PIVOT POINT INDICATORS, DAILY PIVOT POINT INDICATORS, WEEKLY PIVOT POINT INDICATORS, BI-WEEKLY PIVOT POINT INDICATORS, MONTHLY PIVOT POINT INDICATORS, QUARTERLY PIVOT POINT INDICATORS, BI-QUARTERLY PIVOT POINT INDICATORS, ANNUAL PIVOT POINT INDICATORS, CONGRESSIONAL CYCLE PIVOT POINT INDICATORS, PRESIDENTIAL CYCLE PIVOT POINT INDICATORS.

DAILY

PIVOT POINT INDICATOR, 2 DAY PIVOT POINT INDICATOR, 3 DAY PIVOT POINT

INDICATOR, WEEKLY PIVOT POINT INDICATOR. TIME CYCLE PIVOT POINTS.

PIVOT POINT INDICATORS - KEY ACTIVE PIVOT POINT INDICATORS - FOCUS INTEREST OPPORTUNITY PERIOD (FIOP) SCENARIO SETUP OPPORTUNITY PIVOT POINT INDICATORS (SSOI-PPI) - TODAY'S TOMORROW TRADER'S EDGE (TTTE) FOCUS FORECAST PROJECTION PIVOT POINT INDICATOR FRAMECHARTS AND GUIDEMAP GRIDS - KEY ACTIVE TIME CYCLE PIVOT POINT PRICE PROJECTION INDICATOR (EV-PPPP) HIGHLIGHTS AND ILLUSTRATIONS - ADVANCED MARKET INTELLIGENCE PIVOT POINT INDICATORS FOR ACTIVE ADVANCED POSITION AND RISK MANAGEMENT - SUPPORTING ACTIVE ADVANCED POSITION AND RISK MANAGEMENT HIGH ALPHA EXTENSION OTAPS ACTION SIGNAL PRECISION PIVOT POINT APPLICATIONS (OTAPS) - FOR HIGH ALPHA EXTENSION ACTIVE ADVANCED PIVOT POINT APPLICATION MANAGEMENT OPPORTUNITY

MONDAY UPDATE

MONDAY 8/29/2022 929AM ET USA UPDATE - MONDAY'S KEY SSOI FOCUS FORECAST FRAMECHARTS

KEY ACTIVE "ECHOVECTOR PIVOT POINT PRICE PROJECTION TIME CYCLE SLOPE MOMENTUM TRAJECTORY INDICATIVE PIVOT POINT PRICE PROJECTION PARALLELOGRAM (PGRAM) HIGHLIGHTS AND ILLUSTRATIONS" - WITH SOURCE 1 ACTIVE ADVANCE POSITION AND RISK MANAGEMENT "OTAPS SIGNAL APPLICATION VECTOR COORDINATE FORECAST ECHOVECTOR PIVOT POINT PRICE PROJECTION SUPPORT AND RESISTANCE CHANNELS (PGRAMS)" AND "TIME CYCLE ECHOVECTOR PIVOT POINT PRICE PROJECTION TARGET INDICATORS".

https://tos.mx/A1sgobp /es grev master upd

https://tos.mx/mePhMkw /ym upd

https://tos.mx/lhlayxp

http://tos.mx/YzaJvcZ /YM 917am upd

https://tos.mx/E4PUXvO /ES 923am GREV M upd

https://tos.mx/uUBZl3e 928am QQQ M upd

INSIDE THE QUARTERLY TIME CYCLE PIVOT POINT INDICATORS

NASDAQ 100 TECHNOLOGY SECTOR QQQ ETF

https://tos.mx/FOOBHtb /es grev m 2min ebw 1045am upd

https://tos.mx/MCSPGZY /es grev 3min 1049am upd

https://tos.mx/jLrM1iZ /ym wev 24hev 3m 202pm upd

https://tos.mx/mtIJ1b6 /es grev 3min master 205pm upd

TUESDAY UPDATE

TUESDAY 8/30/2022 915AM ET USA UPDATE - TUESDAY'S KEY SSOI FOCUS FORECAST FRAMECHARTS

INSIDE THE QUARTERLY TIME CYCLE PIVOT POINT INDICATORS

NASDAQ 100 TECHNOLOGY SECTOR QQQ ETFhttps://tos.mx/0yDxHh8 915am QQQ Quarterly Master upd

FORWARD ALERTS: SPECIAL MDPP PRECISION PIVOTS "TODAY'S TOMORROW TRADER'S EDGE" KEY-DATES, NOTATIONS, SSOI(S), AND ALERTS FORWARD...

KEY OTAPS ALERT - SP500 /ES EMINI FUTURES PEB (PRICE EQUIVALENCY BASIS): LOOK FOR DP AT OPEN TODAY - SEE EBDS QEV & MEV - TUESDAY OPENING INTRADAY FORECAST PROJECTION BIAS INCLUDES DP ALERT BIAS TARGET AND FULL HEDGE ON OTAPS APPLICATION - SEE QEV AND MEV MITIGATION LEVELS OFF KEY LSE OPEN AND USM ELECTRONIC PRE-M 4AM OPEN INCLUDING 24HEVS. NOTE POTENTIAL WEDNESDAY MITIGATION LONG OPPORTUNITY AFTER INITIAL OPENING DP ON QEV 2MEV AND MEV EBDS: OPTIONPIVOTSLIVE

/ES '23.5 PEB FIRST 15 MIN OTAPS COLLECT.

https://tos.mx/qcOJtqZ es grev 3min 948am upd

https://tos.mx/ojsV1X2 /ym KEY wev 24hev 3m 957am upd

https://tos.mx/WDMgGnT 1010am QQQ

https://tos.mx/ELYPAIg 1012am /es

https://tos.mx/XvQPhOC 1013am /ym

INTRADAY ALERT: 1015am - key mev otaps target fulfilled. See grey illustrative i/o box. QQQ https://tos.mx/ziFIisk. ACTIVE ADVANCED POSITION AND RISK MANAGEMENT INDICATOR: APPLY EVPPPP S2 OTAPS COLLECT: POSITION LONG ABOVE AND SHORT BELOW: PEB /ES: LSE POINTER ROT /es https://tos.mx/DoQutPj

INTRADAY ALERT: 1040am - key mev otaps target fulfilled. See grey illustrative i/o box. QQQ https://tos.mx/0Z8aLpZ. ACTIVE ADVANCED POSITION AND RISK MANAGEMENT INDICATOR: APPLY EVPPPP S3 OTAPS COLLECT: POSITION LONG ABOVE AND SHORT BELOW: PEB /ES: LSE POINTER ROT /es https://tos.mx/wZhPF7Z - dp qev ebd fulfillment bias target met within pre-LSE close morning block. (SPY PEB 299ISH - OFF 8 FROM MORN PRE-M HIGH)

PREP FOR POTENTIAL INTRADAY MITIGATION (CONSOLIDATION) AND POTENTIAL INTRADAY REVERSAL - SEE OPTIONPIVOTSLIVE

https://tos.mx/CsLGmE8 705pm QQQ 100d 30minc upd. pfpbrot. Powerful forecast projection bias Right On Target.

WEDNESDAY UPDATE

https://tos.mx/a1z8jqF 833am /es

https://tos.mx/zI4H5YY 854am /es grev master 3minc wev 48hev 24hev tse lse 4am 8am etc pgrams H&I

https://tos.mx/SLBLER8 912am /es grev master 3minc wev 48hev 24hev tse lse 4am 8am etc pgrams H&I

http://tos.mx/npfc3NL 915am /es grev master 3minc wev 48hev 24hev tse lse 4am 8am etc pgrams H&I

https://tos.mx/piIKqPP 919am QQQ qev 15minc

927am /ym wev etc 3minc

FORWARD

ALERTS: SPECIAL MDPP PRECISION PIVOTS "TODAY'S TOMORROW TRADER'S EDGE" FORWARD FORECAST PROJECTION INDICATIONS: KEY-DATES (TPPS), NOTATIONS, SSOI(S), AND ALERTS FORWARD... INCLUDING NOTED FORWARD FIOPS EVIDENT WITHIN THE CRITERIA OF TIME CYCLE AGGREGATE COMPILATION AND EFFECTIVE FORWARD CONTINUATION, AND ENSUING COORDINATE SLOPEMO TRAJECTORY POINTERS, INFLECTION POINTS, PIVOT POINTS, AND KEY OTAPS LEVEL ALERTS AND TRADING OPPORTUNITIES.

WEDNESDAY UP STRENGTH BEFORE THURSDAY DP WEAKNESS - QEV, 2MEV, MEV PGRAMS

FOLLOWING THE MORNING OPEN CONSOLIDATION SQUARING THE OVERNIGHT GREVs, AND THE 24HEV AND 48HEV AND WEV PGRAM BIASES, LOOK FOR REVERSAL STRENGTH SQUARED TO THE QEV AND 2QEV EBD BIASES, ALONG WITH THE MEV.

ADDITIONAL RE-ITERATION, INSIDE THE QEV: KEY OTAPS ALERT ENSUING TODAY - SP500 /ES EMINI FUTURES PEB (PRICE EQUIVALENCY BASIS): LOOK FOR DP AT OPEN TODAY - SEE EBDS AEV, 2QEV, QEV & MEV - WEDNESDAY OPENING INTRADAY FORECAST PROJECTION BIAS INCLUDES DP ALERT BIAS TARGET FOLLOWED BY KEY DAY DEFINING REVERAL STRENGTH IN MORNING. SEE QEV AND MEV, WEV, 48HEV, 24HEV FORECAST PROJECTION COORDINATION PGRAM OTAPS LEVELS. TSE, USM EXTENDED, AND LSE AND USM ELECTRONIC PRE-M 4AM OPENING LEVELS, AND 6AM COORDINATIONS IN FORCE. INCLUDING. FROM YESTERDAY - - "NOTE POTENTIAL WEDNESDAY MITIGATION LONG OPPORTUNITY AFTER INITIAL OPENING DP ON QEV 2MEV AND MEV EBDS" OPTIONPIVOTSLIVE

------------------------------------------------------------------------------------------------------------------

948AM UPDATE: KEY INTRAWEEK 31975 /YM TARGET MET. KEY OTAPS LEVEL. FULL HEDGE ON PRICE LEVEL INSURANCE APPLICATION RE-ISSUED FOR KEY US LARGE CAP COMPOSITE INDEXES AT THIS OTAPS ON THIS TARGET CYCLICAL QUARTERLY CALENDAR DAY, ONE MONTH AFTER LAST FOMC RATE HIKE

(.spy220907P396 $2.85 PEB)

https://tos.mx/XWqrkdF 1032am /ym wev etc 3minc

(1050am .spy220907P396 2nd-in $3.22 PEB)

https://tos.mx/CGxOQZy 1055am /es

https://tos.mx/uUbDHiu 1115am /ym 3minc zoom

https://tos.mx/PfNd0Bh 1118 /es

https://tos.mx/gsGbu6d 1121am /ym zoom

pfpbrot. Powerful forecast projection bias right on target.

https://tos.mx/0PiDCb2 1129am /ym zoom

https://tos.mx/ff9X7kE 1154am /ym zoom

LAST 90 MINUTES USM RMH KEY STUDY AND NARRATIVE - OPL

https://tos.mx/THKclJ1

https://tos.mx/7znyN4R

https://tos.mx/ey9D0fl

https://tos.mx/fLD4o16 241pm ym

https://tos.mx/Uamt7WN

https://tos.mx/g7L9vf2

https://tos.mx/tbUZOqB 05

https://tos.mx/FQ5hNh0 05

https://tos.mx/8FpkelU 306

https://tos.mx/hSMANWt 08

https://tos.mx/M3iyfwH 08

https://tos.mx/3KE7gbV 09

https://tos.mx/DGOZiCl 09

https://tos.mx/JuD075L 11 ym

https://tos.mx/VI4iuPH 322 ym 407p396

https://tos.mx/MLAq63C es 416 p went to 370 after 496 finding support at 425 (spread middy on sine wave up from 245pm rot)

https://tos.mx/B4WxRev 328pm ym p@425 @candlelow 3mc 24hev pfpbrot

bias still to ds dp rw 330pm stabilization parring t0 355ebd support on keyactiveslopemo spaced red

332pm challenging 425 again from the 409

coordinate with zooms on p396 and crv (missed the 100 off 245pm nicked)

https://tos.mx/B4WxRev es 333t view es 27t too. breaking rot... pto435 then hit 333 support on sinewave http://tos.mx/KCqCdD2 es 333t note symtra from 1115am we are at 337pm... last 15 each lse/usm :)

https://tos.mx/iLfqchI es 340pm 333t

https://tos.mx/JpJy1E8 27 t p@402 at top on bid

https://tos.mx/W0Lk6uZ 342pm ym

https://tos.mx/fbGdWRE 350pm es 27t

https://tos.mx/TSzilxk 351 333t p420high back to 4 at 352pm http://tos.mx/x2fkC6y

https://tos.mx/pAzMfsU 353pm prv402 at tiptop

https://tos.mx/jBUxun8 355pm challenging support again prv squaring near 425 pushing to 4.45 (should double buy at 375 / - one dayt, one swingt

pushing to par beaut wednes

358 http://tos.mx/jBUxun8

https://tos.mx/UgACVka

https://tos.mx/YU6crSz

https://tos.mx/eminpzY 333t 359/400pm

https://tos.mx/Hnag13q 26t

https://tos.mx/kcRQ523 529pm shared workspace

https://tos.mx/X7uPPmY p396

https://tos.mx/A2u3Vb2 c399

THURSDAY UPDATE

FORWARD ALERTS: SPECIAL MDPP PRECISION PIVOTS "TODAY'S TOMORROW TRADER'S EDGE" FORWARD FORECAST PROJECTION INDICATIONS: KEY-DATES (TPPS), NOTATIONS, SSOI(S), AND ALERTS FORWARD... INCLUDING NOTED FORWARD FIOPS EVIDENT WITHIN THE CRITERIA OF TIME CYCLE AGGREGATE COMPILATION AND EFFECTIVE FORWARD CONTINUATION, AND ENSUING COORDINATE SLOPEMO TRAJECTORY POINTERS, INFLECTION POINTS, PIVOT POINTS, AND KEY OTAPS LEVEL ALERTS AND TRADING OPPORTUNITIES.

SP500 KEY ALERT - SYNCHONOUS QEV/MEV SLOPEMO TRAJECTORY RELATION ALERT - POTENTIAL DP PAUSE ON MEV PGRAM MORNING EBD CFEV COORDINATE (SYMTRA) FULFILL.

KEY MSFT WATCH - msft challenging key uptrend support.

https://tos.mx/GBqbacC yesterday close.

https://tos.mx/jdiWNh8 934am

https://tos.mx/jdiWNh8

KEY DJI, SP500, &NDX WATCHES -

https://tos.mx/xuJhtQ8 954am spy qev mev 1hc

https://tos.mx/Nzo25Kj 1001am spy

https://tos.mx/Nzo25Kj 1016am /ym 20mc - 50bp green 75bp red...

https://tos.mx/cssVQMX 1021am spy - key mev ebd morning extension fulfill OTAPS - rot

https://tos.mx/LgTiPyF 1028am msft

https://tos.mx/EvszWYW 1029am /ym 2ND KEY OTAPS

KEYNOTE: STRONG WEIGHT EVIDENCING TODAY ON BOTH THE DOW AND SP500 GOING INTO TODAY'S BOUNCE OFF MORNING TARGETED SUPPORT. POTENTIAL BULL TRAP GOING INTO NEXT WEEK'S RW FORECAST PROJECTION. AS ALWAYS, KEY MORNIG FULFILL OTAPS REMAINS IN EFFECT...

http://tos.mx/MAdmGgV 1048AM SPY 333T S3 OTAPS PEB ROT

10:59:19AM ET USA - OPTIONPIVOTSLIVE

STO PRV PEB FOCUS UPD .SPY220907P390 B$4.21

STO CRV PEB FOCUS UPD .SPY220907C291 B$4.20 [30MFTBB (30 MINUTE FORWARD TRADE BLOCK BIAS)]

1111AM OTAPS CRV 4.80 - 60C CGL (CAPITAL GAIN LOCK ON CRV)

1117AM KEY OTAPS 1000AM DSMT CRV 5.00 - 80C CGL (CAPITAL GAIN LOCK ON CRV)

https://tos.mx/qAkfqtn 1118AM SPY

https://tos.mx/8uFxsUR 1121am /ym

https://tos.mx/RHQqDw3 1123am spy - lse closing half hour wave

https://tos.mx/3DfDkuG 1126am spy 333T

pfpbrot

https://tos.mx/UL6H109 1158am spy 333T

https://tos.mx/0g7sj2j 1200pm fcrv

https://tos.mx/GY9Ahfj 1212pm fprv

https://tos.mx/V16XLgr 1236pm spy 333T

https://tos.mx/K7KO93O 143pm spy 333T

GREV TPP Equilibrating Teeters ROT (Wilbur Winged W Formation Underway - 1005am to 1015am Leftside Wing) https://tos.mx/zyHK7Fk 152pm spy 333T

https://tos.mx/x8FHg0d 240pm spy

https://tos.mx/rjcUj05 250pm spy

https://tos.mx/OYBYNo3 327pm spy

https://tos.mx/P9EYagR 356pm spy

https://tos.mx/zF1ADYi 358pm spy

https://tos.mx/jvoonTi 400pm spy

https://tos.mx/vfxtfDu 405pm spy

https://tos.mx/cEpvqab 418pm msft

https://tos.mx/pPVPBHI 423pm spy

FRIDAY UPDATE

FORWARD ALERTS: SPECIAL MDPP PRECISION PIVOTS "TODAY'S TOMORROW TRADER'S EDGE" FORWARD FORECAST PROJECTION INDICATIONS: KEY-DATES (TPPS), NOTATIONS, SSOI(S), AND ALERTS FORWARD... INCLUDING NOTED FORWARD FIOPS EVIDENT WITHIN THE CRITERIA OF TIME CYCLE AGGREGATE COMPILATION AND EFFECTIVE FORWARD CONTINUATION, AND ENSUING COORDINATE SLOPEMO TRAJECTORY POINTERS, INFLECTION POINTS, PIVOT POINTS, AND KEY OTAPS LEVEL ALERTS AND TRADING OPPORTUNITIES.

SP500 KEY ALERT - THURSDAY'S SYNCHONOUS QEV/MEV SLOPEMO TRAJECTORY RELATION ALERTIS A MAJOR ALERT GOING FORWARD INTO NEXT WEEK. LOOK FOR PGRAM PARRING FROM THE POST JOBS REPORT HIGHS IN FRIDAY MORNING'S PREMARKET ON THE WEV AND QEV. SQUARE THE PGRAMS FOR FORECAST PRECISION PROJECTIONS. THE MORNING BLOCK CAN BE USED AS OPPORTUNITY TO ENTER SHORT POSITIONS (BTO PUTS, STO CALLS) TO PREPARE FOR FORECAST PROJECTION CYCLICAL PRICE DOWNPRESSURE, FOLLOWING THE LSE CLOSE, ESPECIALLY INTO THE WEEK AHEAD, AND ITS FORECAST PROJECTED LOWS.

FOCUS PRV .SPY220909P397, .SPY220909P397 (1.20 SPREAD DIFFERENTIAL)

https://tos.mx/uakAexw 125pm /es grev master 3mc

https://tos.mx/JYUYkEg 518pm QQQ dailyC

------------------------------------------------------------------------------------------------------------------

TO ENLARGE AND FURTHER ZOOM 'TODAY'S TOMORROW TRADER'S EDGE' PIVOT POINT INDICATOR FOCUS FORECAST FRAMECHART SNAPSHOTS

(1) RIGHT CLICK ON THE PROVIDED SNAPSHOT AND 'OPEN IMAGE IN NEW TAB, AND THEN LEFT CLICK ON THE PLUS MAGNIFIER, OR

(2) LEFT CLICK ON THE PROVIDED SNAPSHOT LINK, THEN LEFT CLICK ON THE SNAPSHOT TO ENLARGE, THEN RIGHT CLICK TO FIND 'OPEN IMAGE IN NEW TAB' AND LEFT CLICK, THEN LEFT CLICK THE ZOOM MAGNIFIER.

*THIS POST MAY INCLUDE POST MASTERS AND POST DOCTORAL LEVEL EDUCATIONAL AND DISSERTATIVE INFORMATION AND MARKET INTELLIGENCE REFERENCINGS, AND FURTHER PROFESSORIAL TUTORIAL CONTEXTINGS AND REFERENCINGS, WITHIN THE TECHNICAL FIELDS OF MARKET BEHAVIORAL ECONOMICS, FINANCIAL MARKET PIVOTS TECHNICAL ANALYSIS, AND ADVANCED FINANCIAL PHYSICS, DISSEMITATIVELY.

------------------------------------------------------------------------------------------------------------------

NARRATION SHORTHAND ABBREVIATIONS AND KEY ALGO REFERENCES

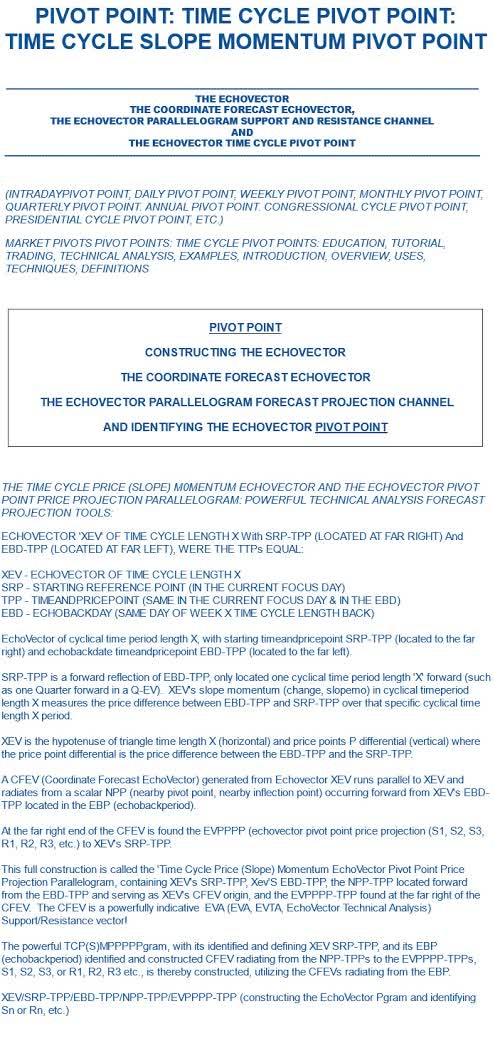

The (1) Time Cycle Forecast Projection EchoVector 'Slope Momentum Trajectory Indicative' Pivot Point Price Projection Parallelogram, And (2)The Active Advanced Position And Risk Management OTAPS Position Polarity Action Signal Support&Resistance Channel, And (3) Key FIOP SSOI TPP (& Price Extension Estimate) 'I/O FORECAST PROJECTION BIAS ACTION OPPORTUNITY BOX' Periods, And (4) Cyclically Compiled Key EchoVector Lenghted Subsumption Period Lengths, Phases, and Wave Formations And Indicative Components - - And Their Base Taxonomy And Starting Shorthand Reference Algorithms...

P - Price

EV - EchoVector

XEV - EchoVector of time cycle length X (with slope momentum delta P over delta X)

SRP - EchoVector Starting Reference Time/Price Point (The far right point located along and EchoVector)

WEV - One Week Lengthed EchoVector, Weekly EchoVector Period Length

PCEV - 4 Year lengthed EchoVector, Presidential Cycle Echovector

H - Hourly, M - Monthly, Q - Quarterly, A - Annual, CC - 2 Year Congressional Cycle Length

4HEV - 4 Hour Lengthed EchoVector

TP - Timepoint; time premium when referencing Derivative Option Rider Vehicle Baskets

TPP - Time and Price Point along a slope momentum trajectory EchoVector

EBP - EchoVector EchoBackPeriod

EBD - EchoVector EchoBackDay

EBDTPP - EchoBackDate TimeandPricePoint (The far left point along a slope momentum EchoVector, x length from the SRP. The SRP is the EBD-TPP's 'reflection' located X length time cycle distance forward from the EBD-TPP.)

NPP - Nearby forward pivot point from the EchoBackDay TPP

CFEV - EVA Coordinate Forecast Projection EchoVector

PGRAM - The TIME CYCLE ECHOVECTOR SLOPE MOMENTUM TRAJECTORY Pivot Point Price Projection Parallelogram Construction Support & Resistance Channel

EVA - EchoVector Analysis

EVTA - EchoVector Financial Markets Technical Analysis

----------------------ALPHABETICAL----------------------

AMPEX - amplified price extension vector from correlate in ebp

B - broadcast, broadcasting

BB - bounce back

BP - Basis Points

BTV - EVA breakthrough vector, YELLOW SPACED

BT - breakthrough

C - call option

CC - counter-clockwise echovector rotation

CFD - echovector current focus day

CFW - echovector current focus week

CGC - Capital Gain Capture

CGL - Capital Gain Lock

CHMK - EVA Checkmark Pattern

CL - closing tradeblock low

CD30M - closing tradeblock end less 30 minutes

CPI - consumer price index

CRV - call rider vehicle, esoteric basket, hedge insurance instrument

CW - clockwise echovector rotation

DC - bounce with no sustaining quality, and setting up lower low.

DBOX - EVA diamond box pattern

DERIV - derivative, option, esoteric, future

DIA - dow30 index etf

DOM - depth of market

DP - price downpressure

DSMT - DownSide Momentum Target

D30 - dow jones 30 industrials composite index

E - echo

EBD - EchoBackDate

EQUIL - EVA equilibration

/ES - sp500 composite index emini futures

ESO - esoteric, derivative, option basket, weeklys

ET - Eastern Time USA

EVPPPP Echovector Pivot Point Price Projection; s1 s2 s3 s4 s5 etc., r1 r2 r3 r4 r5 etc., within key fiop timeblock/timeframe

FCRUM - fulcrum hour/period

FHOPI - Full Hedge On Price Level Insurance

FIOP - EVA focus interest opportunity period

FOMC - Federal Reserve Bank Open Market Committee

FRB - US Federal Reserve Bank

FRI - Friday

FRV - focus rider vehicle basket, fcrv focus call rider vehical, fprv focus put rider vehicle

FSE - Frankfurt Stock Exchange, RMHO 2am ET USA

GREV - EVA global rotation echovector

H - high (often price high, referring to a candle or TB)

HEV - Hourly EchoVector

(24HEV - 24 Hour EchoVector

HOR - horizontal, horizontal pivot point indicator vector

HSE - Hong Kong SE

ID - identified, designated,

IDR - intraday reversal

INTD - Intraday

INTERD - interday or interweek or intermonth or interperiod

INTRA - intraday

I/O Box- eva price/time inside/outside forecast projection risk management reference action box, zoomed scalar spot

JAJO - January April July October Quarterly Cycle Phase

KORP - key otaps with reversal potential bias

KR - key reversal

LB - long bias

LOAD - high volume supply at price level

LSE - London Stock Exchange

M - minute(s)

MC - minute candle, eg., 3mc is 3 minute candle(s)

MEV - Monthly EchoVector

MFTBB - Momentum Forward Trade Block (size) Bias (direction)

MIN - minute(s)

MINC - minute candle, eg., 3minc is 3 minute candle(s)

MMS - market makers

MOMO - momentum, momentum period, 2nd derivative momentum top

MORN - morning

MTB - MainTradeBlock

NL - net short

NPA - not presently available

O - OPEN, OPENING

OBV - on balance volume

OH - opening tradeblock high

OL - opening tradeblock low

OPL OptionPivotsLive

OPT - option, options

OOTM - out of the money option

OTAPS - EVA source 1 (cfev) or source 2 generated position polarity switch signal vector application (Advanced straddle basket application - Google "OTAPS).

On/Off/Through Target Position Polarity (long, short) Application Price Switch Signal Vector, often generated by the PGRAM CFEV (source 1)

P - put Option

PAR - par, parity

PEB - price equivalency basis

PFP - EVA powerful forecast projection

PFPBROT - Powerful Forecast Projection Bias (Long/Short, UP/DP, RS/RW) Right On Target

PGRAM - echovector time cycle slope momentum trajectory pivot point price projection parallelogram

PNLOP - potential net log opportunity period

PPI - Pivot Point Indicator; or, Producer Price Index

PRE-M - Pre-Market Hours

PREM-4AM - Key GREV TPP, Pre-Market Hours early Electronic Open (USM Access)

PRESS - pressure, intraday press to find intermediate wave price level floor or ceiling

POT - pressure on/off tape

PPROG - programmed, pre-programmed

PRE - before, premium

PR - key scalar related price run (extension[s]) after related origin inflection point reference.

PRV - put rider vehicle, esoteric basket, hedge insurance instrument

PV,OPV - pointer vector. Price of option points to value of underlying at time of expiration. Vector pointing there from underlying's price at time of option exchange print price quote.

qev - Quarterly EchoVector in Quarterly Period Lengthed PGRAM (13 Weeks between CFD and EBD

QQQ - nasdaq 100 technology etf

R - resistance

REM - remember

REPO - repositioning, rolling into new or updated position complex

REV - reversal

REX - reduced price extension vector from correlate in ebp

RMH - regular market hours

RMHC - regular market hours close

RMHO - regular market hours open

RNR - forecast-ed move underway dramatically

ROT - right on forecasted target within echovector rotation; return on capital

RS - relative price strength

RW - relative price Weakness

RWS - relative weakness inflection points or periods

RV - options rider vehicle basket

S,SUP - support

SIG - signal, significant

SLOPEMO - PGRAM XEV and cfev slope momentum trajectory

SP - spaced

SPY - sp500 index etf

S/R - support/resistance

SS - scenario setup

SSOI - Scenario Setup Opportunity Indication

ST - short term

SYMTRA - symmetry transpostiion, symmetry transposed vector schedule

T - time; tick; Tuesday; tradeblock

TB - Time Trade Block

TCPSM - time cycle price (slope) momentum

THO - though

TRAJ - price trajectory of xev, cfev, npp vector, otaps vector, options pointer vector, slopemo vector

TSE - Tokyo Stock Exchange

TT - teeter totter

TTTE - Today's Tomorrow Trader's Edge

TU - Tuesday

TUE - Tuesday

TUES - Tuesday

UP - price up-pressure

UPD - update

UW - upwave

USM - United States Market, ie., NYSE & CBOE Etc

W - Wednesday

WED - Wednesday

WKLY - weekly

WWW - EVA Wilbur Winged W Pattern

YEL - yellow

/YM - dow 30 composite index emini futures

Z - zoomed perspective

> - then or greater than

ADDENDUM 1 : LAST WEEK'S KEYNOTES AND FOCUS FORECAST FRAMECHARTS IN REVIEW - FORWARD 8/22/22 TO 8/29/22 - SEE ALSO https://stocktwits.com/Market_Pivots

MONDAY 8/22/2022

http://tos.mx/RU73HiC

qqq Thursday forecast overlay - Key Large Cap Equities QEV Full Hedge On Alert Last Tuesday ROT. Key Down-pressure Continuance Bias Alert OTAPS Last Thursday ROT

TUESDAY 8/232022 - KEY USM INTRAWEEK PIVOT FORECAST PROJECTION FIOP OF FIRST PHASE DOWNLEG MATURITY FROM LAST TUESDAY' AND THURSDAY'S FORECAST PROJECTED DOWNLEGSREADY FOR WEDNESDAY POST LSE OPEN LONG OPPORTUNITY INTO FRIDAY

https://tos.mx/pUYSptK es inside the 48hev master 1234am upd

https://tos.mx/gR3aHhr es inside the 48hev master 130am upd

https://tos.mx/jotpu8z es inside the 48hev master 134am upd

https://tos.mx/8gya27v es inside the 48hev master 135am upd*** +10:50 from 2:45pm tues peb otaps 4131.5

https://tos.mx/qdySunD qqq inside the 2qev qev master 1235am upd

https://tos.mx/6YHGreB nq wev 727 upd 15mc

https://tos.mx/iAxBX1v 2minc http://tos.mx/iAxBX1v spy 730am 2mc upd

https://tos.mx/KeGL8qf

https://tos.mx/ycvQHdC es inside the 48hev master 731/2 am upd***

https://tos.mx/1MBKCYs es inside the 48hev master 825am upd***

https://tos.mx/jisYxwm ES 850AM

https://tos.mx/lqWmdqA es 928 https://tos.mx/AhPojP8es 35tz 929

https://tos.mx/HCrWgoI es 1123

https://tos.mx/OszDMiE spy master 1151

https://tos.mx/LNyxcAg ES 1059

WEDNESDAY 8/24/2022 - KEY LSE MORNING INTRAWEEK PIVOT FORECAST PROJECTION FIOP OF SECOND PHASE DOWNLEG MATURITY OF LAST TUESDAY' AND THURSDAY'S FORECAST PROJECTED DOWNLEGS

https://tos.mx/SHTzbpw ym

https://tos.mx/iG9YLfb es master daily

https://tos.mx/93ZwbF0 731am /ym

https://tos.mx/0lA6a6e /ym 800

https://tos.mx/Cuy8gcT qqq master qev 800

https://tos.mx/H5MTUgh es

https://tos.mx/79jW0bs ym

https://tos.mx/zUh9p70 ym lift

THURSDAY 8/25/2022

https://tos.mx/G036sn5 qqq m 708am

https://tos.mx/JbtMoz0 es 1135 grid 15pt spread yellow off 8am

FRIDAY 8/26/2022 - JH OTAPS STRADDLE

------------------------------------------------------------------------------------------------------------------

RE-ITERATION: MONDAY 8/29/2022 929AM ET USA UPDATE - MONDAY'S KEY SSOI FOCUS FORECAST FRAMECHARTS

https://tos.mx/A1sgobp /es grev master upd

https://tos.mx/mePhMkw /ym upd

https://tos.mx/lhlayxp http://tos.mx/YzaJvcZ /YM 917am

https://tos.mx/E4PUXvO /ES 923am GREV M

https://tos.mx/uUBZl3e 928am QQQ M

https://tos.mx/FOOBHtb es grev m 2min ebw 1045am

https://tos.mx/MCSPGZY se grev 3min 1049am

------------------------------------------------------------------------------------------------------------------

ADDENDUM 2 : RE-VISITATION OF KEYNOTES AND FOIP FFF SSOI FROM KEY HEDGE INSURANCE APPLICATION ACTION WEEK PRECEDING 8/22/22The Week In Review - Shared Work-Space Prior Friday

https://tos.mx/xGbyJO9

------------------------------------------

https://tos.mx/CWvnoyt

https://tos.mx/xkLnIpb

------------------------------------------

(Mathematical Wilbur Winged W Diamond Box Reversal Pattern

Occurs in UHF, Tick, Intraday, Interday, Intraweek, and etcetera, zoom-in and zoom-out timescales (frames)... )

------------------------------------------

https://tos.mx/xkLnIpb

945 950

1550 to close 1/3 8pts

https://tos.mx/xkLnIpb

------------------------------------------

https://tos.mx/t4ciVj9 SPY

https://tos.mx/XJl2oz7 TICK

https://tos.mx/gybi02w

https://tos.mx/gybi02w

---

https://tos.mx/ce721PJ

https://tos.mx/XE2HuCP MASTER 1

https://tos.mx/q5DmGOB SUPPLA

------------------------------------------

605 morning

714 back to 628

585 to 700

8am hour sync

See grev moves with lse yesterday high to post 10am high - lse to first 45min high

Use the 6p to trade the /es

Sync the close after lse basin w/ respect tp qev

Remember to put in target/lowes in earnings

------------------------------------------

https://tos.mx/RMlXJUo

https://tos.mx/m2uy12I nq 635pm

------------------------------------------

THU

https://tos.mx/hFE2rIm ym

https://tos.mx/Vb4azhW es https://tos.mx/iClSgX8

https://tos.mx/lI5vsmL spy

https://tos.mx/JYQhLCC nq

------------------------------------------

373 421 479 605

https://tos.mx/wmaJSIu

http://tos.mx/AZWYyhQ

https://tos.mx/hSWUGum

https://tos.mx/39VrL5N

***https://tos.mx/GhQSOKG

https://tos.mx/MCv64jr v

https://tos.mx/HUIbWy8

https://tos.mx/MTIgXFQ spy

https://tos.mx/TlZk5GU

https://tos.mx/eK0QJPs

https://tos.mx/oQFxrps

https://tos.mx/mL1SxG8

https://tos.mx/mL1SxG8

550 t0 476 on the wed spy

https://tos.mx/sp7OQjE https://tos.mx/sp7OQjE 465 blue spaced

https://tos.mx/WA6jkRt

https://tos.mx/WA6jkRt

https://tos.mx/9C3H9r5

https://tos.mx/UQvVARw

back to 500

https://tos.mx/2EAiIBf

https://tos.mx/rZ7G2RH nq

https://tos.mx/ZY5MmjL

https://tos.mx/3aTgzGu

https://tos.mx/joLnR34

https://tos.mx/WfBEVwG nq http://tos.mx/y76jVoN http://tos.mx/y76jVoN

------------------------------------------

/dx

#dxy

usdx

uup bull

udn bear

usdu

dl.r.u

------------------------------------------

21.50 21.25 target in, ROT from this past weekend off tues fiop top wi/ fp ssoi pgram inside the aev & qev, and inside the qev fp bias (forecast projection - eva symtra coordinated).

So, look for fulfill on the low in the afternoon the day before traj to the low in the morning with fulfill in the afternoon before futures for the mild bounce.

Remember the 4am squaring on the 2 day.

This was in the dow on opt exp fman aug.

Look for the upside on the next wed on the 2m 2m 1m and wev.

Nice targeting off the key qev ebws w/ respect to cpi, ppi, fed min, target, lowes, cosco etc looking to f the 85.

However the 77 failed and then to the 65 and then to the 50.

and then to the 40 and then to the 25 and 22 and then back to the 30 and 33 and then to the 44 and then to the 64 and then back to the 45 and then back to the 80 and then back to the 60 ..... low during the futures 15 then the pulse at 1549.

Dow sine waving yet tech resistant.

Interesting how dow held up in morning then lead down in afternoon, now after futures and fulfill is sine-waving lead.

This on a monthly opt exp Friday.

Wed call dragging correlate to next Friday call.

Use the Friday outs to trade and and those key squarings or 4 day our squarings to guide with inside days only on key teeters (spy teeter 1&1/2 and then 2&1/2to3 with backups between (.7-1).

------------------------------------------

(See options prog on cn)

Equilibrium. Inflation. High housing. Oil. Solar conversion (tech supply producer ... not like oil. developer but not mineral in battery). Wage strength. Conversion from fossil fuels to solar wind hydro electric. Services instead of retail... inventory glut on one hand supply chain issues on another. Home invent backup. Electronic gadget tv glut. Food energy up. Choke on supply side. Restaurant demand down in some states.Who's at yum macDs pzza etc. 8/19/22

___________________________________________________________________________________

DISCLAIMER: This article is for educational and informational purposes only. There can be significant risks involved with investing including loss of principal. There is no guarantee that the goals or the strategies and examples discussed will be achieved. NO content published by us on the Site, our Blogs, Newsletters, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Again, this post is for educational and informational purposes only. BEFORE MAKING ANY INVESTMENT DECISIONS WE STRONGLY ENCOURAGE YOU TO FIRST CONSULT WITH YOUR PERSONAL FINANCIAL ADVISOR.

____________________________________________________________________________________

SEE PRIOR POSTS FOR RELATED ALERTS AND KEY CONTEXTUALIZATIONS

FROM MDPP PRECISION PIVOTS, OPTIONPIVOTSLIVE, AND MARKETPIVOTSTV

AND

FROM THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCE POSITION AND RISK

MANAGEMENT NEWSLETER, FREE ONLINE CONSOLIDATED VERSION

AND FOR FOCUS INTEREST OPPORTUNITY PERIOD SCENARIO SETUP OPPORTUNITY FRAMINGS AND INDICATIONS, AND FOR SIGNIFICANT SUPPLEMENTAL MARKET INTELLIGENCE, PROVIDED FOR OUR PROFESSIONAL ASSOCIATED MEMBERSHIP'S (AND OUR GLOBAL READERSHIP'S) ADVANTAGE, REFERENCE, STUDY, AND REVIEW ___________________________________________________________________________________

Monday, August 22, 2022

MARKET PIVOTS PIVOT POINT UPDATE: Pivot Point Calculation, Pivot Point Definition, Pivot Point Formula, Pivot Point Indicator, Pivot Point Strategy, Pivot Point Technique And Pivot Point Projection. Best Pivot Points. INSIDE THE ANNUAL PIVOT POINT. INSIDE THE BI-QUARTERLY PIVOT POINT. INSIDE THE QUARTERLY PIVOT POINT. INSIDE THE MONTHLY PIVOT POINT. INSIDE THE WEEKLY PIVOT POINT. INSIDE THE DAILY PIVOT POINT. 8/22/22 5:32PM EDT USA UPDATE. Monday Following FMAN Quarterly Cycles August 2022 Options Expiration Day and Week. Powerful MDPP Precision Pivots Forecast Projections And Scenario Setup Opportunities And Alerts Right On Target! SPY DIA QQQ. echovectorvest.blogspot.com timecyclepivotpoints.com

MARKET PIVOTS PIVOT POINT

UPDATE: Pivot Point Calculation, Pivot Point Definition, Pivot Point

Formula, Pivot Point Indicator, Pivot Point Strategy, Pivot Point

Technique And Pivot Point Projection. Best Pivot Points. INSIDE THE

ANNUAL PIVOT POINT. INSIDE THE BI-QUARTERLY PIVOT POINT. INSIDE THE

QUARTERLY PIVOT POINT. INSIDE THE MONTHLY PIVOT POINT. INSIDE THE WEEKLY

PIVOT POINT. INSIDE THE DAILY PIVOT POINT. 8/22/22 5:32PM EDT USA

UPDATE. Monday Following FMAN Quarterly Cycles August 2022 Options

Expiration Day and Week. Powerful MDPP Precision Pivots Forecast

Projections And Scenario Setup Opportunities And Alerts Right On Target!

SPY DIA QQQ. echovectorvest.blogspot.com timecyclepivotpoints.com

PIVOT POINT INDICATORS, DAILY PIVOT POINT INDICATORS, WEEKLY PIVOT POINT INDICATORS, BI-WEEKLY PIVOT POINT INDICATORS, MONTHLY PIVOT POINT INDICATORS, QUARTERLY PIVOT POINT INDICATORS, BI-QUARTERLY PIVOT POINT INDICATORS, ANNUAL PIVOT POINT INDICATORS, CONGRESSIONAL CYCLE PIVOT POINT INDICATORS, PRESIDENTIAL CYCLE PIVOT POINT INDICATORS.

DAILY PIVOT POINT INDICATOR, 2 DAY PIVOT POINT INDICATOR, 3 DAY PIVOT POINT INDICATOR, WEEKLY PIVOT POINT INDICATOR. TIME CYCLE PIVOT POINTS.

MONDAY 8/22/22 5:30PM ET USA UPDATES

MDPP PRECISION PIVOTS GLOBAL FINANCIAL MARKETS LABORATORY EXCLUSIVE: KEY ACTIVE WILBUR TIME CYCLE PIVOT POINT PRICE FORECAST PROJECTION INDICATOR HIGHLIGHTS AND ILLUSTRATIONS AND ACTIVE ADVANCED SCENARIO SETUP OPPORTUNITY MARKET INTELLIGENCE AND ASSOCIATIVE "TODAY'S TOMORROW TRADER'S EDGE" FOCUS FORECAST FRAMECHARTS AND SUPPORTING NARRATIVE RELEASES: INCLUDES SPYDER NASDAQ 100 TRUST QQQ ETF AND SP500 SPX COMPOSITE INDEX SPY ETF AND OTHERS...

PIVOT POINT INDICATORS

INSIDE THE QUARTERLY TIME CYCLE PIVOT POINT INDICATORS

NASDAQ 100 TECHNOLOGY SECTOR QQQ ETF

https://tos.mx/3sSIrwq

FMAN (Feb-May-Aug-Nov) Associated Quarterly Cycles Calendar Group within the Annual Calendar.

FORWARD ALERTS: SPECIAL MDPP PRECISION PIVOTS "TODAY'S TOMORROW TRADER'S EDGE" KEY-DATES, NOTATIONS, SSOI(S), AND ALERTS FORWARD...

KEY OTAPS ALERT - .SPY220826C417 PEB (PRICE EQUIVALENCY BASIS): $2.25 (15:45PM ET USA) - FULL HEDGE ON ALERT OTAPS TARGET FROM TUESDAY 8/16/22 FORECAST PROJECTED INTRADAY HIGH FULL HEDGE ON APPLICATION DP ALERT BIAS TARGET OTAP.S: OPTIONPIVOTSLIVE

.SPY220826C417 - KEY ACTIVE PIVOT POINT PRICE PROJECTION INDICATORS

(KEY

ACTIVE MICRO ZOOM INTRADAY PGRAM S/R CHANNEL CFEV SLOPEMO TRAJECTORIES

AND EVPPPP TPP EQULIBRATION INDICATORS HIGHLIGHTED AND ILLUSTRATED)

https://tos.mx/rpa7S1p

TO ENLARGE AND FURTHER ZOOM 'TODAY'S TOMORROW TRADER'S EDGE' PIVOT POINT INDICATOR FOCUS FORECAST FRAMECHART SNAPSHOTS

(1) RIGHT CLICK ON THE PROVIDED SNAPSHOT AND 'OPEN IMAGE IN NEW TAB, AND THEN LEFT CLICK ON THE PLUS MAGNIFIER, OR

(2) LEFT CLICK ON THE PROVIDED SNAPSHOT LINK, THEN LEFT CLICK ON THE SNAPSHOT TO ENLARGE, THEN RIGHT CLICK TO FIND 'OPEN IMAGE IN NEW TAB' AND LEFT CLICK, THEN LEFT CLICK THE ZOOM MAGNIFIER.

*THIS POST MAY INCLUDE POST MASTERS AND POST DOCTORAL LEVEL EDUCATIONAL AND DISSERTATIVE INFORMATION AND MARKET INTELLIGENCE REFERENCINGS, AND FURTHER PROFESSORIAL TUTORIAL CONTEXTINGS AND REFERENCINGS, WITHIN THE TECHNICAL FIELDS OF MARKET BEHAVIORAL ECONOMICS, FINANCIAL MARKET PIVOTS TECHNICAL ANALYSIS, AND ADVANCED FINANCIAL PHYSICS, DISSEMITATIVELY.

DISCLAIMER: This article is for educational and informational purposes only. There can be significant risks involved with investing including loss of principal. There is no guarantee that the goals or the strategies and examples discussed will be achieved. NO content published by us on the Site, our Blogs, Newsletters, and any Social Media we engage in constitutes a recommendation that any particular investment strategy, security, portfolio of securities, or transaction is suitable for any specific person. Further understand that none of our bloggers, information providers, App providers, or their affiliates are advising you personally concerning the nature, potential, value or suitability of any particular security, portfolio of securities, transaction, investment strategy or other matter. Again, this post is for educational and informational purposes only. BEFORE MAKING ANY INVESTMENT DECISIONS WE STRONGLY ENCOURAGE YOU TO FIRST CONSULT WITH YOUR PERSONAL FINANCIAL ADVISOR.

___________________________________________________________________________________

SEE PRIOR POSTS FOR RELATED ALERTS AND KEY CONTEXTUALIZATIONS

FROM MDPP PRECISION PIVOTS, OPTIONPIVOTSLIVE, AND MARKETPIVOTSTV

AND

FROM THE MARKET PIVOTS FORECASTER AND ACTIVE ADVANCE POSITION AND RISK

MANAGEMENT NEWSLETER, FREE ONLINE CONSOLIDATED VERSION

AND FOR FOCUS INTEREST OPPORTUNITY PERIOD SCENARIO SETUP OPPORTUNITY FRAMINGS AND INDICATIONS, AND FOR SIGNIFICANT SUPPLEMENTAL MARKET INTELLIGENCE, PROVIDED FOR OUR PROFESSIONAL ASSOCIATED MEMBERSHIP'S (AND OUR GLOBAL READERSHIP'S) ADVANTAGE, REFERENCE, STUDY, AND REVIEW ___________________________________________________________________________________

Watch

Watch

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.