HOURLY PIVOT POINT INDICATORS, DAILY PIVOT POINT INDICATORS, WEEKLY PIVOT POINT INDICATORS, BI-WEEKLY PIVOT POINT INDICATORS, MONTHLY PIVOT POINT INDICATORS, QUARTERLY PIVOT POINT INDICATORS, BI-QUARTERLY PIVOT POINT INDICATORS, ANNUAL PIVOT POINT INDICATORS, CONGRESSIONAL CYCLE PIVOT POINT INDICATORS, PRESIDENTIAL CYCLE PIVOT POINT INDICATORS

S&P500 SPY ETF AND /ES EMINI FUTURES - INSIDE THE QUARTERLY TIME CYCLE PIVOT POINT INDICATORS

5:58PM EDT UPDATE

DAILY PIVOT POINT INDICATOR, 2 DAY PIVOT POINT INDICATOR, 3DAY PIVOT POINT INDICATOR, WEEKLY PIVOT POINT INDICATOR. TIME CYCLE PIVOT POINTS

https://tos.mx/Tm1vzBp

https://tos.mx/7OF9lJW

BI-QUARTERLY PIVOT POINT INDICATORS

https://tos.mx/XAEteSB

https://tos.mx/782tJQy

QUARTERLY PIVOT POINT INDICATORS

https://tos.mx/SymDNEN

https://tos.mx/CGtxlfc

MONTHLY PIVOT POINT INDICATORS

https://tos.mx/9iIVN0l

https://tos.mx/BUZU0AO

BI-WEEKLY PIVOT POINT INDICATORS

https://tos.mx/eFpLQPY

https://tos.mx/KWTu8eO

DAILY PIVOT POINT INDICATOR, 2 DAY PIVOT POINT INDICATOR, 3DAY PIVOT POINT INDICATOR, WEEKLY PIVOT POINT INDICATOR. TIME CYCLE PIVOT POINTS

7:45PM UPDATE

https://tos.mx/mWZaph0

4-YEAR PRESIDENTIAL CYCLE ECHOBACKPERIOD ZOOMED, WITH FURTHER RISK MANAGEMENT BLOCK INDICATOR HIGHLIGHTED

https://tos.mx/KXvJPmp

https://tos.mx/0V5HpWN 8:33PM

10:00PM UPDATE

SPY ETF PORTABLE ZOOMABLE 'TODAY'S TOMORROW' TUTORIAL FORECAST PROJECTION PIVOT POINTS INDICATOR EASYGUIDEMAP GRID - FOCUS FORECAST PROJECTION FRAMECHARTS' MASTER GRID

https://tos.mx/rwpwH2U

TO ENLARGE AND FURTHER ZOOM 'TODAY'S TOMORROW TRADER'S EDGE PIVOT POINT INDICATOR FOCUS FORECAST FRAMECHART SNAPSHOTS

(1) RIGHT CLICK ON THE PROVIDED SNAPSHOT AND 'OPEN IMAGE IN NEW TAB, AND THEN LEFT CLICK ON THE PLUS MAGNIFIER, OR

(2)

LEFT CLICK ON THE PROVIDED SNAPSHOT LINK, THEN LEFT CLICK ON THE

SNAPSHOT TO ENLARGE, THEN RIGHT CLICK TO FIND 'OPEN IMAGE IN NEW TAB'

AND LEFT CLICK, THEN LEFT CLICK THE ZOOM MAGNIFIER

ADDENDUM

https://seekingalpha.com/instablog/993715-kevin-wilbur/5620689-federal-reserve-bank-fomc-announcement-day-wednesday-july-28-2021-dia-etfs-intraday-priceechovectorvest.blogspot.com market-pivots.com marketpivotpoints.com marketpivots.net

*THIS

POST MAY INCLUDE POST MASTERS AND POST DOCTORAL LEVEL EDUCATIONAL AND

DISSERTATIVE INFORMATION, AND PROFESSORIAL TUTORIAL CONTEXTING AND

REFERENCING, WITHIN THE TECHNICAL FIELDS OF MARKET BEHAVIORAL ECONOMICS,

FINANCIAL MARKET PIVOTS TECHNICAL ANALYSIS, AND ADVANCED FINANCIAL

PHYSICS, DISSEMITATIVELY. ___________________________________________________________________________________

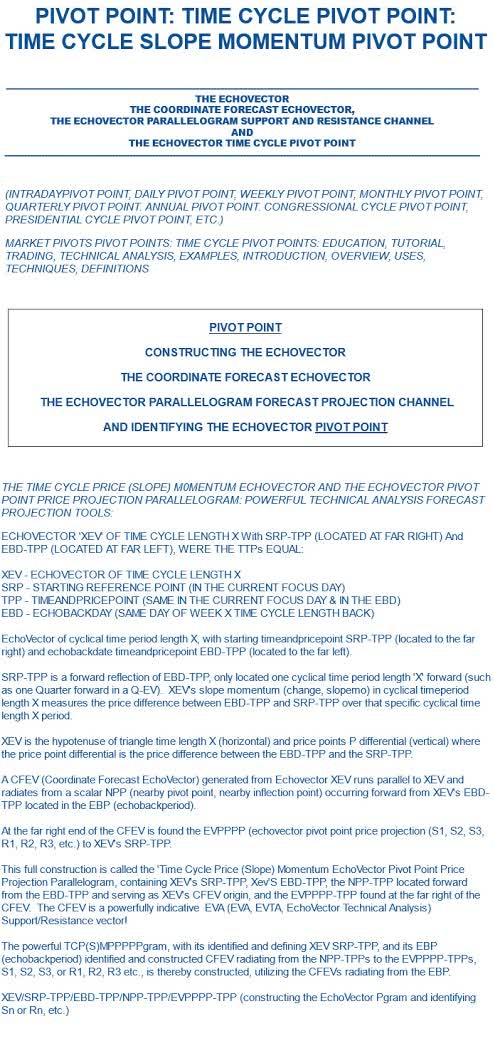

PIVOT POINT CALCULATION AND CONSTRUCTION SESSION

ILLUSTRATING

THE TIME CYCLE PIVOT POINT INDICATORS AND THEIR KEY SREV CFEV 'S AND R'

SUPPORT/RESISTANCE PIVOT POINT PRICE PROJECTION VECTORS

S&P500 SPY ETF PIVOT POINTS INDICATOR - ANNUAL AND SUBSUMPTIVE TIME CYCLE PIVOT POINTS IMPLICATIONS AND THEIR ASSOCIATED ECHOBACKPERIODS AND COORDINATE FORECAST SUPPORT AND RESISTANCE VECTORS (CFEVs, SREVs) HIGHLIGHTED AND ILLUSTRATED - DAILY CANDLES

PRESENTED BY THE PRECISION PIVOTS GLOBAL FINANCIAL MARKETS LABORATORY!

================================================

THE TIME CYCLE PRICE (SLOPE) MOMENTUM ECHOVECTOR AND ECHOVECTOR PIVOT POINT PRICE PROJECTION PARALLELOGRAM:

POWERFUL TECHNICAL ANALYSIS FORECAST PROJECTION TOOLS:

ECHOVECTOR XEV OF TIME CYCLE LENGTH X With SRP-TPP (LOCATED ON FAR RIGHT) And EBD-TPP (LOCATED ON FAR FAR LEFT).

XEV - ECHOVECTOR OF TIME CYCLE LENGTH X

SRP - STARTING REFERENCE POINT (IN CURRENT FOCUS DAY)

TPP - TIMEANDPRICEPOINT (IN CURRENT FOCUS DAY & EBD)

EBD - ECHOBACKDATE (SAME DAY OF WEEK, X TIME CYCLE LENGTH BACK)

EchoVector of cyclical time period length X, with starting timeandpricepoint SRP-TPP (to the far right) and echobackdate timeandpricepoint EBD-TPP (to the far left).

SRP-TPP is a forward reflection of EBD-TPP, only located one cyclical time period length 'X' forward (such as one Quarter forward in a Q-EV). XEV's slope momentum (change, slopemo) in cyclical time period length X measures the price difference between EBD-TPP and SRP-TPP over that specific cyclical time length X period.

XEV is the hypotenuse of triangle time length X (horizontal) and price points P differential (vertical) where the price point differential is the price difference between the EBD-TPP and the SRP-TPP.

A CFEV (Coordinate Forecast EchoVector) generated from EchoVector XEV runs parallel to XEV and radiates from a scalar NPP (nearby pivot point, nearby inflection point) occurring forward from XEV's EBD-TPP located in the EBP (echobackperiod).

At the far right end of the CFEV is found the EVPPPP (EchoVector Pivot Point Price Projection (S1, S2, S3, S4, R1, R2, R3, R4, etc.) to XEV's SRP-TPP.

This full construction is called the 'Time Cycle Price (Slope) Momentum EchoVector Pivot Point Price Projection Parallelogram, containing XEV's SRP-TPP, Xev'S EBD-TPP, the NPP-TPP located forward from the EBD-TPP and serving as XEV's CFEV origin, and the EVPPPP-TPP found at the far right of the CFEV.

The CFEV is a powerfully indicative EVA Support/Resistance vector! The powerful TCPSMPPPPPgram, with its identified and defining XEV SRP-TPP, and its EBP (echobackperiod) identified and constructed CFEV, radiating from the NPP-TPPs to the EVPPPP-TPPs, (S1, S2, S3, S4, R1, R2, R3, R4, etc.), is thereby constructed.

XEV SRP-TPP/EBD-TPP/NPP-TPP/EVPPPP-TPP (Sn Or Rn)

----------------------------------------------------------------------------------------------------------------------------------------

POSTING UPDATES FROM - MARKETPIVOTSTV SP500TV AND OPTIONPIVOTSLIVE (OPL)

A PORTION OF THIS WEEK'S KEY POWERFUL FORWARD EVTAA EDUCATIONAL CONTEXTING/FRAMING...

SP500TV OPL TUTORIAL NARRATIVE BIAS PRESENTED AND FULFILLED!

POWERFUL EVTA CONTEXTING - TUTORIAL FORECASTS PROJECTION SCIENCE NOW PROVIDED FREE ONLINE!

----------------------------------------------------------------------------------------------------------------------------------------

THANKING THIS MONTH'S APPRECIATED SPONSOR

POWERTRADESTATONS AND POWERTRADESTATIONSGLOBAL

BE SURE LOOK FOR THE POWERTRADESTATION IMPRIMATUR ON EACH TRADING COMPUTER LISTING TO MAKE SURE YOU ARE PURCHASING A GENUINE POWERTRADESTATION!

"We Put Our Traders And Their Success First!"

POWERTRADESTATONS AND POWERTRADESTATIONSGLOBAL

"Experienced traders & trader technicians working with traders for traders to help enable traders & investors to make better trades!"

Striving to Provide Both Excellence & Economy In Proven Extended Market Visibility Supporting Financial Tradestations, To Help Our Traders Advance!"

Optimizing Intelligence, Performance And Price For Our Traders Globally!

-------------------------------------------------------------------------------------------------------------------------------------------------------

DISCLAIMER: This post is for educational and informational purposes only. There can be significant risks involved with investing including loss of principal. There is no guarantee that the goals or the strategies and examples discussed will be achieved. NO content published by us on the Site, our Blogs, Newsletters, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Again, this post is for educational, informational, and entertainment purposes only. BEFORE MAKING ANY INVESTMENT DECISIONS WE STRONGLY ENCOURAGE YOU TO FIRST CONSULT WITH YOUR PERSONAL FINANCIAL ADVISER.

___________________________________________________________________________________

SEE PRIOR POSTS FOR ADDITIONAL CONTEXT, STUDY AND REVIEW ___________________________________________________________________________________

ADDENDUMS

WEDNESDAY 9/15

7:10PM EDT UPDATE

DAILY PIVOT POINT INDICATOR, 2 DAY PIVOT POINT INDICATOR, 3DAY PIVOT POINT INDICATOR, WEEKLY PIVOT POINT INDICATOR. TIME CYCLE PIVOT POINTS

https://tos.mx/iNs2eSh

WEEKLY PIVOT POINT INDICATORS, BI-WEEKLY PIVOT POINT INDICATORS, MONTHLY PIVOT POINT INDICATORS

https://tos.mx/Ix5mLop

QUARTERLY PIVOT POINT INDICATORS

https://tos.mx/qzWAmAO

https://tos.mx/fa3kRLy

BI-QUARTERLY PIVOT POINT INDICATORS

https://tos.mx/ORyVBZq

https://tos.mx/tDlOS0R

https://tos.mx/AA3swOd

ANNUAL PIVOT POINT INDICATORS

https://tos.mx/DtAcHvP

4-YEAR PRESIDENTIAL CYCLE ECHOBACKPERIOD ZOOMED, WITH FURTHER RISK MANAGEMENT BLOCK INDICATOR HIGHLIGHTED

https://tos.mx/KXvJPmp

https://tos.mx/1ITvjKT

FOMC Minutes one month ago, 8/18/21; FOMC Announcement one year ago, 9/16/20.

EARLIER WEDNESDAY

https://tos.mx/joxIOVX

WEDNESDAY MORNING PRE-MARKET BRIEFING UPDATES: With

no FOMC Minutes Release this month at 2PM Wednesday, we anticipate an

opportunity for a relative counter clockwise rotation in the monthly

time cycle echovector (MEV) into the close from that hour's low, with

subsequent FIOP impact and opportunity forward.)

9/15/21

1005AM Updates:

https://tos.mx/VhVuIs2 24HEV SPY

https://tos.mx/qAssV7Y MEV /ES

1014AM

https://tos.mx/VQ4Jq3a 24HEV SPY

1016AM

https://tos.mx/janbbl2 SPY 15P445 FPRV

1028AM

https://tos.mx/QNzSboi /ES MEV

https://tos.mx/tYMpBJg SPY 24HEV

https://tos.mx/O7JdQuh PRV 1SPY 5P445

https://tos.mx/1IdONUW CRV SPY 15C446

1035AM

9/9/21 UPDATE

8:30AM EDT UPDATE

DAILY PIVOT POINT INDICATOR, 2 DAY PIVOT POINT INDICATOR, 3DAY PIVOT POINT INDICATOR, WEEKLY PIVOT POINT INDICATOR. TIME CYCLE PIVOT POINTS

http://tos.mx/fZulCXi

QUARTERLY PIVOT POINT INDICATORS

https://tos.mx/NjFEPbd

11:12AM Thursday Update

ANNUAL AND QUARTERLY PIVOT POINT INDICATORS

http://tos.mx/Ha8fgC9

9/8/21 UPDATE

6:30PM EDST UPDATE

DAILY PIVOT POINT INDICATOR, 2 DAY PIVOT POINT INDICATOR, 3DAY PIVOT POINT INDICATOR, WEEKLY PIVOT POINT INDICATOR. TIME CYCLE PIVOT POINTS

https://tos.mx/aoQxT8r

DAILY

PIVOT POINT INDICATOR - DARK GREEN - SOLID SPACED DOTTED (SREV/CFEV)

2 DAY PIVOT POINT INDICATOR - AQUABLUE - SOLID SPACED DOTTED (SREV/CFEV)

3DAY PIVOT POINT INDICATOR - BRONZE - SOLID SPACED DOTTED (SREV/CFEV)

WEEKLY PIVOT POINT INDICATOR PURPLE AND LIGHT GREEN - SOLID SPACED DOTTED (SREV/CFEV)

QUARTERLY PIVOT POINT INDICATORS

https://tos.mx/pbPqJpa

https://tos.mx/zC6SFc6 CFP Zoomed

https://tos.mx/Xk0ibkH QEV EBP Zoomed

USM QEV - DARK GREEN - KEY CYCLE SRP TPP - SOLID, KEY FORWARD NPP TPPs SREVs/CFEVs- SPACED

SPACED GREEN, RED, BLUE PARALEL TO SOLID GREEN, AND INDICATING KEY NPP TPPs

BIQUARTERLY AND QUARTERLY PIVOT POINT INDICATORS

https://tos.mx/rlr7rap

ANNUAL PIVOT POINT INDICATORS

https://tos.mx/ssKl7AF

---------------------------------------------------------------------------

SHORTHAND ABBREVIATIONS - ALGO REFERENCES

---------------------------------------------------------------------------

P - price

EV - echovector

XEV - echovector of time cycle length X (and slope momentum delta p over delta x)

SRP - echovector starting reference time/price point (its far right point)

WEV - one week lengthed Echovector, Weekly

PCEV - 4 year lengthed echovector, Presidential Cycle Echovector

H - hourly, M - monthly, Q - quarterly, A - annual, CC - 2 year Congressional Cycle length

4HEV - 4 hour lengthed echovector

TP - timepoint, time premium in reference to option RVs

TPP - time and price point along a slope momentum echovector

EBP - echovector echobackperiod

EBD - echovector echobackday

EBDTPP - echobackdate timeandpricepoint (the far left point along a slope momentum echovector, x length from the SRP. The SRP is the EBD TPP reflection X cycle length forward)

NPP - nearby forward pivot point from the echobackday tpp

CFEV - EVA coordinate forecast projection echovector

PGRAM - EVA time cycle pivot point price projection parallelogram support and resistance channel

EVA - EchoVector Analysis

EVTA - EchoVector Financial Markets Technical Analysis

----------------------ALPHABETICAL----------------------

AMPEX - amplified price extension vector from correlate in ebp

B - broadcast, broadcasting

BB - bounce back

BTV - EVA breakthrough vector, YELLOW SPACED

BT - breakthrough

C - call option

CC - counter-clockwise echovector rotation

CFD, CFW - echovector current focus day, current focus week

CHMK - EVA Checkmark Pattern

CL - closing tradeblock low

CD30M - closing tradeblock end less 30 minutes

CPI - consumer price index

CRV - call rider vehicle, esoteric basket, hedge insurance instrument

CW - clockwise echovector rotation

DC - bounce with no sustaining quality, and setting up lower low.

DBOX - EVA diamond box pattern

DERIV - derivative, option, esoteric, future

DIA - dow30 index etf

DOM - depth of market

DP - price downpressure

D30 - dow jones 30 industrials composite index

E - echo

EQUIL - EVA equilibration

/ES - sp500 emini futures

ESO - esoteric, derivative, option basket, weeklys

FCRUM - fulcrum hour/period

FIOP - EVA focus interest opportunity period

FRI - Friday

FRV - focus rider vehicle basket, fcrv focus call rider vehical, fprv focus put rider vehicle

FSE - Frankfurt SE

GREV - EVA global rotation echovector

H - high (often price high, referring to a candle or TB)

HOR - horizontal, horizontal pivot point vector

HSE - Hong Kong SE

ID - identified, designated,

IDR - intraday reversal

INTD - Intraday

INTERD - interday or interweek or intermonth or interperiod

INTRA - intraday

I/O Box- eva price/time inside/outside forecast projection risk management reference action box, zoomed scalar spot

JAJO - January April July October Quarterly Cycle Phase

KORP - key otaps with reversal potential bias

KR - key reversal

LB - long bias

LOAD - high volume supply at price level

LSE - London SE

M - minute

MMS - market makers

MOMO - momentum, momentum period, 2nd derivative momentum top

MORN - morning

MTB - MainTradeBlock

NL - net short

NPA - not presently available

O - OPEN, OPENING

OBV - on balance volume

OH - opening tradeblock high

OL - opening tradeblock low

OPT - option, options

OOTM - out of the money option

OTAPS - EVA otaps signal vector application (Advanced straddle basket application - Google)

P - put Option

PAR - par, parity

PEB - price equivalency basis

PFP - EVA powerful forecast projection

P'GRAM - time cycle echovector pivot point price projection parallelogram

PNLOP - potential net log opportunity period

PRESS - pressure, intraday press to find intermediate wave price level floor or ceiling

POT - pressure on/off tape

PPROG - programmed, pre-programmed

PRE - before, premium

PR - key scalar related price run (extension[s]) after related origin inflection point reference.

PRV - put rider vehicle, esoteric basket, hedge insurance instrument

PV,OPV - pointer vector. Price of option points to value of underlying at time of expiration. Vector pointing there from underlying's price at time of option exchange print price quote.

QQQ - nasdaq 100 etf

R - resistance

REM - remember

REPO - repositioning, rolling into new or updated position complex

REV - reversal

REX - reduced price extension vector from correlate in ebp

RMH - regular market hours

RMHC - regular market hours close

RMHO - regular market hours open

RNR - forecast-ed move underway dramatically

ROT - right on target, echovector rotation

RS - relative price strength

RW - relative price Weakness

RWS - relative weakness inflection points or periods

RV - options rider vehicle basket

S,SUP - support

SIG - signal, significant

SLOPMO - price vector slope momentum

SP - spaced

SPY - sp500 index etf

S/R - support/resistance

SS - scenario setup

ST - short term

SYMTRA - symmetry transpostiion

T - tickTB - tradeblock

TCPSM - time cycle price (slope) momentum

THO - though

TRAJ - price trajectory of xev, cfev, npp vector, otaps vector, options pointer vector, slopemo vector

TSE - Tokyo Stock Exchange

TT - teeter totter

TUES - Tuesday

UP - price up-pressure

UW - upwave

USM - NYSE & CBOE Etc

WKLY - weekly

WWW - EVA Wilbur Winged W Pattern

YEL - yellow> - then or greater than

___________________________________________________________________________

THURSDAY 9/16/21 NARRATIVE SUMMARY OPL ___________________________________________________________________________

THURS MORN AM PRE-MARKET

Bias down after yellow 2wev squaring fulfillment

http://tos.mx/hyTz0fD

----------------------------

Beautiful ff on 2wev target w/p445 in t 105. cgl at 135 on second wave down (first wave before top at 145 after bto at open from 115)

http://tos.mx/zRq4vOz

cgl 142. 941am

155 at 942am otaps

180 AT 946AM KORP (POT)

950AM ST CGL ON NL AT 46.9 PEB W/ DT REV

952AM CGL OTAPS AT 46.5

190 CGL PRV 953

205 954AM

215 955 KORP (POT)

OTAPS 445.25 PEB CGL NL

958AM ... 45.40 PEB PAR UP TO BTV MORNING WORK IN

PRV AND CRV ATION EQUILIBRATION ON KEY WWW

10AM 446 KEY OTAPS 2ND LEVEL PCEV, 225 PRV

NOTE THE 2ND DERIV MOVE TO 446 AND AND THE MOVE 30 CENTS LOWER YIELDS ONLY NICKEL ON PRV

OTAPS prv peb 240 46.5

1005am 45.10... key otaps korp 260 prv and fulfill on intraday q target... look for cusp in rev.

cgl 446 peb... look for cusp sup

http://tos.mx/fOwYSBG

*445 prv 290 KORP

otaps 235 prv peb 1034am

*otaps 225 prv peb 1035am korp

otaps 260 prv peb 1046am on key qev

otaps 285 prv peb 1046am on key cusp neckline sup

*otaps 325 prv peb finis - KORP

=============================

THURS PM

OTAPS 1247PM CGL NL OFF PRIOR KORP from prv 325

to 147, after tap inflecting along thw way.

CGL 1253PM 45.90 PEB

SPYFRI17P445 PEB FPRV BASKET

170 PRV PEB CGL AT 1255 OTAPS

175 PRV PEB CGL AT 103 OTAPS

180 PRV PEB CGL AT 105 OTAPS W/ NL BTV REV

163 PRV 113PM CGL BASING & SHOULDER

*145 PRV 122PM KORP

158 PRV 123PM S/D TRI EQUILB

168 PRV 132PM

173 PRV 133PM HORIZON 133T

*188 PRV 138PM INCLINE MET SUP REV

http://tos.mx/A04WchE

*173 PRV 141PM INCLINE MET RES REV

*183 PRV 146PM *DBOT* ON INCL SUP REV

168 PRV 150PM

153 PRV 151PM

148 PRV 151PM

138 PRV 152PM HORSESHOE

115/118 PRV 154 KEY OTAPS QEV AND OPEN HORIZ

113 PRV 157PM

*108 PRV OTAPS REV

*119 PRV 206PM REV

114 PRV 208PM

109 PRV 209PM

90 PRV 210PM

*85 PRV 211PM REV INTRADAY R

100 PRV 216PM HORIZ 9T KEY PCEV FP OTAPS CFEV

105 PRV 219PM BASING - - TAKING BREAK

*(OTAPSING 112 REV)

http://tos.mx/fOwYSBG ANNUAL

97 PRV 234PM OTAPS

80 PRV 254PM ROT

75 256 KEY OTAPS

*50 310 ROT HORSESHOE KORP

(TUTORIAL - 3 MINUTE MOVE 700, 1300, 1700, ON 5100 LOAD, FOLOWING FUTURES FIFTEEN)

70 325PM

75 328PM 50%er.

80 345PM

85 348PM 70%er. (ON BID) CGL OTAPS

88 353PM

92 355PM

*96 357PM (ON BID)

*87 359PM

*99 400PM

___________________________________________________________________________

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.