FRIDAY DECEMBER 27 2019 PM MARKET WRAP-UP WITH FORWARD MONDAY MARKET TRADING DAY IMPLCATIONS AND OUTLOOK, EchoVector Technical Analysis Associates' OptionPivotsLive Market Laboratory Update: SPX /ES SPY ETF: Market-Pivots.Com, EminiPivots.Com, OptionPivots.Com, AdvanceVest.Com, Powertradestations.Com

TODAY'S POST

THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER

TODAY'S MOST RECENT MDPP PRECISION PIVOTS PREMIUM DESKS RELEASE POST NOW FREE ONLINE!

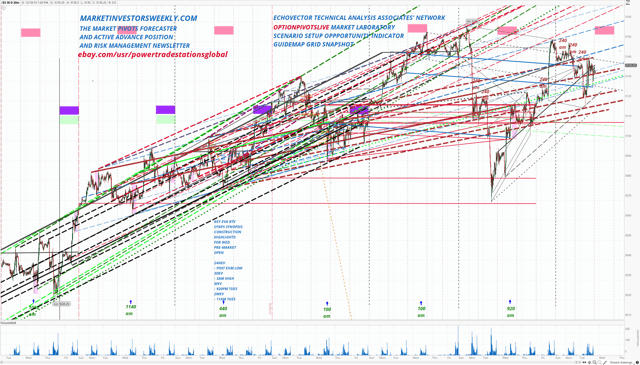

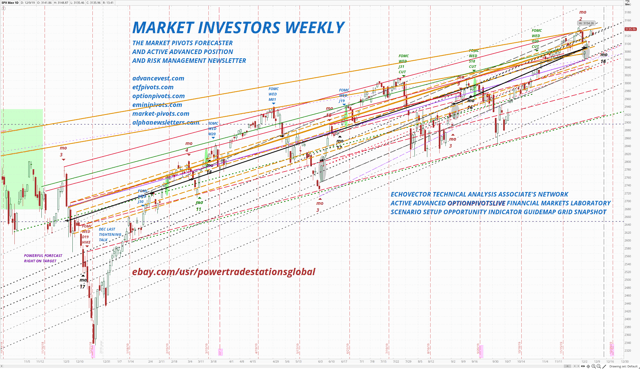

- MARKETINVESTORSWEEKLY.COM FEATURE GENERAL OUTLOOK FOCUS FORECAST FRAMECHART OF THE DAY

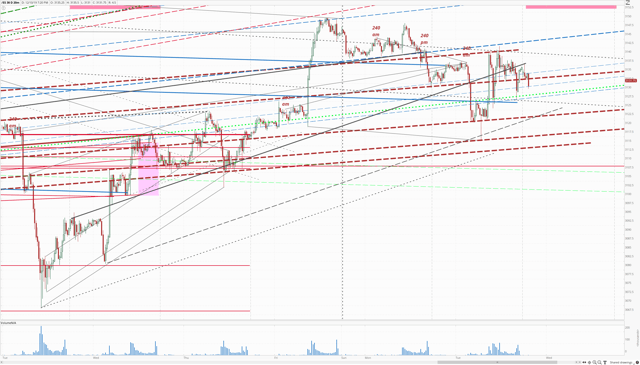

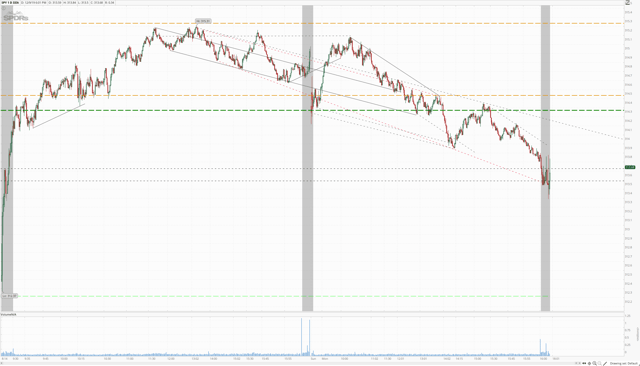

- S&P500 SPX LARGE CAP INDEX ECHOVECTOR ANALYSIS FOCUS FORECAST FRAMECHART AND SCENARIO SETUP OPPORTUNITY GUIDEMAP GRID

- OPTIONPIVOTSLIVE ACTIVE ADVANCED FINANCIAL MARKETS LABORATORY BROADCAST SNAPSHOT (LIMITED SEATS AVAILABLE)

- NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTERS GROUP: MARKET-PIVOTS.COM SPYPIVOTS.COM OPTIONPIVOTS.COM EMINIPIVOTS.COM ETFPIVOTS.COM DOWPIVOTS.COM QQQPIVOTS.COM BONDPIVOTS.COM DOLLARPIVOTS.COM GOLDPIVOTS.COM COMMODITYPIVOTS.COM

- KEY ACTIVE ANNUAL, BI-QUARTERLY, QUARTERLY, MONTHLY, BI-WEEKLY, WEEKLY ECHOVECTORS AND ECHO-BACK-DATE TIME-AND-PRICE-POINTS HIGHLIGHTED AND ILLUSTRATED

- US FEDERAL RESERVE BANK FEDERAL OPEN MARKET COMMITTEE MEETING ANNOUNCEMENT WEDNESDAY ECHOBACKDATES FOR 2019 ARE ALSO HIGHLIGHTED AND ILLUSTRATED IN PRIOR POSTS

- SPONSORED BY MDPP PRECISION PIVOTS AND THE MARKET ALPHA NEWSLETTERS GROUP AND POWERTRADESTATIONS.COM

- SEE ebay.com/usr/powertradestationsglobal

- #powertradestations #powertradestationsglobal #echovector #optionpivots #eminipivots #advancevest #spy #WWW #OTAPS #marketinvestorsweekly #echovectoranalysis #advancevest #marketalphanewslettersgroup

FRIDAY DECEMBER 27 2019 PM

PROVIDING ACTIVE ADVANCED FINANCIAL MANAGEMENT ECHOVECTOR TECHNICAL ANALYSIS FOCUS FORECAST FRAMECHARTS AND SPECIAL SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS SNAPSHOTS - FOR THE ACTIVE ADVANCED FINANCIAL MANAGER AND TRADER/TRADING GROUP...

THOUSANDS OF HISTORICAL FOCUS FORECAST FRAMECHARTS AND IMPORTANT TIMING SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS ARE STORED AND AVAILABLE, FOR PUBLIC REFERENCE, STUDY, AND REVIEW, AND ARE ALSO PORTABLE TO YOUR TOS PLATFORM FOR LIVE APPLICATION!!

------------------------------------------------------------------

------------------------------------------------------------------

Sponsored Today By

MARKET INVESTORS WEEKLY

THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER

THE MARKET ALPHA NEWSLETTERS GROUP

PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS

THE OPTIONPIVOTSLIVE ONLINE GLOBAL MARKET LABORATORY

And By

POWERTRADESTATIONS AND POWERTRADESTATIONSGLOBAL

S&P500 SPX LARGE CAP INDEX FOCUS FORECAST FRAMECHART: DAILY CANDLE

SCENARIO SETUP OPPORTUNITY INDICATOR (SSOI)

FOCUS FORECAST FRAMECHARTS (FFF)

FOR SELECT OPTIONPIVOTSLIVE BROADCAST CLASSROOM PREMIUM DESK RELEASED FOCUS FORECAST FRAMECHARTS AND PORTABLE SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS RELEASED INSTANTLY LIVE TO THE MARKET ALPHA NEWSLETTERS GROUP AND TO THE POWERTRADESTATIONS EXTENDED GLOBAL COMMUNITY MEMBERSHIP, SEE

------------------------------------------------------------------

-- Monitors Not Included --

SAMPLE SYSTEMS PRESENTLY AVAILABLE

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

NEWLY RELISTED! FallSuperSale! 3840x2400Powerhouse! $389

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

8Core 3.00GHz 240GBSSD 1TBHDD W10P/W7P

OUR MOST POPULAR WINDOWS 7 PRO DELL POWERTRADESTATION! $549

HP Z600 POWERTRADESTATION TRADING COMPUTER

HP Z600 POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

6 Monitor GPU Support 3DHDUltraHiRes 64GB RAM

SUPER OCTOBER 2019 UPGRADE! 3.33GHz! 512GBSSD! 64GBRAM! 62 Sold $575

HP Z600 POWERTRADESTATION TRADING COMPUTER

6 Monitor GPU Support 48GB RAM

Xeon12Core w/12Threads 512GBSSD 2TBHDD W10P

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

6 Monitor GPU Support

8 True Physical Cores 3.16GHz Xeons! SSD! 3DHDUltHiRes! $629

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

HP Z600 POWERTRADESTATION WORKSTATION TRADING COMPUTER

8 Monitor GPU Support 48GB RAM

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

10 Monitor GPU Support 32GB RAM

DELL POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTERADDITIONAL QUICKLINKS TO

POPULAR SAMPLE POWERTRADESTATIONS

DELL TRADESTATION 4Mon 64GB RAM 8Core Xeon 256GBSSD 2TBHDD W10P Trading Computer | eBay

DELL 4-MONITOR TRADING COMPUTER TRUE XEON TURBO 3.46GHz 18GBRAM 512GBSSD 2TBHDD | eBay

DELL TRADING COMPUTER 6Monitor 3DHDUltraHiRes 8CoreXeon 64RAM 512SSD 2TBHDD W10P | eBay

DELL TRADESTATION 6Mon 64GB RAM 8Core Xeon 512GBSSD 2TBHDD W10P Trading Computer | eBay

DELL 4-MONITOR TRADING COMPUTER TRUE XEON TURBO 3.46GHz 18GBRAM 256GBSSD 2TBHDD | eBay

XFAST HP Z600 Workstation Trading Computer 8Mon 12CoreXeon 512SSD 4TBHDD 48GBRAM | eBay

DELL Trading Computer 6Monitor XeonMaxTurbo3.86GHz 512GBSSD 2TBHDD 96GBRAM W10P! | eBay

DELL Trading Computer 10Monitor 512GBSSD 6TBHDD 64GBRAM 8CoreXeon3.33GHz W10P! | eBay

------------------------------------------------------------------

------------------------------------------------------------------

OPTIONPIVOTS.COM: RUSSELL 2000 AND S&P500 SPY ETF: MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHARTS AND TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE ANALYSIS AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS: HIGHLIGHTS AND ILLUSTRATIONS: POWERFUL FORECAST RIGHT ON TARGET: NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTER GROUP AND MARKET-PIVOTS.COM

------------------------------------------------------------------

Sponsored by POWERTRADESTATIONS.COM

POWERTRADESTATIONS AND POWERTRADESTATIONSglobal

ARE PROUD SPONSORS OF

BE SURE LOOK FOR THE POWERTRADESTATION IMPRIMATUR ON EACH TRADING COMPUTER LISTING TO MAKE SURE YOU ARE PURCHASING A GENUINE POWERTRADESTATION!

--------------------------

REPEAT OF PRIOR SAMPLE POST

Tuesday December 10 2019, EchoVector Technical Analysis Associates' OptionPivotsLive Market Laboratory Update: SPX /ES SPY ETF: Market-Pivots.Com, EminiPivots.Com, OptionPivots.Com, AdvanceVest.Com, Powertradestations.Com

TODAY'S POST

THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER

TODAY'S MOST RECENT MDPP PRECISION PIVOTS PREMIUM DESKS RELEASE POST NOW FREE ONLINE!

- MARKETINVESTORSWEEKLY.COM FEATURE GENERAL OUTLOOK FOCUS FORECAST FRAMECHART OF THE DAY FOR TUESDAY/WEDNESDAY DECEMBER 10/11 2019.

- S&P500 SPX LARGE CAP INDEX ECHOVECTOR ANALYSIS FOCUS FORECAST FRAMECHART AND SCENARIO SETUP OPPORTUNITY GUIDEMAP GRID

- OPTIONPIVOTSLIVE ACTIVE ADVANCED FINANCIAL MARKETS LABORATORY BROADCAST SNAPSHOT (LIMITED SEATS AVAILABLE)

- NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTERS GROUP: MARKET-PIVOTS.COM SPYPIVOTS.COM OPTIONPIVOTS.COM EMINIPIVOTS.COM ETFPIVOTS.COM DOWPIVOTS.COM QQQPIVOTS.COM BONDPIVOTS.COM DOLLARPIVOTS.COM GOLDPIVOTS.COM COMMODITYPIVOTS.COM

- KEY ACTIVE ANNUAL, BI-QUARTERLY, QUARTERLY, MONTHLY, BI-WEEKLY, WEEKLY ECHOVECTORS AND ECHO-BACK-DATE TIME-AND-PRICE-POINTS HIGHLIGHTED AND ILLUSTRATED

- US FEDERAL RESERVE BANK FEDERAL OPEN MARKET COMMITTEE MEETING ANNOUNCEMENT WEDNESDAY ECHOBACKDATES FOR 2019 ARE ALSO HIGHLIGHTED AND ILLUSTRATED

- SPONSORED BY MDPP PRECISION PIVOTS AND THE MARKET ALPHA NEWSLETTERS GROUP AND POWERTRADESTATIONS.COM

- SEE ebay.com/usr/powertradestationsglobal

- #powertradestations #powertradestationsglobal #echovector #optionpivots #eminipivots #advancevest #spy #WWW #OTAPS #marketinvestorsweekly #echovectoranalysis #advancevest #marketalphanewslettersgroup

TUESDAY DECEMBER 10 2019 PM

PROVIDING ACTIVE ADVANCED FINANCIAL MANAGEMENT ECHOVECTOR TECHNICAL ANALYSIS FOCUS FORECAST FRAMECHARTS AND SPECIAL SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS SNAPSHOTS - FOR THE ACTIVE ADVANCED FINANCIAL MANAGER AND TRADER/TRADING GROUP...

THOUSANDS OF HISTORICAL FOCUS FORECAST FRAMECHARTS AND IMPORTANT TIMING SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS ARE STORED AND AVAILABLE, FOR PUBLIC REFERENCE, STUDY, AND REVIEW, AND ARE ALSO PORTABLE TO YOUR TOS PLATFORM FOR LIVE APPLICATION!!

------------------------------------------------------------------

------------------------------------------------------------------

Sponsored Today By

MARKET INVESTORS WEEKLY

THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER

THE MARKET ALPHA NEWSLETTERS GROUP

PROTECTVEST AND ADVANCEVEST MDPP PRECISION PIVOTS

THE OPTIONPIVOTSLIVE ONLINE GLOBAL MARKET LABORATORY

And By

POWERTRADESTATIONS

S&P500 SPX LARGE CAP INDEX FOCUS FORECAST FRAMECHART: DAILY CANDLE

SCENARIO SETUP OPPORTUNITY INDICATOR (SSOI)

FOCUS FORECAST FRAMECHARTS (FFF)

FOR SELECT OPTIONPIVOTSLIVE BROADCAST CLASSROOM PREMIUM DESK RELEASED FOCUS FORECAST FRAMECHARTS AND PORTABLE SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS RELEASED INSTANTLY LIVE TO THE MARKET ALPHA NEWSLETTERS GROUP AND TO THE POWERTRADESTATIONS EXTENDED GLOBAL COMMUNITY MEMBERSHIP, SEE

------------------------------------------------------------------

-- Monitors Not Included --

SAMPLE SYSTEMS PRESENTLY AVAILABLE

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

NEWLY RELISTED! FallSuperSale! 3840x2400Powerhouse! $389

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

8Core 3.00GHz 240GBSSD 1TBHDD W10P/W7P

OUR MOST POPULAR WINDOWS 7 PRO DELL POWERTRADESTATION! $549

HP Z600 POWERTRADESTATION TRADING COMPUTER

HP Z600 POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

6 Monitor GPU Support 3DHDUltraHiRes 64GB RAM

SUPER OCTOBER 2019 UPGRADE! 3.33GHz! 512GBSSD! 64GBRAM! 62 Sold $575

HP Z600 POWERTRADESTATION TRADING COMPUTER

6 Monitor GPU Support 48GB RAM

Xeon12Core w/12Threads 512GBSSD 2TBHDD W10P

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

6 Monitor GPU Support

8 True Physical Cores 3.16GHz Xeons! SSD! 3DHDUltHiRes! $629

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER

HP Z600 POWERTRADESTATION WORKSTATION TRADING COMPUTER

8 Monitor GPU Support 48GB RAM

DELL POWERTRADESTATION TRADING COMPUTER

DELL POWERTRADESTATION TRADING COMPUTER HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

10 Monitor GPU Support 32GB RAM

DELL POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTER

HP POWERTRADESTATION TRADING COMPUTERADDITIONAL QUICKLINKS TO

POPULAR SAMPLE POWERTRADESTATIONS

DELL TRADESTATION 4Mon 64GB RAM 8Core Xeon 256GBSSD 2TBHDD W10P Trading Computer | eBay

DELL 4-MONITOR TRADING COMPUTER TRUE XEON TURBO 3.46GHz 18GBRAM 512GBSSD 2TBHDD | eBay

DELL TRADING COMPUTER 6Monitor 3DHDUltraHiRes 8CoreXeon 64RAM 512SSD 2TBHDD W10P | eBay

DELL TRADESTATION 6Mon 64GB RAM 8Core Xeon 512GBSSD 2TBHDD W10P Trading Computer | eBay

DELL 4-MONITOR TRADING COMPUTER TRUE XEON TURBO 3.46GHz 18GBRAM 256GBSSD 2TBHDD | eBay

XFAST HP Z600 Workstation Trading Computer 8Mon 12CoreXeon 512SSD 4TBHDD 48GBRAM | eBay

DELL Trading Computer 6Monitor XeonMaxTurbo3.86GHz 512GBSSD 2TBHDD 96GBRAM W10P! | eBay

DELL Trading Computer 10Monitor 512GBSSD 6TBHDD 64GBRAM 8CoreXeon3.33GHz W10P! | eBay

------------------------------------------------------------------

------------------------------------------------------------------

OPTIONPIVOTS.COM: RUSSELL 2000 AND S&P500 SPY ETF: MDPP PRECISION PIVOTS ECHOVECTOR ANALYSIS TUTORIAL FOCUS FORECAST FRAMECHARTS AND TIME CYCLE PRICE MOMENTUM ECHOVECTOR PIVOT POINT PRICE ANALYSIS AND OTAPS-PPS ACTIVE ADVANCED MANAGEMENT SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRIDS: HIGHLIGHTS AND ILLUSTRATIONS: POWERFUL FORECAST RIGHT ON TARGET: NOW FREE ONLINE TO THE MARKET ALPHA NEWSLETTER GROUP AND MARKET-PIVOTS.COM

------------------------------------------------------------------

Sponsored by POWERTRADESTATIONS.COM

POWERTRADESTATIONS AND POWERTRADESTATIONSglobal

ARE PROUD SPONSORS OF

BE SURE LOOK FOR THE POWERTRADESTATION IMPRIMATUR ON EACH TRADING COMPUTER LISTING TO MAKE SURE YOU ARE PURCHASING A GENUINE POWERTRADESTATION!

--------------------------

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.