|

About: SPDR Dow Jones Industrial Average ETF (DIA), DJI, IWM, QQQ, SPX, SPY

- SELECT FINANCIAL MARKETS FOCUS INSTRUMENT SNAPSHOTS ON THE DOW JONES 30 INDUSTRIALS AVERAGE DIA ETF PUBLICLY RELEASED FROM THE SP500TV OPTIONPIVOTSLIVE MARKETPIVOTSTV STREAMING GLOBAL PODCAST/BROADCAST BY MDPP PRECISION PIVOTS.

- Features Select TODAY'S TOMORROW TRADER'S EDGE EasyGuideMap Grid Snapshots & Scenario Setup Opportunity Indicator Focus Forecast FrameCharts Released to THE MARKET PIVOTS FORECASTER FREE ONLINE VERSION & MARKET INVESTORS WEEKLY.

- May Include Featured DJX, DIA, /YM, SPX, INX, SPY, /ES, NDX, QQQ, /NQ, RUT, IWM, /RTY, TLT, /ZB, GLD /GC, USO, /QM, DYX, USDX, UUP, EasyGuideMap Grid Snapshots AND MORE!

A PROFESSIONAL CONTENT NO-POPUP WEBSITE THANKING THIS MONTH'S FEATURED SPONSORS Powertradstations and Powertradestationsglobal!

TODAY'S POST

THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCED POSITION AND RISK MANAGEMENT NEWSLETTER

THE MARKET ALPHA NEWSLETTERS GROUP CONSOLIDATED FREE ONLINE NEWSLETTERS VERSION

AND BY BRIGHTHOUSEPUBLISHING.COM!

TODAY'S MOST RECENT MDPP PRECISION PIVOTS PREMIUM DESKS RELEASED FOCUS FORECAST EASYGUIDE TRADERS EDGE FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS ARE NOW FREE ONLINE AT THE MARKET PIVOTS FORECASTER!

ANALYSIS, ALERTS, OTAPS SIGNALS, CHART ILLUSTRATIONS, AND COMMENTARY

MARKET INVESTORS WEEKLY IS NOW IN ASSOCIATION WITH THE MARKET PIVOTS FORECASTER AND WITH

PROTECTVEST AND ADVANCVEST MDPP PRECISION PIVOTS

"Positioning for change... staying ahead of the curve... we're keeping watch for you!"

ALSO PROVIDING THE MARKET PIVOTS FORECASTER FREE ONLINE CONSOLIDATED NEWSLETTERS VERSION A WEEKLY SUMMATION OF FEATURED AND SELECT ADVANCED ECHOVECTOR TECHNICAL ANALYSIS TRADER'S EDGE EASYGUIDE FOCUS FORECAST FRAMECHARTS AND SCENARIO SETUP OPPORTUNITY GUIDEMAP GRID 'PREMIUM DESKS RELEASED SNAPSHOT IMAGES' FROM SP500TV, THE OPTIONPIVOTSLIVE ONLINE ACTIVE ADVANCED ECHOVECTOR TECHNICAL ANALYSIS ASSOCIATES MARKET LABORATORY GLOBAL MARKET PODCAST/BROADCAST, AND MARKETPIVOTSTV - A COMPREHENSIVE CHRONICLE AND SPECIAL RELEASE SNAPSHOT IMAGES POSTING PRESENTATION OF FEATURED AND SELECT LIVE MARKET INTELLIGENCE SNAPSHOT IMAGES POSTED IN THE MARKET PIVOTS FORECASTER - FOR TODAY AND DURING THE PAST WEEKS!

________________________________________________________

SP500TV OPTIONPIVOTSLIVE AT MARKETPIVOTSTV: ACTIVE ADVANCED ECHOVECTOR TECHNICAL ANALYSIS MARKET LABORATORY PRESENTED IN REAL-TIME BY MDPP PRECISION PIVOTS - LIMITED SEATS AVAILABLE -

GO TO screenleap.com/marketpivots

YOU CAN UTILIZE UTILIZE THE FOLLOWING EVA (ECHOVECTOR ANALYSIS) ALGO CONSTRUCTION TERMINOLOGICAL REFERENCES & SHORTHAND ABBREVIATIONS DURING A SPECIALIST'S BROADCAST NARRATIVE

P price

EV echovector

XEV echovector of time cycle length X (and slope momentum delta p over delta x)

SRP echovector starting reference time/price point

(its far right point)

WEV One Week lengthed Echovector, Weekly

H hourly, M monthly, Q quarterly, A annual, CC Congressional cycle length

TP timepoint

TPP time and price point along a slope momentum echovector

EBP echovector echobackperiod

EBD echovector echobackday

EBD TPP echobackdate timeandpricepoint

(the

far left point along a slope momentum echovector, x length from the

SRP. The SRP is the EBD TPP reflection X cycle length forward)

NPP nearby forward pivot point from the echobackday tpp

CFEV coordinate forecast projection echovctor

DP price downpressure

UP price up-pressure

RV options rider vehicle basket

T tick

SS scenario setup

FIOP focus interest opportunity period

I/O Box. inside/outside forecast projection risk management timeprice reference box

PGRAM time cycle pivot point price projection parallelogram support and resistance channel

RS relative price strength

RW relative price Weakness

GREV global rotation echovector

TB tradeblock

MTB maintradeblock, minitradeblock, microtradeblock

OH opening tradeblock high

OL opening tradeblock low

CL closing tradeblock low

CD30M closing tradeblock end less 30 minitutes.

EVA Echovector Analysis

BTV Breakthrough Vector

BT breaklthrough

WWW Wilbur Winged W Pattern

CHMK EVA Checkmark Pattern

TSE Tokyo Stock Exchange

HSE Hong Kong SE

FSE Frankfurt SE

LSE London SE

USM NYSE & CBOE Etc

TT teeter totter

FCRUM fulcrum hour/period

C call option

P put Option

ST short term

INTD Intraday

NS net short

NL net long

POT pressure on/off tape

S/R support/resistance

OTAPS otaps signal vector application (Advanced straddle basket application - Google)

DIA dow30 index etf

SPY sp500 index etf

/ES sp500 emini futures

QQQ nasdaq 100 etf

________________________________________________________

TO ENLARGE SELECT ECHOVECTOR ANALYSIS ASSOCIATES FEATURED AND/OR ADVANCED OPTIONPIVOTSLIVE MARKET LABORATORY SCREENLEAP.COM PODCAST/BROADCAST PREMIUM DESKS RELEASED SCENARIO SETUP OPPORTUNITY INDICATOR GUIDEMAP GRID SNAPSHOTS AND TRADERS' EDGE FOCUS FORECAST FRAMECHART PROJECTIONS, RIGHT CLICK ON SELECTED IMAGE, AND CLICK ON 'VIEW IMAGE,' AND CLICK WHEN YOU SEE 'THE PLUS MAGNIFIER' TO ALSO FURTHER ZOOM THE IMAGE

________________________________________________________

PORT GUIDEMAP GRIDS USING PROVIDED URL TOS.MX QUICKLINKS TO THEN ZOOM IN AND OUT TO VIEW, STUDY, AND REVIEW GRID KEY FOCUS FORECAST PROJECTION FRAMECHART PERSPECTIVES AND THEIR SCENARIO SETUP OPPORTUNITY INDICATIONS!

SP500 ES EMINI FUTURES PORTABLE EASYGUIDEMAP GRID

DOW30 DIA ETF PORTABLE EASYGUIDEMAP GRID

AGAIN, TO ENLARGE AND THEN FURTHER ZOOM PROVIDED TRADER'S EDGE FOCUS FORECAST FRAMECHART SNAPSHOTS FOR EASIEST VIEWING AND INSPECTION, CLICK ON PROVIDED SNAPSHOT LINK, THEN RIGHT CLICK ON SNAPSHOT TO ENLARGE, THEN LEFT CLICK ON ENLARGED SNAPSHOT TO FIND 'VIEW IMAGE' AND RIGHT CLICK THERE, THEN RIGHT CLICK ON 'PLUS MAGNIFIER TO FURTHER ZOOM

BE SURE TO VIEW PRIOR POSTS FOR FURTHER CONTEXTING, STUDY AND REVIEW

THANKING THIS MONTH'S SPECIAL SPONSOR, POWERTRADESTATIONSGLOBAL

"We Put Our Traders & Their Success First!"

------------------------------------------------------------------

MODEL ONTOLOGY TECHNICALS

HOW TO CONSTRUCT ECHOVECTORS AND ECHOVECTOR PIVOT POINT PRICE PROJECTIONS FROM "THE ECHOVECTOR TECHNICAL ANALYSIS ASSOCIATES TECHNICAL HANDBOOK" - -

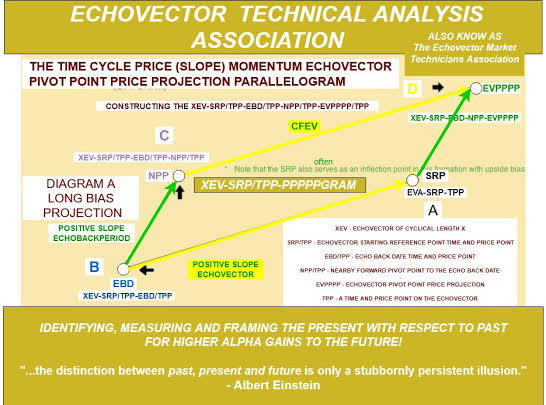

CONSTRUCTING THE ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAM AND COORDINATE FORECAST ECHOVECTOR PIVOT POINT PROJECTION SUPPORT AND RESISTANCE VECTORS FOR ANY SELECTED CYCLICAL LENGTH X, OR GROUP OF CYCLICAL LENGTHS X, Y, Z, ETC., FROM YOUR ELECTED ECHOVECTOR STARTING REFERENCE TIME/PRICE POINT SRP - EVA 101

"Fundamental EVA Time Cycle EchoVector Support and Resistance Vectors for any selected time cycle length are easy to generate yourself. Just pick your financial instruments starting reference point's day, time, and price (srp-tpp) & your cyclical length, x, then find your corresponding echobackdate time&pricepoint (ebd-tpp) one cyclical length of time back from your starting reference point (such as Friday's 4PM closing price).

The time cycle price slope momentum echovector (x-ev) is the line between them (also the triangulated hypotenuse within the echovector pivot point price projection parallelogram under construction). Identify a nearby forward pivot point (NPP) of interest that rests in your focus instrument's price path forward in time from its now identified ebd-tpp, and "duplicate & drag" your echovector, of time cycle length x, to "left-side start" there at your identified forward focus nearby pivot (or inflection) point.

This is the coordinate forecast echovector (CFEV) within the EVA parallelogram.The EV pivot point time/price projection (evpppp) occurs at the end of the right side of the cfev, completing the EV forecast bias parallelogram's 4 key points (the xev-srp-tpp, the xev-ebd-tpp, the identified xev-ebd-tpp-npp, and the xev-evpppp-tpp). The parallelogram's 4 sides (the echovector, the coordinate forecast echovector, the echobackdate timeandpricepoint's forward focus nearby pivot point price extension vector, and the starting reference point's forward forecast bias price extension vector are each essential parts of the time cycle price momentum echovector pivot point price projection parallelogram's construction.

Remember that the echovector is "symmetry transposed" (duplicated and dragged) to start at the npp to form the coordinate forecast echovector, and that the the echobackdate timeandpricepoint's forward focus nearby pivot point price extension vector is "symmetry transposed" (duplicated and dragged) to start at the srp to form the forward forecast bias price extension vector (whether up or down).

And the at the ends of both (and either) the cfev and the ffbpev is found the evpppp-tpp.Then proceed to form your three key forecast bias time cycle price momentum echovector pivot point price parallelograms for the each of the key cycle lengths within any one of your various echovector analysis scenario setup opportunity indicator guidemap grid scope perspectives, for their aggregated intersects & combined vector momentum pressure bias point force directions... such as those found in a monthly(mev)/biweekly(2wev)/weekly(wev) echovector cycle lengths highlighting and illustrating echovector analysis scenario setup opportunity indicator focus forecast framechart and guidemap grid (which helps to illustrate roughly a 4/2/1 ratio of echovector cyclical lengths in echovector force bias construction, intersection, aggregation, compilation, and forecast.

These three conjunctive parallelograms can yield (generate & illustrate) powerful intersecting echovector cyclical price pressure bias pivot point projections (under the criterion of identified cyclical continuance).

Also consider looking at the annual/biquarterly/quarterly cycle lengths EVA SSOI guidemap grid, the congressional/annual/biquartelycycle lengths EVA SSOI guidemap grid, the presidential/congressional/annual cycle lengths EVA SSOI guidemap grid, the biweekly/weekly/midweek cycle lengths EVA SSOI guidemap grid, the weekly/halfweek/daily cycle lengths EVA SSOI guidemap grid, and the 12hour/6hour/3hour and 4h/2h/1h and 2h/1h/halfhour, intraday cycle lengths EVA SSOI guidemap grids, etc.And don't forget the regime change/presidential/congressional cycle lengths EVA SSOI guidemap grid too.

NOTE: Also, when and where you find multiple key Economic Calendar, and Earnings Calendar, and Federal Reserve Announcement Calendar, Futures Expiration Calendar, and Options Expiration Calendar echovectors, in cyclical intersect and phase aggregation, can be indications of powerful pivot points and ensuing and opportunistic directional composite price pressures and extensions!"

AND: Do note forget to include the Global Rotation GREVs (globsal

rotation echovectors - eg., TSE, HSE, FSE, LSE, NYSE inclusions and

coordinations, in your analysis and model constructions for precision

pivots and otaps forecast projection timings, and key slope momentum

support and resistance trajectory signal generations and applications.

POWERFUL FORECAST PROJECTION BIAS APPLICATIONS.

------------------------------------------------------------------

METHODOLOGY NOTES

INTRODUCTION TO ECHOVECTOR ANALYSIS AND ECHOVECTOR PIVOT POINTS

"EchoVector Theory and EchoVector Analysis assert that a securities prior price patterns may influence its present and future price patterns. Present and future price patterns may then, in part, be considered as 'echoing' these prior price patterns to some identifiable and measurable degree.EchoVector Analysis is also used to forecast and project potential price Pivot Points (referred to as PPP's --potential pivot points, or EVPP's --EchoVector Pivot Points) and active, past and future coordinate forecast echovector support and resistance echovectors (SREV's) for a security from a starting reference price at a starting reference time, based on the securities prior price pattern within a given and significant and definable cyclical time frame.

EchoVector Pivot Points and EchoVector Support and Resistance Vectors are fundamental components of EchoVector Analysis. EchoVector SREV's are constructed from key components in the EchoVector Pivot Point Calculation.

EchoVector SREV's are defined and calculated and also referred to as Coordinate Forecast EchoVectors (CFEV's) to the initial EchoVector (XEV) calculation and construction, where X designates not only the time length of the EchoVector XEV, but also the time length of XEV's CFEVs. The EchoVector Pivot Points are found as the endpoints of XEV's CFEVs' calculations and the CFEVs' constructions.

The EchoVector Pivot Point Calculation is a fundamentally different and more advanced calculation than the traditional pivot point calculation.

The EchoVector Pivot Point Calculation differs from traditional pivot point calculation by reflecting this given and specified cyclical price pattern length and reference, and its significance and information, within the pivot point calculation. This cyclical price pattern and reference is included in the calculations and constructions of the echovector and its respective coordinate forecast echovectors, as well as in the calculation of the related echovector pivot points.

While a traditional pivot point calculation may use simple price averages of prior price highs, lows and closes indifferent to their sequence in time to calculate its set of support and resistance levels, the echovector pivot point calculation begins with any starting time and price point and respective cyclical time frame reference X, and then identifies the corresponding "Echo-Back-Date-Time-And-Price-Point (EBD-TPP)" within this cyclical time frame reference coordinate to the starting reference price and time point A.

It then calculates the echovector (XEV) generated by the starting reference time/price point and the echo-back-date-time-and-price-point, and includes the pre-determined and pre-defined accompanying constellation of "Coordinate Forecast EchoVector" origins derived from the prior price pattern evidenced around the echo-back-date-time-and-price-point (EBD-TPP) within a certain pre-selected and specified range (time and/or price version) that occurred within the particular referenced cyclical time-frame and period X.

The projected scope-relative EchoVector Pivot Points, the EVPPs that follow Security I's starting point A of EchoVector XEV, of designated cycle time length X , are then calculated and constructed using the EBD-TPP and its scope-relative nearby pivot points and inflection points (NPPs-NFPs), and by the corresponding echovector slope momentum rate indicator shared by both the original echovector and its coordinate forecast echovectors within the fundamental forecast echovector pivot point price parallelogram construction, and by the support and resistance levels and the slope momentum indicator determined by XEV and by the included coordinate forecast echovectors (they also fully utilizing the time-sequence and already occurring NPP-NFP prices to A's EBD-TPP, and the constellation of CFEV origins produced).

EchoVector Pivot Points are therefore advanced and fluid calculations and effective endpoints of projected coordinate forecast echovector support and resistance time/price levels, projections that are constructed from and follow in time from the starting reference price, time/price point A (echovector endpoint) of the initial subject focus echovector construction, and which occur within an EchoVector Pivot Point Price Projection Parallelogram construct: levels which are derived from coordinate (support and/or resistance) forecast echovectors calculated from particular 'scope and range defined' starting times and price points reflecting the time and price points of proximate scale and scope and time/price pivoting action that followed the initial subject focus interest echovector's echo-back-date-time-and-price-point B (derived from and relative to the initial subject focus echovector's starting time-point and price-point A, and the echovector's given and specified cyclically-based focus interest time-span X, and the initial subject focus echovector's subsequently derived slope relative momentum measures).

The EchoVector Support and Resistance Vectors, referred to as the Coordinate Forecast Echovectors, are used to generate the EchoVector Pivot Points.

"From "Introduction to EchoVector Analysis And EchoVector Pivot Points"

COPYRIGHT 2013-2020 ECHOVECTORVEST MDPP PRECISION PIVOTS

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS

Copyright MDPP Precision Pivots 2020

----------------------------------------------------------------

FOLLOW DAILY UPDATES AND RELEASES

S&P500 SPY ETF AND /ES Emini Futures And Related Options: Today's Financial Time Cycle Price Momentum EchoVector Pivot Point Price Analysis Associates' OptionPivotsLive Online Market Laboratory Highlighting Key Tutorial Scenario Setup Opportunity Indicator Focus Forecast FrameCharts and GuideMap Grids: Today: /ES Emini Futures And SPY ETF S&P500 Live EchoVector Scenario Setup Opportunity Indicator Tutorial Focus Forecast FrameCharts And GuideMap Grids Highlighted And Illustrated: Key Tutorial GuideMap Grids And Tutorial Narrations Include Highlights And Illustrations Of Key Active Focus Forecast Echovector Technical Analysis EchoBackPeriods And EchoBackDate TimeAndPricePoints (Intra-Day, Daily, Weekly, Bi-Weekly, Monthly, BiMonthly, Quarterly, And More), Echovector And Coordinate Forecast Echovector Support And Resistance Vectors, OTAPS-PPS Target Vector Support And Resistance Vectos and Key Straddle Point Indicators, Key Forecast Echovector Pivot Points And Inflection Points, All Occurring Within The Key Active Focus Time Cycle Price Momentum Echovector Pivot Point Price Projection Parallelogram Compilations, Also Highlighted And Illustrated:MARKETINVESTORSWEEKLY.COM MARKET-PIVOTS.COM ETFPIVOTS.COM SPYPIVOTS.COM EMINIPIVOTS.COM OPTIONPIVOTS.COM FXPIVOTS.COM ALPHANEWSLETTERS.COM BRIGHTHOUSEPUBLISHING.COM POWERTRADESTATIONS.COM

------------------------------------------------------------------

WE DO NOT ADVISE. PLEASE SEE OUR IMPORTANT DISCLAIMER BELOW.

DISCLAIMER

This post is for educational and informational purposes only.There can be significant risks involved with investing including loss of principal.

PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS and THE MARKET ALPHA NEWSLETTERS GROUP makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections presented or discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS or THE MARKET ALPHA NEWSLETTERS GROUP.

There is no guarantee that the goals of the strategies and examples discussed by PROTECTVEST AND ADVANCEVEST BY ECHOVECTORVEST MDPP PRECISION PIVOTS and THE MDPP PRECISION PIVOTS FORECAST MODEL AND ALERT PARADIGM or THE MARKET ALPHA NEWSLETTERS GROUP will be achieved.

NO content published by us on the Site, our Blogs, Newsletters, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person.

Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter.

Again, this post is for educational and informational purposes only.

BEFORE MAKING ANY INVESTMENT DECISIONS WE STRONGLY ENCOURAGE YOU TO FIRST CONSULT WITH YOUR PERSONAL FINANCIAL ADVISER.

------------------------------------------------------------------AGAIN, SEE EXAMPLES OF PRIOR POSTS FOR REFERENCE, STUDY, AND REVIEW

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.