TPP, the NPP-TPP located forward from the EBD-TPP and serving as XEV's CFEV origin, and the EVPPPP-TPP found at the far right of the CFEV.

The CFEV is a powerfully indicative EVA Support/Resistance vector! The powerful TCPSMPPPPPgram, with its identified and defining XEV SRP-TPP, and its EBP (echobackperiod) identified and constructed CFEV, radiating from the NPP-TPPs to the EVPPPP-TPPs, (S1, S2, S3, S4, R1, R2, R3, R4, etc.), is thereby constructed.

XEV SRP-TPP/EBD-TPP/NPP-TPP/EVPPPP-TPP (Sn Or Rn)

---------------------------------------------------------------------------

SHORTHAND ABBREVIATIONS - ALGO REFERENCES

---------------------------------------------------------------------------

P - price

EV - echovector

XEV - echovector of time cycle length X (and slope momentum delta p over delta x)

SRP - echovector starting reference time/price point (its far right point)

WEV - one week lengthed Echovector, Weekly

PCEV - 4 year lengthed echovector, Presidential Cycle Echovector

H - hourly, M - monthly, Q - quarterly, A - annual, CC - 2 year Congressional Cycle length

4HEV - 4 hour lengthed echovector

TP - timepoint, time premium in reference to option RVs

TPP - time and price point along a slope momentum echovector

EBP - echovector echobackperiod

EBD - echovector echobackday

EBDTPP - echobackdate timeandpricepoint (the far left point along a slope momentum echovector, x length from the SRP. The SRP is the EBD TPP reflection X cycle length forward)

NPP - nearby forward pivot point from the echobackday tpp

CFEV - EVA coordinate forecast projection echovector

PGRAM - EVA time cycle pivot point price projection parallelogram support and resistance channel

EVA - EchoVector Analysis

EVTA - EchoVector Financial Markets Technical Analysis

----------------------ALPHABETICAL----------------------

AMPEX - amplified price extension vector from correlate in ebp

B - broadcast, broadcasting

BB - bounce back

BTV - EVA breakthrough vector, YELLOW SPACED

BT - breakthrough

C - call option

CC - counter-clockwise echovector rotation

CFD, CFW - echovector current focus day, current focus week

CHMK - EVA Checkmark Pattern

CL - closing tradeblock low

CD30M - closing tradeblock end less 30 minutes

CPI - consumer price index

CRV - call rider vehicle, esoteric basket, hedge insurance instrument

CW - clockwise echovector rotation

DC - bounce with no sustaining quality, and setting up lower low.

DBOX - EVA diamond box pattern

DERIV - derivative, option, esoteric, future

DIA - dow30 index etf

DOM - depth of market

DP - price downpressure

D30 - dow jones 30 industrials composite index

E - echo

EQUIL - EVA equilibration

/ES - sp500 emini futures

ESO - esoteric, derivative, option basket, weeklys

FCRUM - fulcrum hour/period

FIOP - EVA focus interest opportunity period

FRI - Friday

FRV - focus rider vehicle basket, fcrv focus call rider vehical, fprv focus put rider vehicle

FSE - Frankfurt SE

GREV - EVA global rotation echovector

H - high (often price high, referring to a candle or TB)

HOR - horizontal, horizontal pivot point vector

HSE - Hong Kong SE

ID - identified, designated,

IDR - intraday reversal

INTD - Intraday

INTERD - interday or interweek or intermonth or interperiod

INTRA - intraday

I/O Box- eva price/time inside/outside forecast projection risk management reference action box, zoomed scalar spot

JAJO - January April July October Quarterly Cycle Phase

KR - key reversal

LB - long bias

LOAD - high volume supply at price level

LSE - London SE

M - minute

MMS - market makers

MOMO - momentum, momentum period, 2nd derivative momentum top

MORN - morning

MTB - MainTradeBlock

NL - net short

NPA - not presently available

O - OPEN, OPENING

OBV - on balance volume

OH - opening tradeblock high

OL - opening tradeblock low

OPT - option, options

OOTM - out of the money option

OTAPS - EVA otaps signal vector application (Advanced straddle basket application - Google)

P - put Option

PAR - par, parity

PEB - price equivalency basis

PFP - EVA powerful forecast projection

P'GRAM - time cycle echovector pivot point price projection parallelogram

PNLOP - potential net log opportunity period

PRESS - pressure, intraday press to find intermediate wave price level floor or ceiling

POT - pressure on/off tape

PPROG - programmed, pre-programmed

PRE - before, premium

PR - key scalar related price run (extension[s]) after related origin inflection point reference.

PRV - put rider vehicle, esoteric basket, hedge insurance instrument

PV,OPV - pointer vector. Price of option points to value of underlying at time of expiration. Vector pointing there from underlying's price at time of option exchange print price quote.

QQQ - nasdaq 100 etf

R - resistance

REM - remember

REPO - repositioning, rolling into new or updated position complex

REV - reversal

REX - reduced price extension vector from correlate in ebp

RMH - regular market hours

RMHC - regular market hours close

RMHO - regular market hours open

RNR - forecast-ed move underway dramatically

ROT - right on target, echovector rotation

RS - relative price strength

RW - relative price Weakness

RWS - relative weakness inflection points or periods

RV - options rider vehicle basket

S,SUP - support

SIG - signal, significant

SLOPMO - price vector slope momentum

SP - spaced

SPY - sp500 index etf

S/R - support/resistance

SS - scenario setup

ST - short term

SYMTRA - symmetry transpostiion

T - tickTB - tradeblock

TCPSM - time cycle price (slope) momentum

THO - though

TRAJ - price trajectory of xev, cfev, npp vector, otaps vector, options pointer vector, slopemo vector

TSE - Tokyo Stock Exchange

TT - teeter totter

TUES - Tuesday

UP - price up-pressure

UW - upwave

USM - NYSE & CBOE Etc

WKLY - weekly

WWW - EVA Wilbur Winged W Pattern

YEL - yellow> - then or greater than

----------------------------------------------------------------------------------------------------------------------------------------

POSTING UPDATES FROM - MARKETPIVOTSTV SP500TV AND OPTIONPIVOTSLIVE (OPL)

A PORTION OF THIS WEEK'S KEY POWERFUL FORWARD EVTAA EDUCATIONAL CONTEXTING/FRAMING...

SP500TV OPL TUTORIAL NARRATIVE BIAS PRESENTED AND FULFILLED!

POWERFUL EVTA CONTEXTING - TUTORIAL FORECASTS PROJECTION SCIENCE NOW PROVIDED FREE ONLINE!

----------------------------------------------------------------------------------------------------------------------------------------

THANKING THIS MONTH'S APPRECIATED SPONSOR

POWERTRADESTATONS AND POWERTRADESTATIONSGLOBAL

BE SURE LOOK FOR THE POWERTRADESTATION IMPRIMATUR ON EACH TRADING COMPUTER LISTING TO MAKE SURE YOU ARE PURCHASING A GENUINE POWERTRADESTATION!

"We Put Our Traders And Their Success First!"

POWERTRADESTATONS AND POWERTRADESTATIONSGLOBAL

"Experienced traders & trader technicians working with traders for traders to help enable traders & investors to make better trades!"

Striving to Provide Both Excellence & Economy In Proven Extended Market Visibility Supporting Financial Tradestations, To Help Our Traders Advance!"

Optimizing Intelligence, Performance And Price For Our Traders Globally!

DISCLAIMER: This post is for educational and informational purposes only. There can be significant risks involved with investing including loss of principal. There is no guarantee that the goals or the strategies and examples discussed will be achieved. NO content published by us on the Site, our Blogs, Newsletters, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Again, this post is for educational, informational, and entertainment purposes only. BEFORE MAKING ANY INVESTMENT DECISIONS WE STRONGLY ENCOURAGE YOU TO FIRST CONSULT WITH YOUR PERSONAL FINANCIAL ADVISER.

August 23, 2021 Update